It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals.

In recent months, it’s become increasingly common for an appraisal to come in below the contract price on the house. Shawn Telford, Chief Appraiser for CoreLogic, explains it like this:

“Recently, we observed buyers paying prices above listing price and higher than the market data available to appraisers can support. This difference is known as ‘the appraisal gap . . . .’”

Why does an appraisal gap happen?

Basically, with the heightened buyer demand, purchasers are often willing to pay over asking to secure the home of their dreams. If you’ve ever toured a house you’ve fallen in love with, you understand. Once you start to picture yourself and your furniture in the rooms, you want to do everything you can to land the property, including putting in a high offer to try to beat out other would-be buyers.

When the appraiser comes in, they look at things a bit more objectively. Their job is to assess the inherent value of the home, so they’re going to study the facts. Dustin Harris, Appraiser Coach, drives this point home:

“It’s important for everyone to understand that the appraiser’s job in the end is to remain that unbiased third party, to truly tell the client what that home is worth in the current market, regardless of what decisions have been made on the price side of things.”

In simple terms, while homebuyers may be willing to pay more, appraisers are there to assess the market value of the home. Their goal is to make sure the lender isn’t loaning more money than the home is worth. It’s objective, rather than emotional.

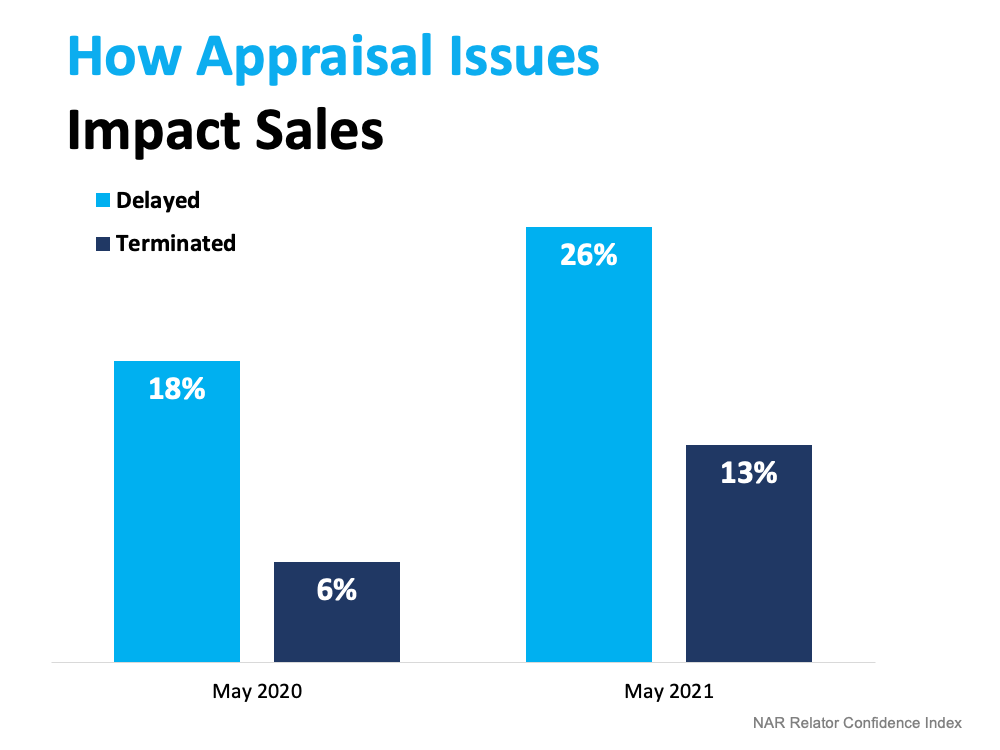

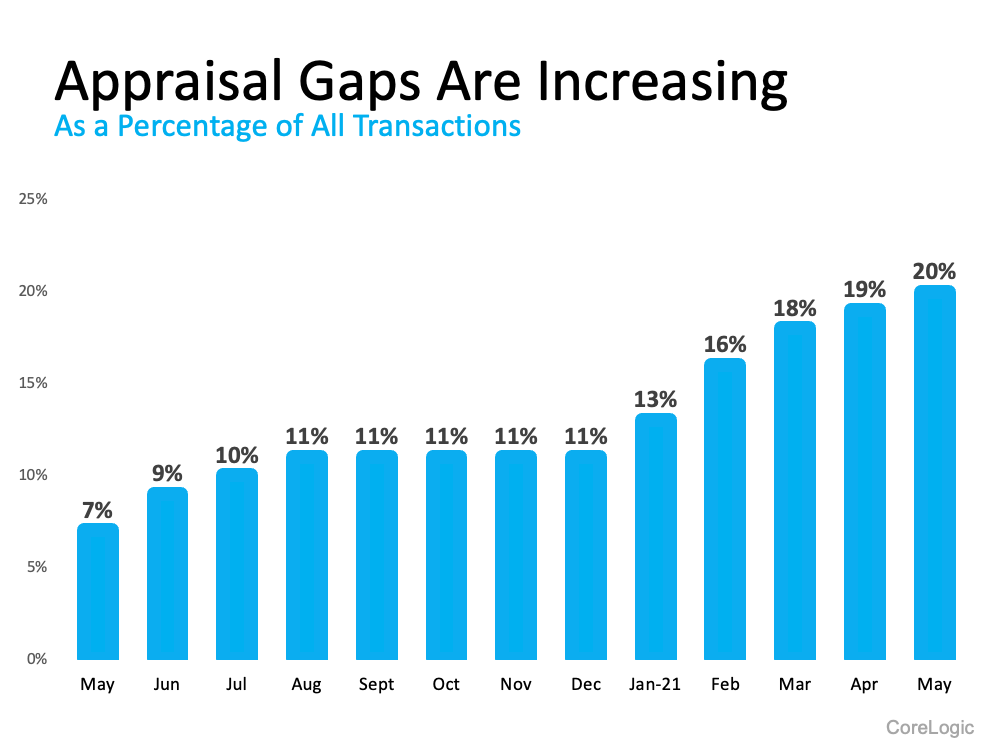

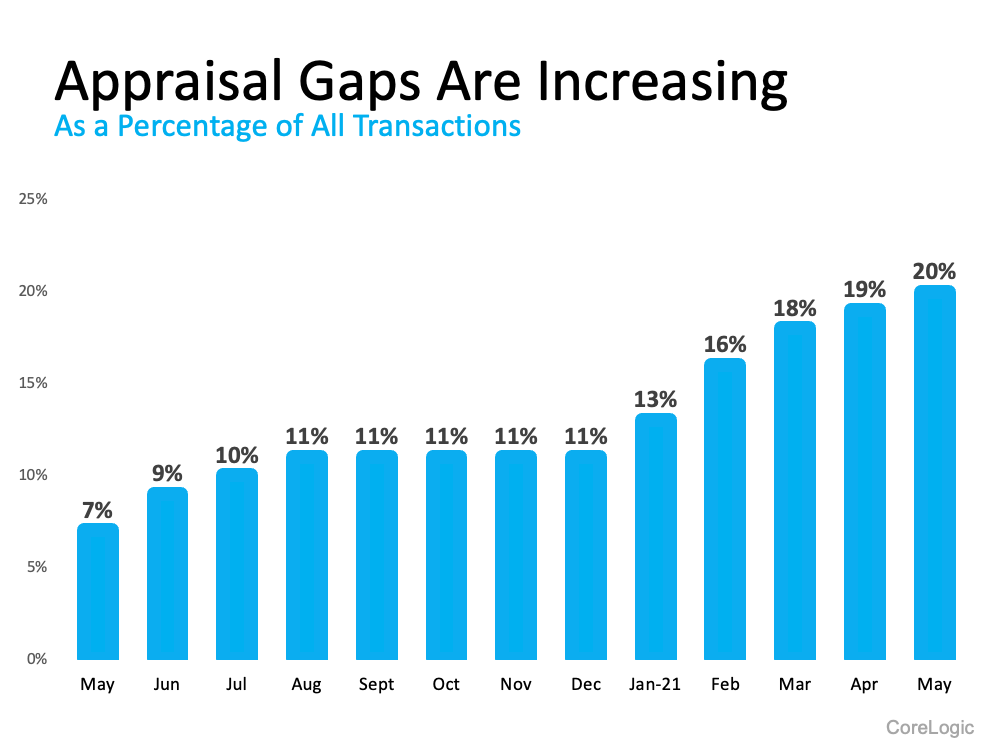

In a highly competitive market like today’s, having a discrepancy between the two numbers isn’t unusual. Here’s a look at the increasing rate of appraisal gaps, according to data from CoreLogic (see graph below):

What does this mean for you?

Ultimately, knowledge is power. The best thing you can do is understand appraisal gaps may impact your transaction if you’re buying or selling. If you do encounter an appraisal below your contract price, know that in today’s sellers’ market, the most common approach is for the seller to ask the buyer to make up the difference in price. Buyers, be prepared to bring extra money to the table if you really want the home.

Above all else, lean on your real estate agent. Whether you’re a buyer or seller, your trusted advisor is your ally if you come up against an appraisal gap. We’ll help you understand your options and handle any additional negotiations that need to happen.

Bottom Line

In today’s real estate market, it’s important to stay informed on the latest trends. Let’s connect so you have an ally to help you navigate an appraisal gap to get the best possible outcome.

![Key Terms for Homebuyers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/03/09163312/20220311-MEM-1046x2681.png)

![Pop Quiz: Can You Define These Key Terms in Today’s Housing Market? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/07/22135823/20210723-MEM-1046x2651.png)