Why the Housing Market Is a Powerful Economic Driver

With businesses starting to slowly open back up again in some parts of the country, it’s important to understand how housing can have a major impact on the recovery of the U.S. economy. As we’ve mentioned before, buying a home is a driving financial force in this process. Today, many analysts believe one of the first things we’ll be able to safely bring back is the home building sector, creating more jobs and impacting local neighborhoods in a big way. According to Robert Dietz in The Eye on Housing:

“The pace of new home sales will post significant declines during the second quarter due to the impacts of higher unemployment and shutdown effects of much of the U.S. economy, including elements of the real estate sector in certain markets. However, given the momentum housing construction held at the start of 2020, the housing industry will help lead the economy in the eventual recovery.”

The National Association of Home Builders (NAHB) notes the impact new construction can have on the job market:

“Building 1,000 average single-family homes creates 2,900 full-time jobs and generates $110.96 million in taxes and fees for all levels of government to support police, firefighters and schools, according to NAHB’s National Impact of Home Building and Remodeling report.”

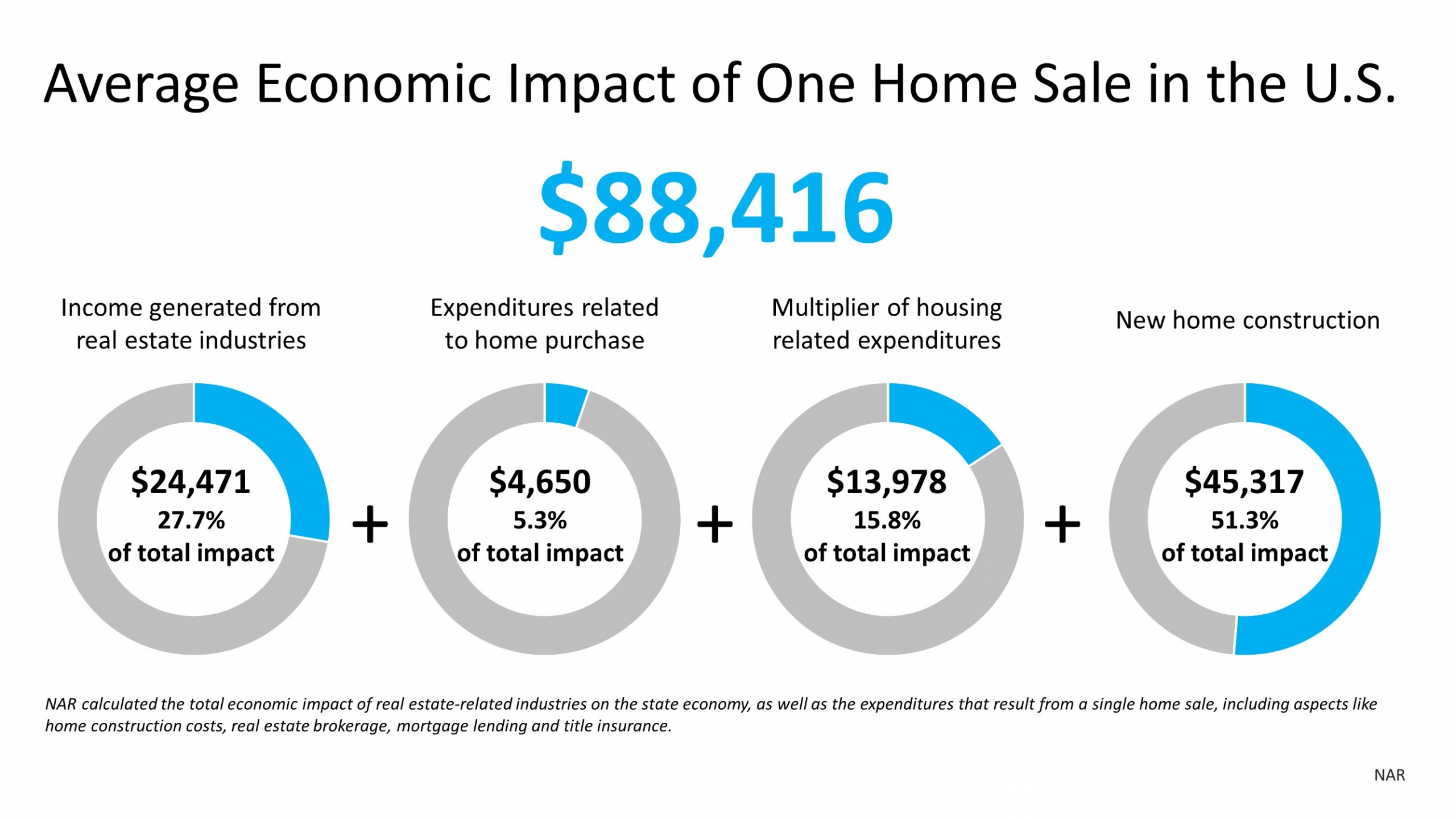

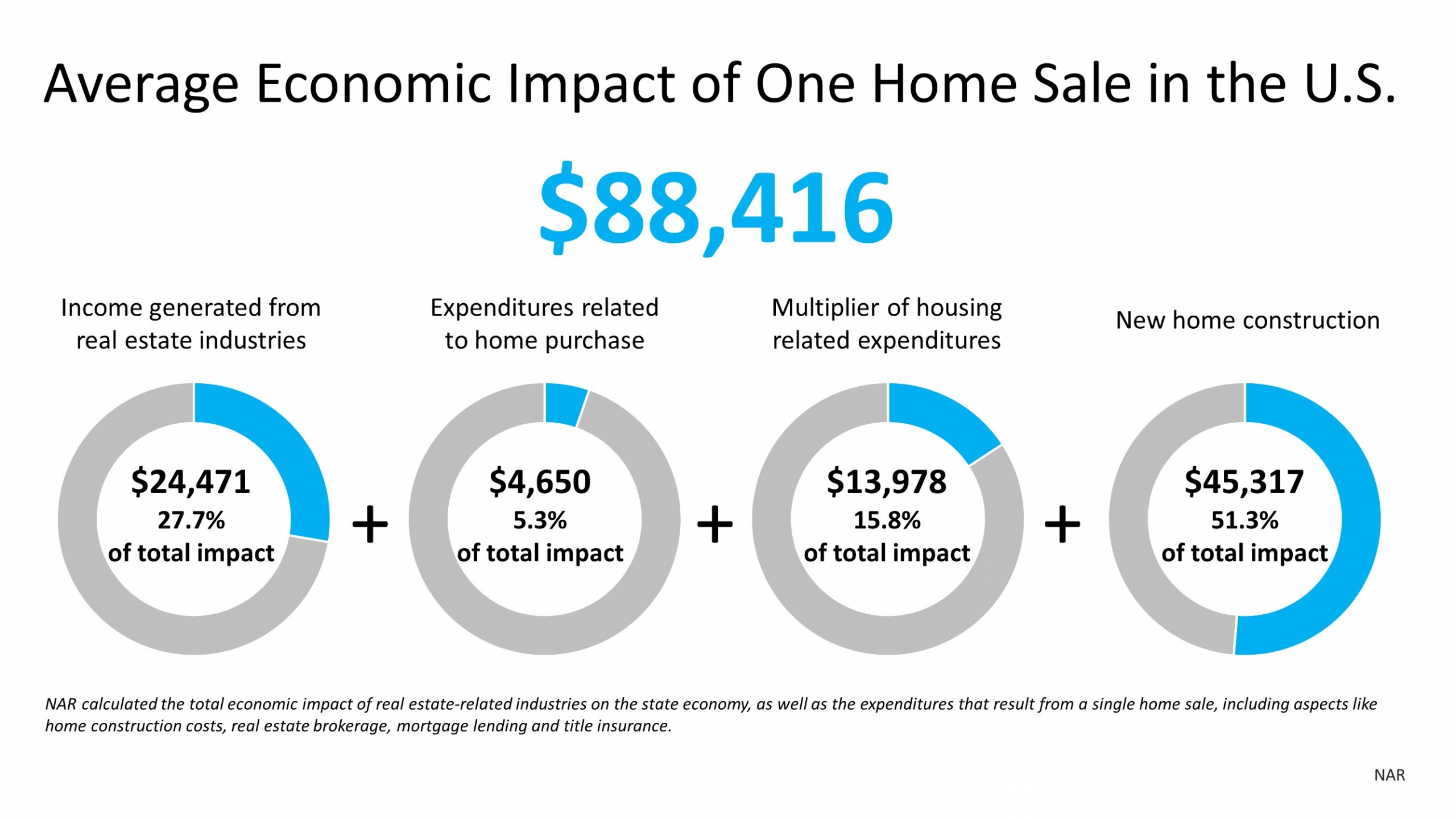

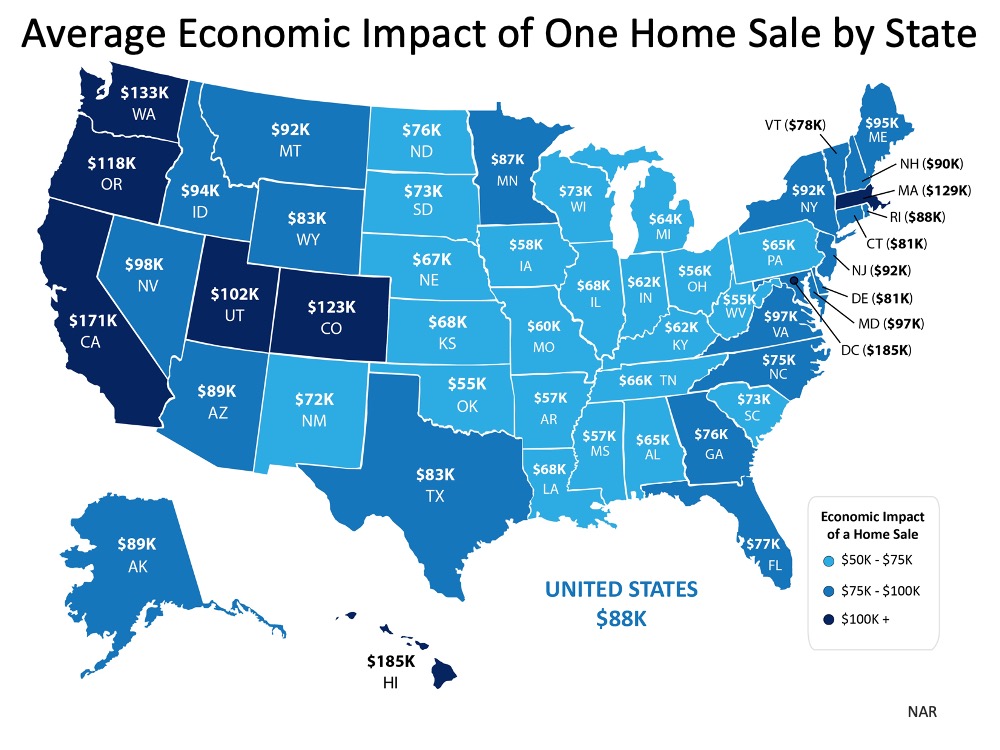

These employment opportunities, along with the home purchase, drive the economy in a major way. The National Association of Realtors (NAR) recently shared a report that notes the full economic impact of home sales. This report summarizes:

“The total economic impact of real estate related industries on the state economy, as well as the expenditures that result from a single home sale, including aspects like home construction costs, real estate brokerage, mortgage lending and title insurance.”

