What Do Supply and Demand Tell Us About Today’s Housing Market?

There’s a well-known economic theory – the law of supply and demand – that explains what’s happening with prices in the current real estate market. Put simply, when demand for an item is high, prices rise. When the supply of the item increases, prices fall. Of course, when demand is very high and supply is very low, prices can rise significantly.

Understanding the impact both supply and demand have can provide the answers to a few popular questions about today’s housing market:

- Why are prices rising?

- Where are prices headed?

- What does this mean for homebuyers?

Why Are Prices Rising?

According to the latest Home Price Insights report from CoreLogic, home prices have risen 18.1% since this time last year. But what’s driving the increase?

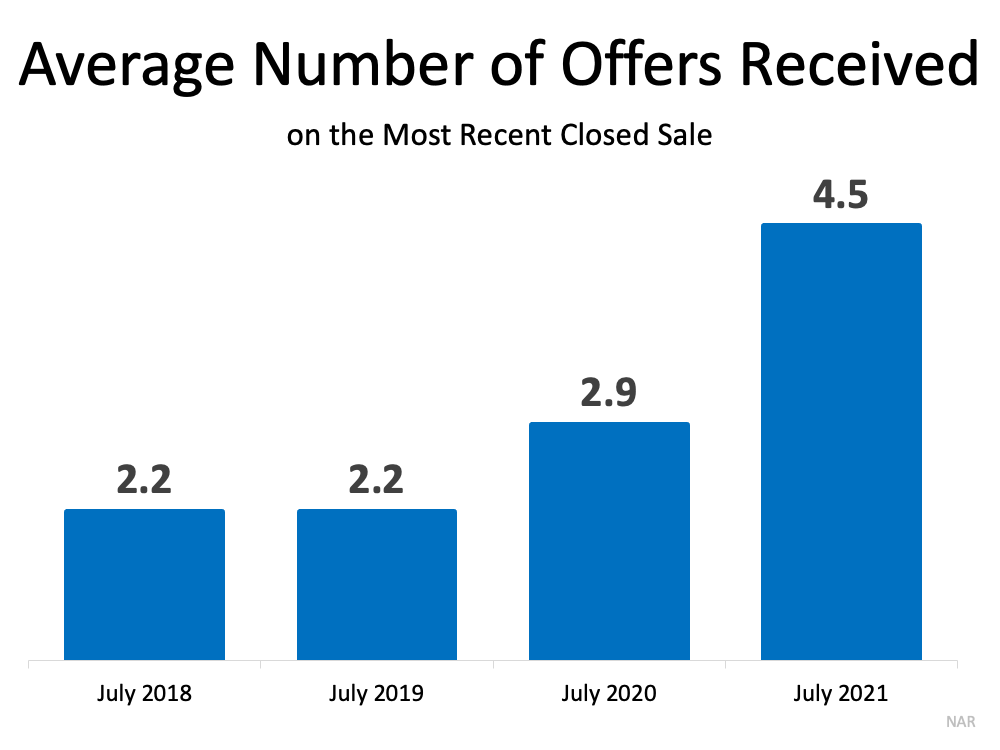

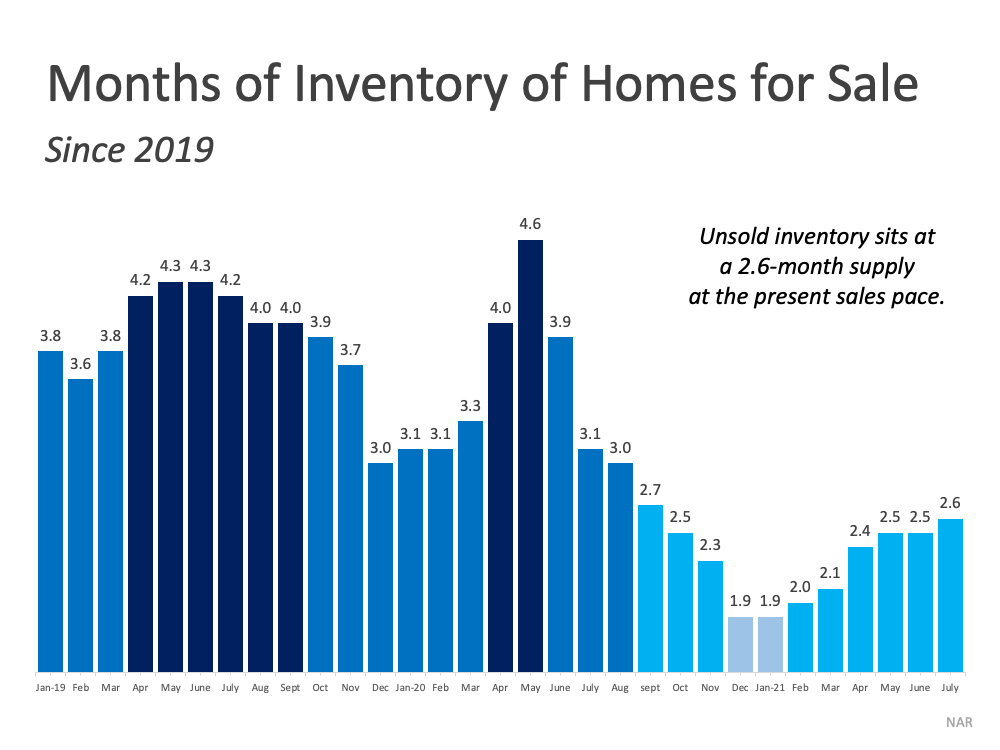

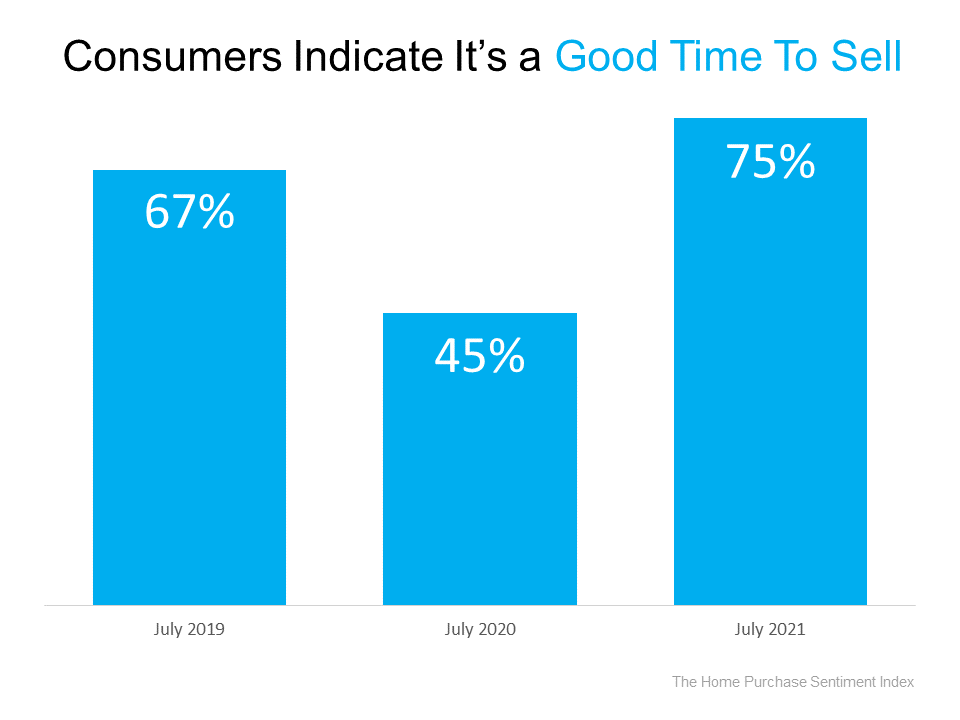

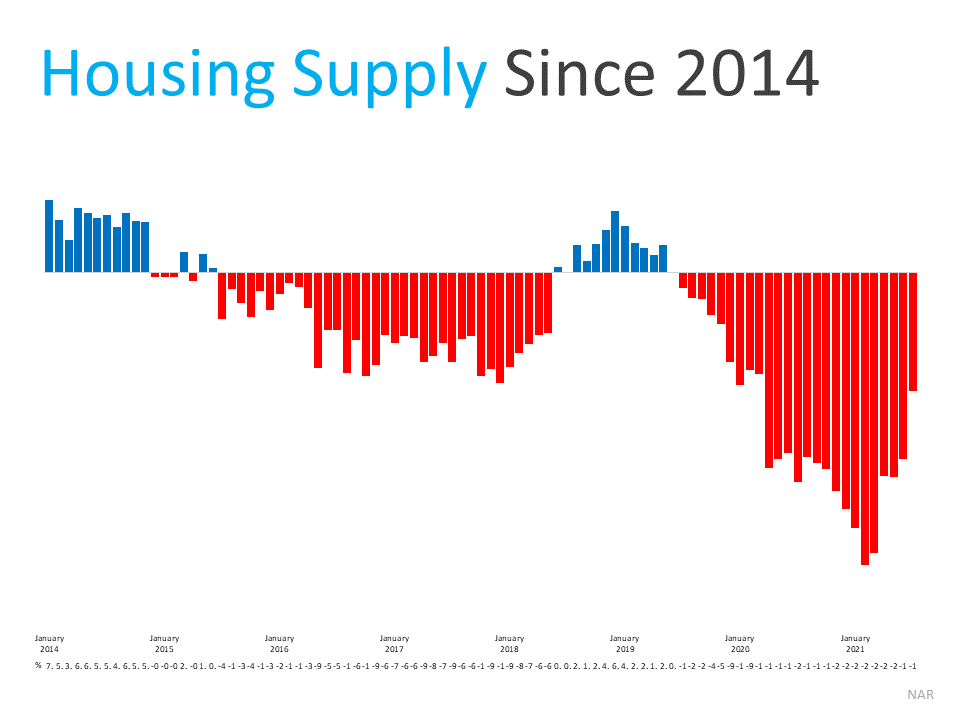

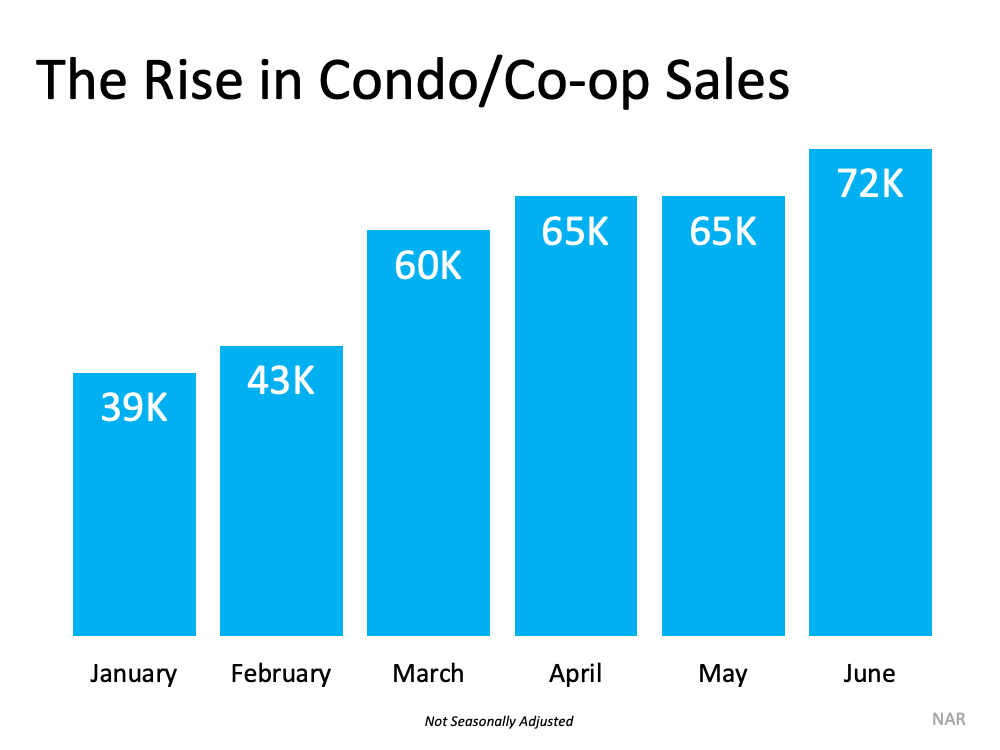

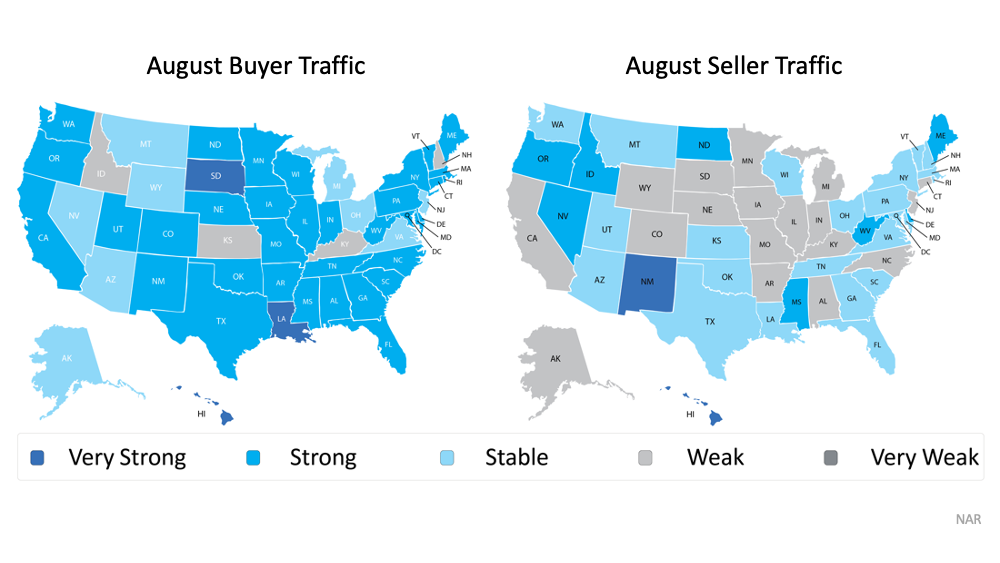

Recent buyer and seller activity data from the National Association of Realtors (NAR) helps answer that question. When we take NAR’s buyer activity data and compare it to the seller traffic during the same timeframe, we can see buyer demand continues to outpace seller activity by a wide margin. In other words, the demand for homes is significantly greater than the current supply that’s available to buy (see maps below): This combination of low supply and high demand is what’s driving home prices up. Bill McBride, author of the Calculated Risk blog, puts it best, saying:

This combination of low supply and high demand is what’s driving home prices up. Bill McBride, author of the Calculated Risk blog, puts it best, saying:

“By some measures, house prices seem high, but the recent price increases make sense from a supply and demand perspective.”

Where Are Prices Headed?

The supply of homes for sale will greatly affect where prices head over the coming months. Many experts forecast prices will continue to increase, but they’ll likely appreciate at a slower rate.

Buyers hoping to purchase the home of their dreams may see this as welcome news. In this case, perspective is important: a slight moderation of home prices does not mean prices will depreciate or fall. Price increases may occur at a slower pace, but experts still expect them to rise.

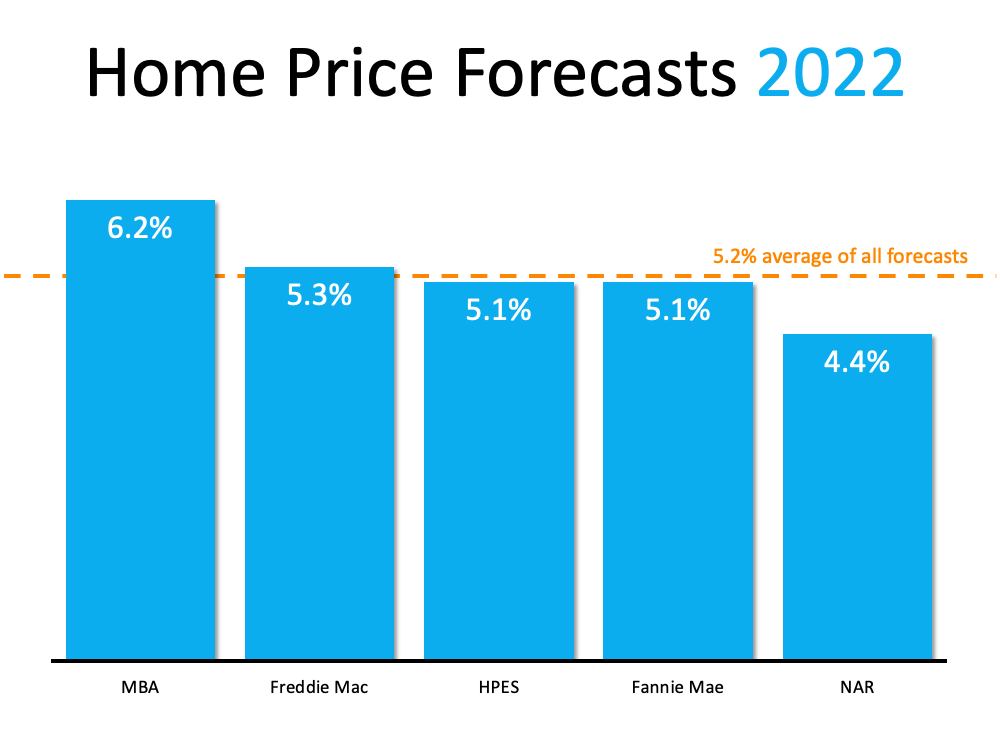

Five major entities that closely follow the real estate market forecast home prices will continue appreciating through 2022 (see graph below):

What Does This Mean for Homebuyers?

If you’re waiting to enter the market because you’re expecting prices to drop, you may end up paying more in the long run. Even if price increases occur at a slower rate next year, prices are still projected to rise. That means the home of your dreams will likely cost even more in 2022.

Bottom Line

The truth is, high demand and low supply are what’s driving up home prices in today’s housing market. And while prices may increase at a slower pace in the coming months, experts still expect them to rise. If you’re a potential homebuyer, let’s connect today to discuss what that could mean for you if you wait even longer to buy.