Why You May Want To Start Your Home Search Today

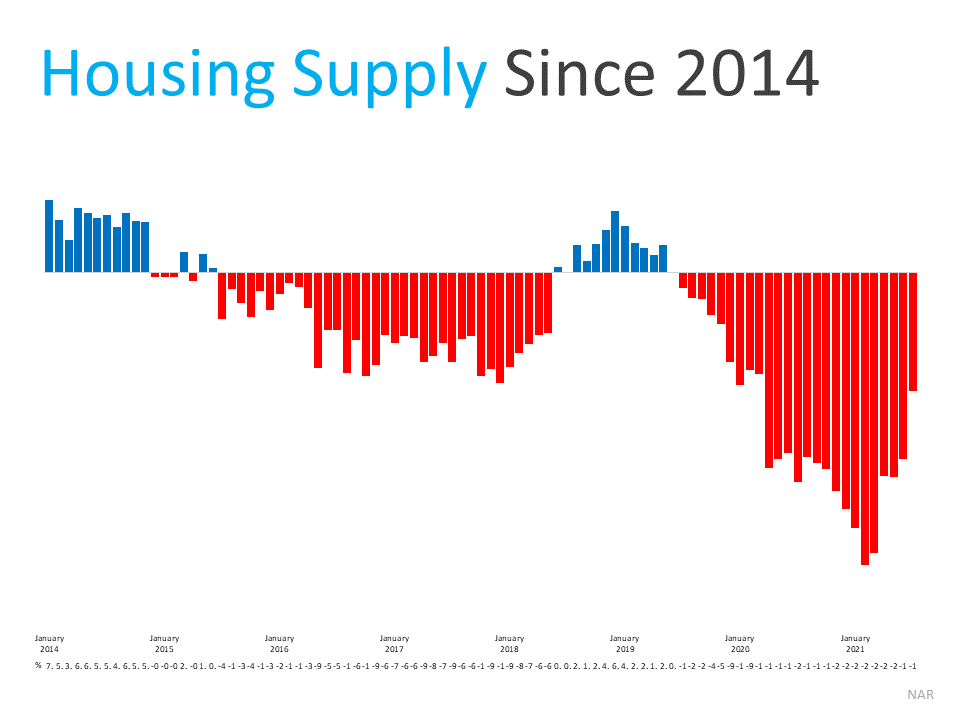

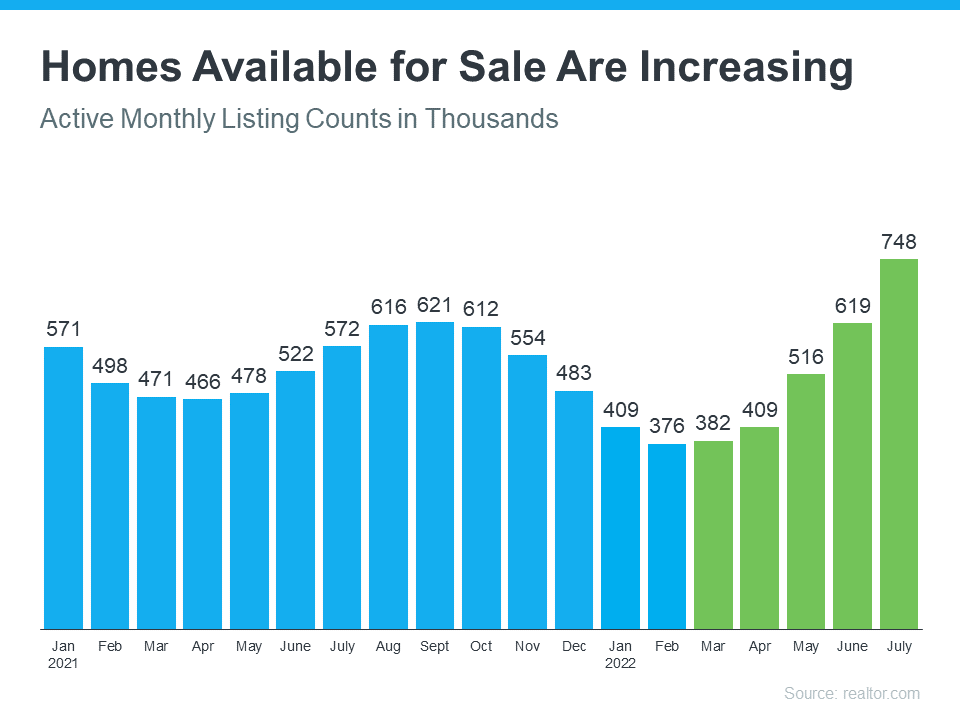

If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyers may wait things out, there’s a reason serious buyers are making moves right now, and that’s the growing number of homes for sale.