Here’s the breakdown of how the average home sale boosts the economy: As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the sheer number of workers it requires to design, build, equip, and finalize the sale of the home. The NAHB paints a clear picture of these roles:

As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the sheer number of workers it requires to design, build, equip, and finalize the sale of the home. The NAHB paints a clear picture of these roles:

As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the sheer number of workers it requires to design, build, equip, and finalize the sale of the home. The NAHB paints a clear picture of these roles:

As noted above in the circle on the right, the impact is almost double when you purchase new construction, given the sheer number of workers it requires to design, build, equip, and finalize the sale of the home. The NAHB paints a clear picture of these roles:“The NAHB model shows that job creation through housing is broad-based. Building new homes and apartments generates jobs in industries that produce lumber, concrete, lighting fixtures, heating equipment and other products that go into a home remodeling project. Other jobs are generated in the process of transporting, storing and selling these products.Additional jobs are generated for professionals such as architects, engineers, real estate agents, lawyers and accountants who provide services to home builders, home buyers and remodelers.”

The same NAR report also breaks down the average economic impact by state: On an emotional level, what’s most important for today’s consumers to feel confident about is the safety component that goes into the process. Mitigating the risk of essential personnel at this moment in time is more crucial than ever as we all aim to reduce the spread of the coronavirus. Fortunately, the NAHB has put immense effort into a plan that prioritizes the health and safety of home builders and contractors:

