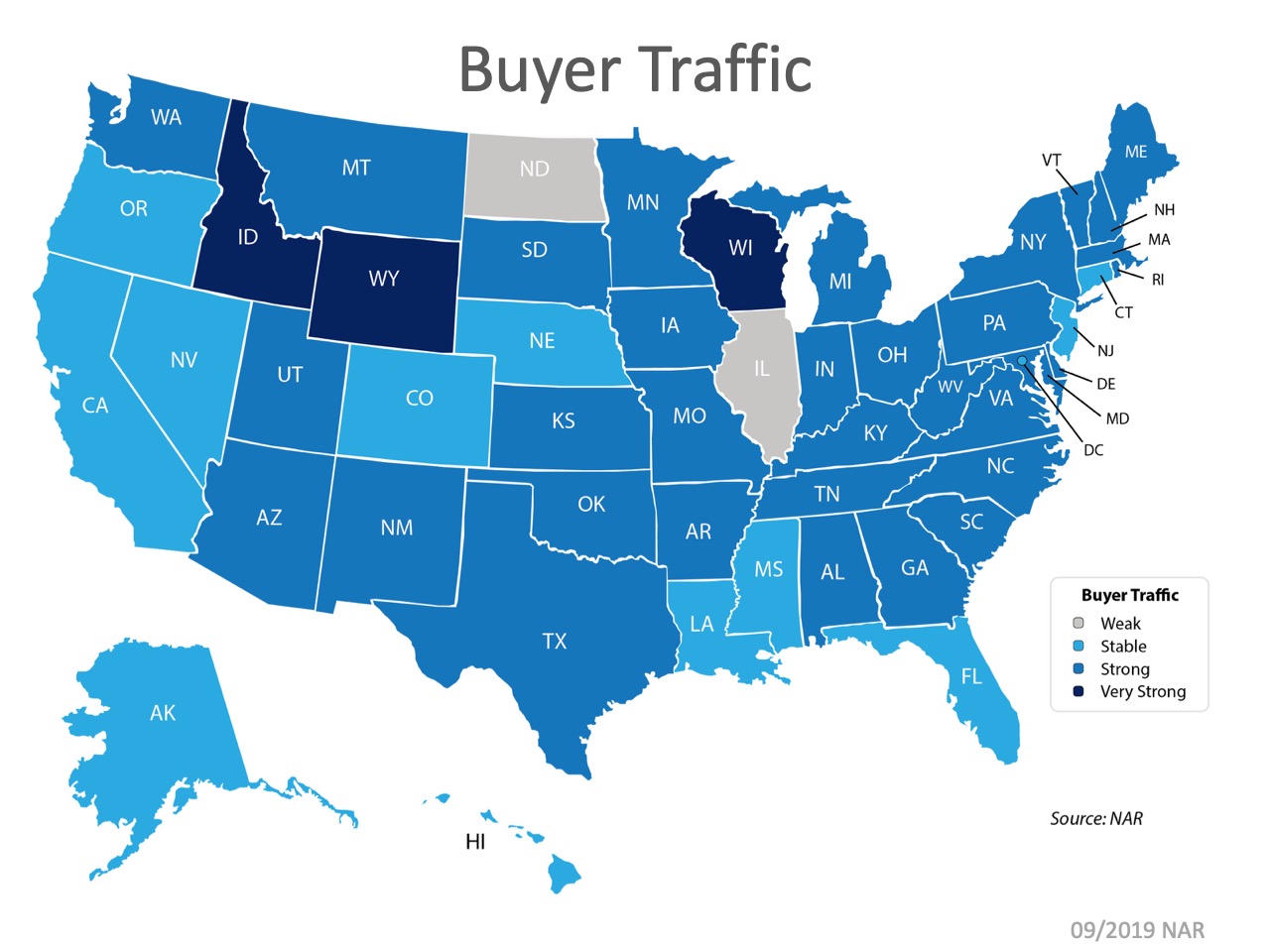

Today’s Buyers Are Serious about Purchasing a Home

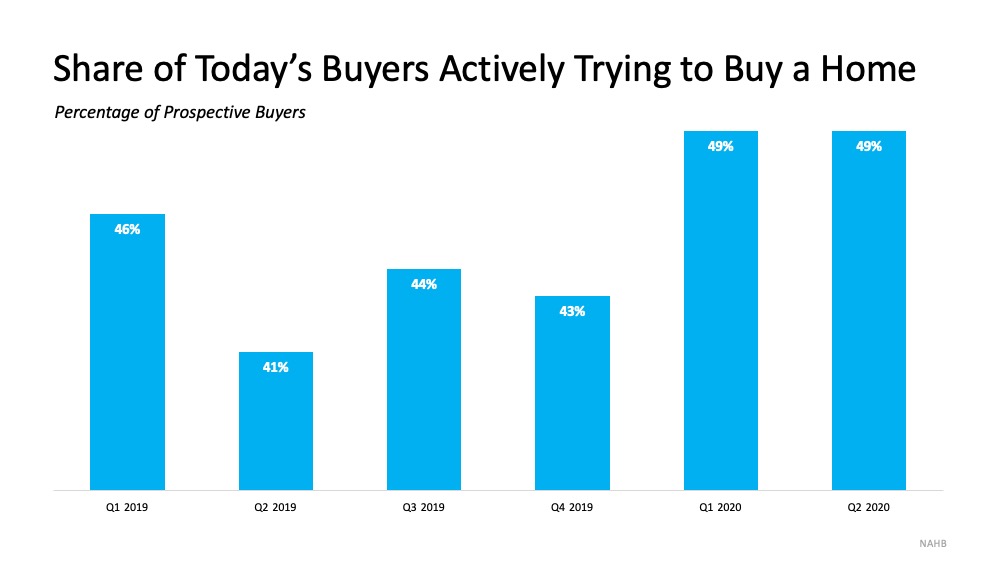

Today’s homebuyers are not just talking about their plans, they’re actively engaged in the buying process – and they’re serious about it. A recent report by the National Association of Home Builders (NAHB) indicates:

“…. Of American adults considering a future home purchase in the second quarter of 2020, about half (49%) are not simply planning it, they are actively engaged in the process to find a home. That is a significantly higher share than the comparable figure a year ago (41%), which suggests that the COVID-19 crisis and its accompanying record-low mortgage rates have converted some prospective buyers into active buyers.”