So far this year, housing inventory has been increasing and that’s making the prospect of finding your dream home less difficult. While there are always reasons you could delay making a big decision, there are also always reasons to consider moving forward. And having a growing number of options for your home search may be exactly what you needed to feel more confident in making a move.

What’s Causing Housing Inventory To Grow?

As new data comes out, we're getting an updated picture of why housing supply is increasing so much this year. As Bill McBride, Author of Calculated Risk, explains:

“We are seeing a significant change in inventory, but no pickup in new listings. Most of the increase in inventory so far has been due to softer demand - likely because of higher mortgage rates.”

Basically, the inventory growth is primarily from homes staying on the market a bit longer (known as active listings). And that’s happening because higher mortgage rates and home prices have helped moderate the peak frenzy of buyer demand.

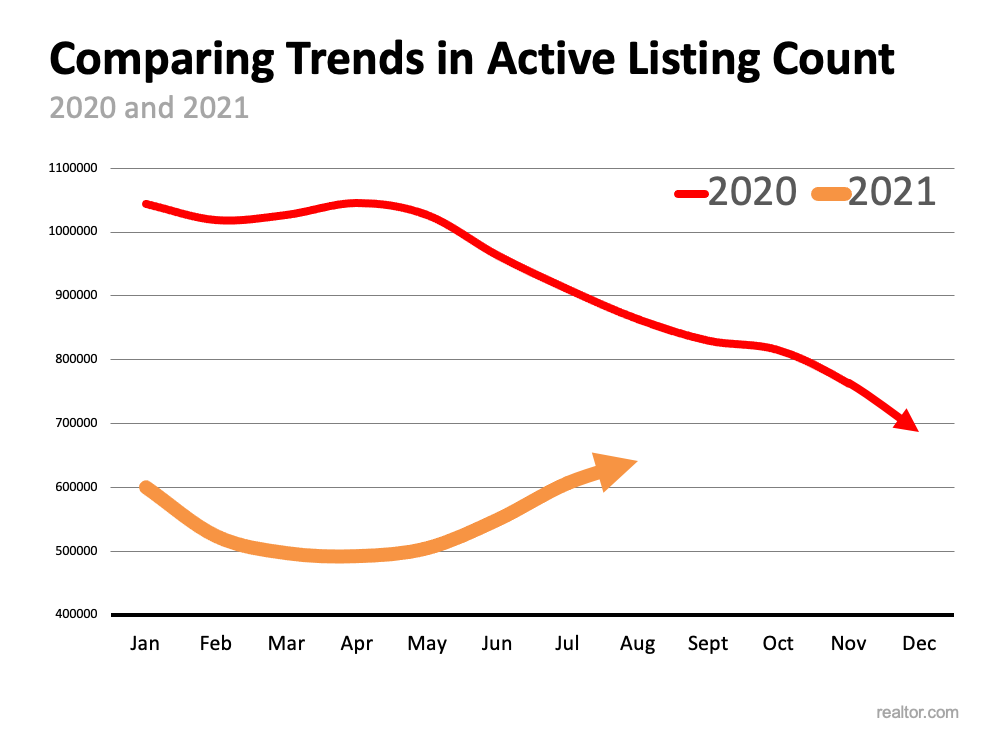

The graph below uses data from realtor.com to show how much active listings have risen over the past five months as a result (shown in green):

Why This Growth Is Good News for You

Regardless of the source, the increase in available housing supply is good for buyers. More housing supply actively for sale means you have more options as your search for your next home. A recent article from realtor.com explains just how significant the inventory growth has been and why it’s good news for your plans to buy:

“Nationally, the inventory of homes actively for sale on a typical day in July increased by 30.7% over the past year, the largest increase in inventory in the data history and higher than last month’s growth rate of 18.7% which was itself record-breaking. This amounted to 176,000 more homes actively for sale on a typical day in July compared to the previous year and more choice for buyers who are still looking for a new home.”

The growth this year is certainly good news for you, especially if you’ve had trouble finding a home that meets your needs. If you start your search today, those additional options should make it less difficult to find a home than it would have been over the past two years.

Bottom Line

If you’re ready to jump into the market and take advantage of the increasing supply of homes for sale, let’s connect today. The opportunity is knocking, will you answer?

![Fact or Fiction: Homebuyer Edition [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/09/09142043/20210910-MEM-1046x1998.png)