On an emotional level, what’s most important for today’s consumers to feel confident about is the safety component that goes into the process. Mitigating the risk of essential personnel at this moment in time is more crucial than ever as we all aim to reduce the spread of the coronavirus. Fortunately, the NAHB has put immense effort into a plan that prioritizes the health and safety of home builders and contractors:

On an emotional level, what’s most important for today’s consumers to feel confident about is the safety component that goes into the process. Mitigating the risk of essential personnel at this moment in time is more crucial than ever as we all aim to reduce the spread of the coronavirus. Fortunately, the NAHB has put immense effort into a plan that prioritizes the health and safety of home builders and contractors:

On an emotional level, what’s most important for today’s consumers to feel confident about is the safety component that goes into the process. Mitigating the risk of essential personnel at this moment in time is more crucial than ever as we all aim to reduce the spread of the coronavirus. Fortunately, the NAHB has put immense effort into a plan that prioritizes the health and safety of home builders and contractors:“This is why NAHB and construction industry partners have developed a Coronavirus Preparedness and Response Plan specifically tailored to construction job sites. The plan is customizable and covers areas that include manager and worker responsibilities, job site protective measures, cleaning and disinfecting, responding to exposure incidents, and OSHA record-keeping requirements.”

Bottom Line

Buying a home is a substantial economic driver today, and when new construction picks back up again, it will be an even stronger recovery force throughout the country. If you’re in a position to buy a home this year, you can have a significant impact on your local neighborhoods and safely make the move you’ve been waiting for. It’s a win-win.

![Today’s Expert Insight on the Housing Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/23123713/20200424-MEM-EN-1046x1308.jpg)

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)