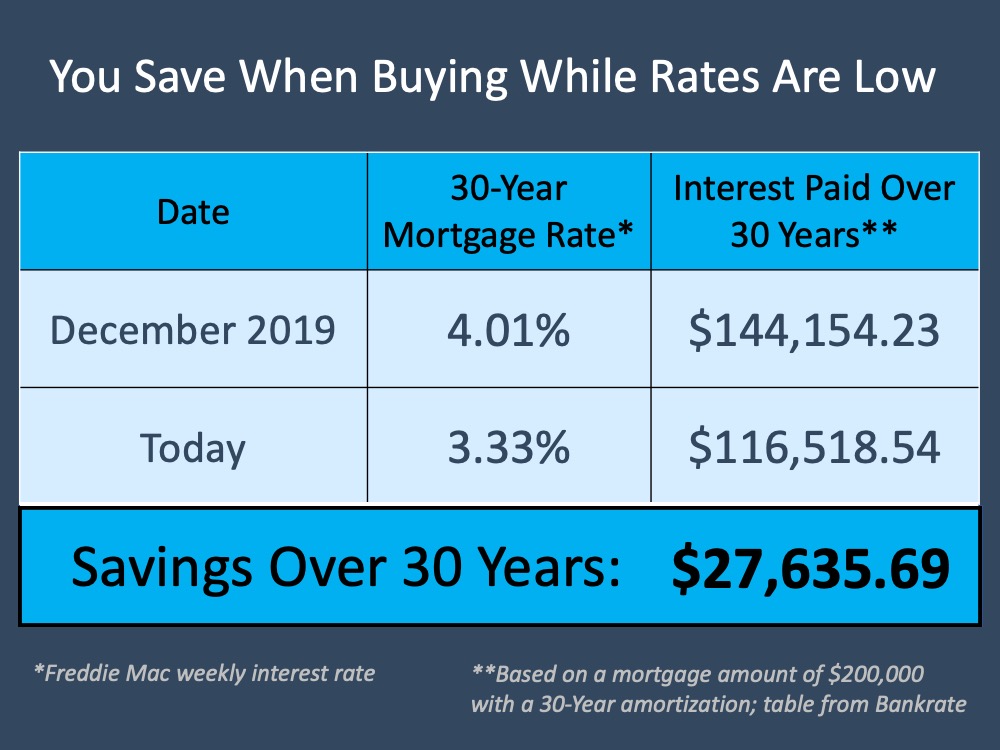

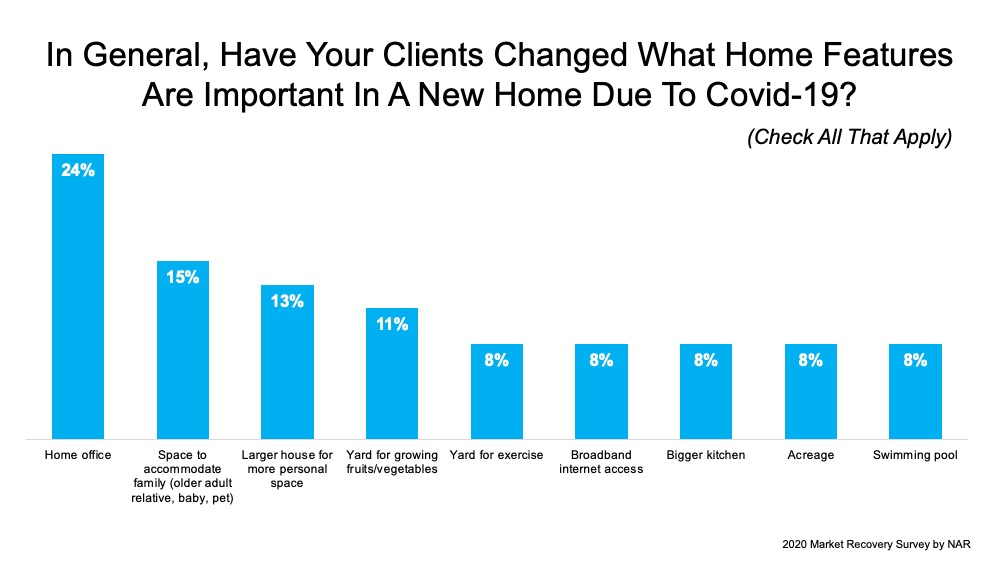

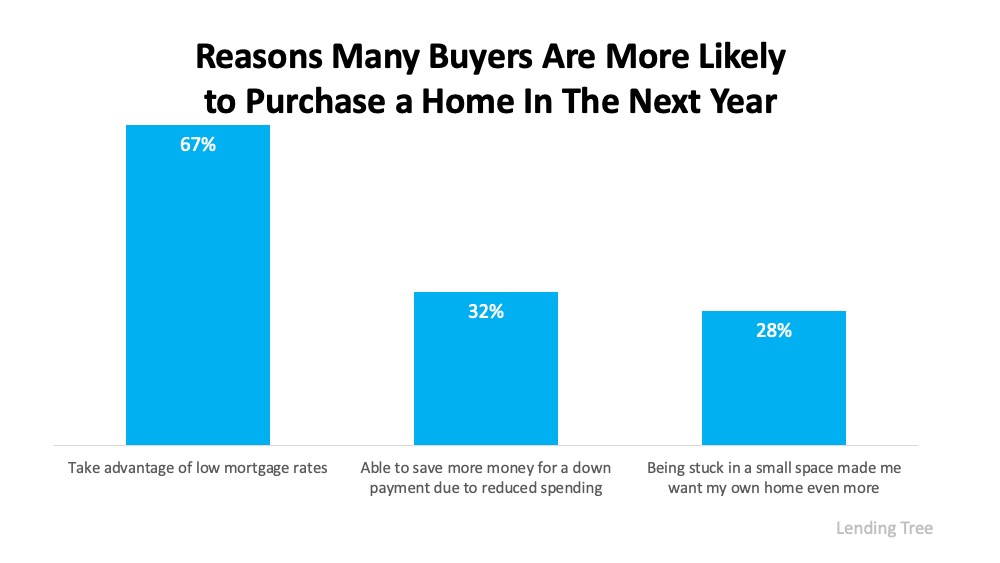

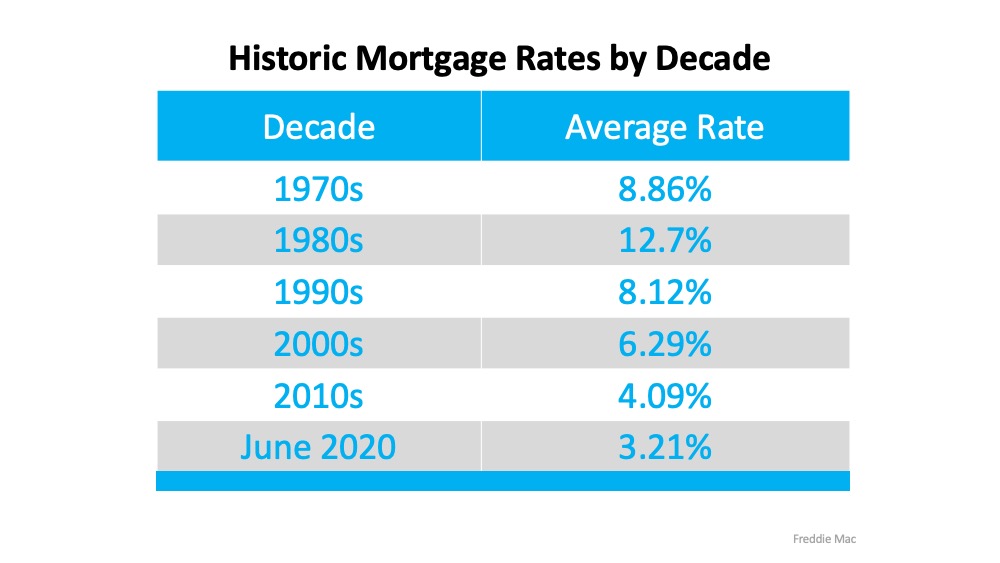

It’s no surprise that buyers are out in full force today. Many Americans now need more space to work from home, and the current low mortgage rates are providing an extra boost of motivation to enter the housing market.

It’s no surprise that buyers are out in full force today. Many Americans now need more space to work from home, and the current low mortgage rates are providing an extra boost of motivation to enter the housing market.

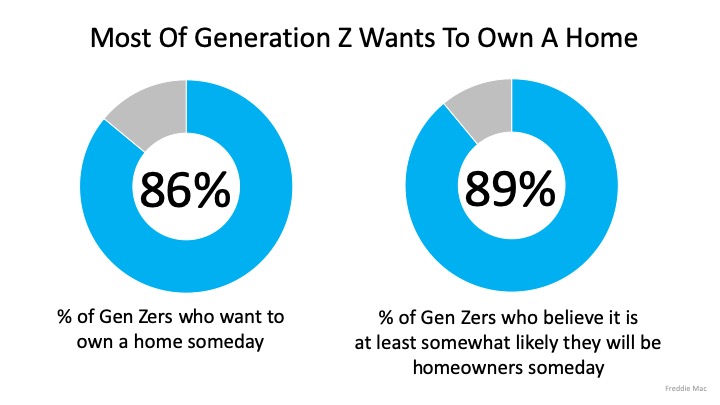

If you’re considering selling your house, know that today’s buyers are serious about making a move. Your opportunity to sell your house in a market with high demand is growing, especially as more millennials enter the housing market too. The same report also notes:

“Of Millennials planning a home purchase in the next year, 57% are already actively searching for a home.”

Odeta Kushi, Deputy Chief Economist at First American, explains:

“When breaking down house-buying power by educational attainment for millennials in 2019, we find that the higher the education, the higher the household income, and the higher the house-buying power. In 2019, median house-buying power for millennials increased 16 percent relative to 2018.”

As demand for homes to buy grows and more millennials enter the market with growing buying power, the opportunity to sell your house grows too.

Bottom Line

Today’s buyers are serious ones and more millennials are helping to fuel that charge. So, if you’re considering selling your home, let’s connect today to determine your next steps in the process while buyers are actively looking.

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)