Renting vs. Buying: The Net Worth Gap You Need To See

Trying to decide between renting or buying a home? One key factor that could help you choose is just how much homeownership can grow your net worth.

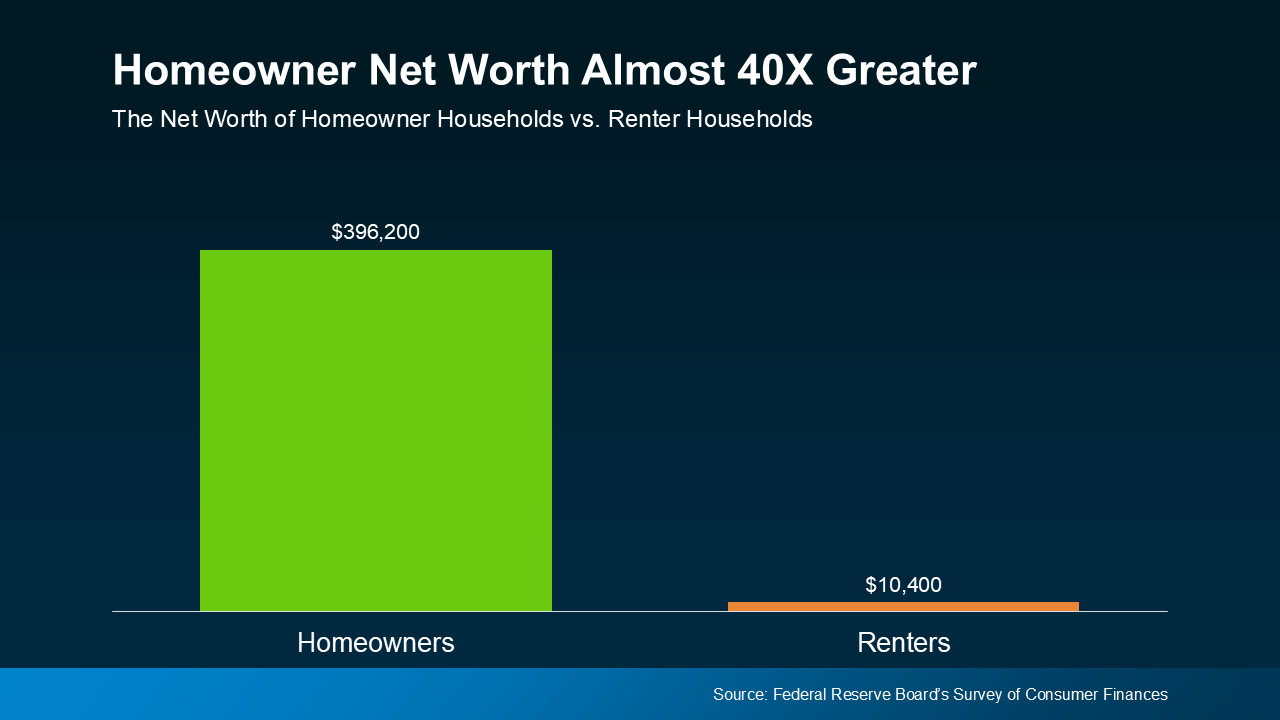

Every three years, the Federal Reserve Board shares a report called the Survey of Consumer Finances (SCF). It shows how much wealth homeowners and renters have – and the difference is significant.

On average, a homeowner’s net worth is nearly 40 times higher than a renter’s. Check out the graph below to see the difference for yourself:

Why Homeowner Wealth Is So High

Why Homeowner Wealth Is So High

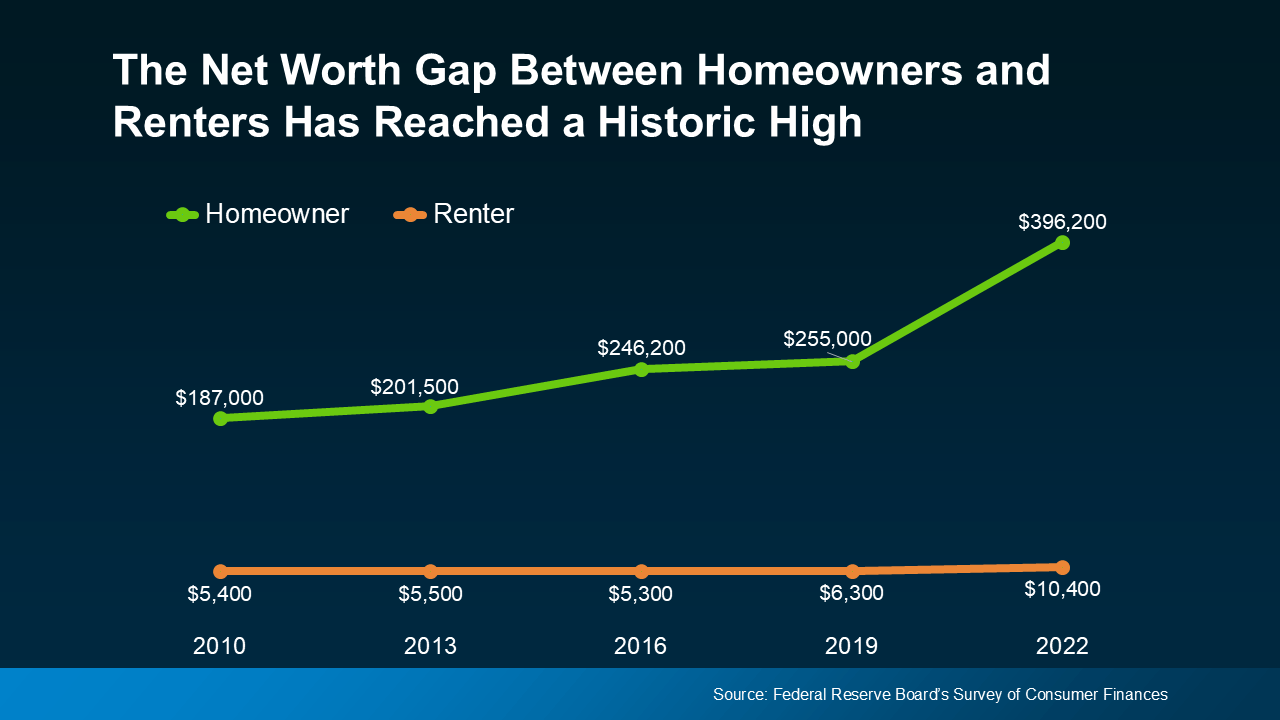

In the previous version of that report, the average homeowner’s net worth was about $255,000, while the average renter’s was just $6,300. That’s still a big gap. But in the most recent update, the spread got even bigger as homeowner wealth grew even more (see graph below):

As the SCF report says:

As the SCF report says:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One big reason why homeowner wealth shot up is home equity.

Equity is the difference between your home’s value and what you owe on your mortgage. You gain equity by paying down your mortgage and when your home’s value goes up.

Over the past few years, home prices have gone up a lot. That’s because there weren’t enough available homes for all the people who wanted one. This supply-demand imbalance pushed home prices up – and that translated into faster equity gains and even more net worth for homeowners.

If you’re still torn between whether to rent or buy, here’s what you should know. While inventory has grown this year, in most places, there’s still not enough to go around. That’s why expert forecasts show prices are expected to go up again next year nationally. It’ll just be at a more moderate pace.

While that’s not the sky-high appreciation we saw during the pandemic, it still means potential equity gains for you if you buy now. As Ksenia Potapov, Economist at First American, explains:

“Despite the risk of volatility in the housing market, homeownership remains an important driver of wealth accumulation and the largest source of total wealth among most households.”

But prices and inventory are going to vary by area. So, lean on a local real estate agent. They’ll be able to give you the local trends and speak to the other financial and lifestyle benefits that come with owning a home. That crucial information will help you decide the best move for you right now. As Bankrate explains:

“Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances. If you’re on the fence about which is right for you, it may be helpful to speak with a local real estate agent who knows your market well. An experienced agent can help you weigh your options and make a more informed decision.”

Bottom Line

If you’re not sure if you should rent or buy, keep in mind that if you can make the numbers work, owning a home can really grow your wealth over time.

And if homeownership feels out of reach, let’s connect so we can explore programs that may make buying possible.