Market Trends and Insights for Home Buyers and Homeowners. #equalhousingopportunity

Monday, December 30, 2013

Sunday, December 29, 2013

Friday, December 27, 2013

Thursday, December 26, 2013

Alternative Home Buying and Selling Strategies

NORFOLK, VA, Dec 26, 2013—In a dream world, every interested homebuyer would

qualify for a mortgage, and every seller would be able to sell their home in a

timely, efficient and stress-free fashion. However, that is not always the

case. In the following article, Louis Eisenberg, Associate Broker REALTOR ABR

SFR of Prudential Towne Realty takes us through two of the most popular alternative

methods for buying and selling when a mortgage may not be available.

Seller Financing

Also known as a purchase money mortgage, seller financing is when the seller agrees to “lend” money to the buyer to purchase and close on the seller’s home. “Usually sellers do this when money is tight, interest rates are high or when a buyer has difficulty qualifying for a conventional loan or meeting the purchase price,” explains Eisenberg.

Seller financing differs from a traditional loan because the seller does not actually give the buyer cash to complete the purchase, as does the lender. Instead, Eisenberg notes, it involves issuing a credit against the purchase price of the home. The buyer executes a promissory note or trust deed in the seller's favor.

The seller may take back a second note or finance the entire purchase if he owns the home free and clear, and the buyer makes a sizeable down payment and agrees to pay the seller directly every month.

The interest rate on a purchase money note is negotiable, as are the other terms in a seller-financed transaction, and is generally influenced by current Treasury bill and certificate of deposit rates. The rate may be higher than those on conventional loans, and the length of the loan shorter, anywhere from five to 15 years.

Lease options

“A lease option is an agreement between a renter and a landlord in which the renter signs a lease with an option to purchase the property,” says Eisenberg. The catch? The option only binds the seller; the tenant has a choice to make a purchase or not.

“Lease options are common among buyers who would like to own a home but do not have enough money for the down payment and closing costs,” explains Eisenberg. A lease option may also be attractive to tenants who are working to improve bad credit before approaching a lender for a home loan.

Under this arrangement, the landlord agrees to give a renter an exclusive option to purchase the property. According to Eisenberg, the option price is usually, but not always, determined at the outset, and the agreement states when the purchase should take place.

A portion of the rent is used to make the future down payment. Most lenders will accept the down payment if the rental payments exceed the market rent and a valid lease-purchase agreement is in effect.

“Before you opt to do a lease option, find out as much as possible about how they work,” cautions Eisenberg. And as always, have an attorney review any paperwork before you and the tenant sign on the dotted line.

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Seller Financing

Also known as a purchase money mortgage, seller financing is when the seller agrees to “lend” money to the buyer to purchase and close on the seller’s home. “Usually sellers do this when money is tight, interest rates are high or when a buyer has difficulty qualifying for a conventional loan or meeting the purchase price,” explains Eisenberg.

Seller financing differs from a traditional loan because the seller does not actually give the buyer cash to complete the purchase, as does the lender. Instead, Eisenberg notes, it involves issuing a credit against the purchase price of the home. The buyer executes a promissory note or trust deed in the seller's favor.

The seller may take back a second note or finance the entire purchase if he owns the home free and clear, and the buyer makes a sizeable down payment and agrees to pay the seller directly every month.

The interest rate on a purchase money note is negotiable, as are the other terms in a seller-financed transaction, and is generally influenced by current Treasury bill and certificate of deposit rates. The rate may be higher than those on conventional loans, and the length of the loan shorter, anywhere from five to 15 years.

Lease options

“A lease option is an agreement between a renter and a landlord in which the renter signs a lease with an option to purchase the property,” says Eisenberg. The catch? The option only binds the seller; the tenant has a choice to make a purchase or not.

“Lease options are common among buyers who would like to own a home but do not have enough money for the down payment and closing costs,” explains Eisenberg. A lease option may also be attractive to tenants who are working to improve bad credit before approaching a lender for a home loan.

Under this arrangement, the landlord agrees to give a renter an exclusive option to purchase the property. According to Eisenberg, the option price is usually, but not always, determined at the outset, and the agreement states when the purchase should take place.

A portion of the rent is used to make the future down payment. Most lenders will accept the down payment if the rental payments exceed the market rent and a valid lease-purchase agreement is in effect.

“Before you opt to do a lease option, find out as much as possible about how they work,” cautions Eisenberg. And as always, have an attorney review any paperwork before you and the tenant sign on the dotted line.

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, December 23, 2013

Thursday, December 19, 2013

Remodeling: Do It Yourself or Go Pro?

NORFOLK, VA, Dec 19, 2013—With all of the DIY television shows on the air

these days, many of us are easily inspired to tackle home improvement projects

ourselves. While taking on a task solo can sometimes be cost effective, if the

project is too large, or your skills fall short, you can end up costing

yourself more in the long run--financially, and in terms of time and stress.

Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty offers us a few words of wisdom that may help you decide if you want to hire outside help when remodeling.

“There are a lot of factors to consider when making this decision,” says Eisenberg. “A lot will depend on your time, level of expertise or willingness to handle the job, amount of help from friends or relatives, and how much you want, or need, to save by doing the job yourself.” If you rely on your own elbow grease, you could save up to 20 percent of the project cost. However, if you have a critical blunder, you will have to pay someone to redo your mistakes.

There are several do-it-yourself books that offer guidance, and some home improvement stores, such as Home Depot or Lowe’s, offer classes that can be helpful getting you on the right track.

Be aware, however, that you may end up spending more time, and up to double your estimated budget, if problems arise.

Also, notes Eisenberg, you may have difficulty selling your home if the workmanship looks shoddy.

“Unless you are very experienced, home improvement experts suggest that you stick to painting, minor landscaping, building interior shelving, and other minor improvements,” suggests Eisenberg.

Remember, too, that you may need to deal with local agencies to get permits, inspections, variances, and certificates of occupancy.

For more remodeling information, please contact Louis Eisenberg Realtor, Prudential Towne Realty109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty offers us a few words of wisdom that may help you decide if you want to hire outside help when remodeling.

“There are a lot of factors to consider when making this decision,” says Eisenberg. “A lot will depend on your time, level of expertise or willingness to handle the job, amount of help from friends or relatives, and how much you want, or need, to save by doing the job yourself.” If you rely on your own elbow grease, you could save up to 20 percent of the project cost. However, if you have a critical blunder, you will have to pay someone to redo your mistakes.

There are several do-it-yourself books that offer guidance, and some home improvement stores, such as Home Depot or Lowe’s, offer classes that can be helpful getting you on the right track.

Be aware, however, that you may end up spending more time, and up to double your estimated budget, if problems arise.

Also, notes Eisenberg, you may have difficulty selling your home if the workmanship looks shoddy.

“Unless you are very experienced, home improvement experts suggest that you stick to painting, minor landscaping, building interior shelving, and other minor improvements,” suggests Eisenberg.

Remember, too, that you may need to deal with local agencies to get permits, inspections, variances, and certificates of occupancy.

For more remodeling information, please contact Louis Eisenberg Realtor, Prudential Towne Realty109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Friday, December 13, 2013

Tuesday, December 10, 2013

Mortgage Madness: What you need to know right now

NORFOLK, VA, Dec 10, 2013—Weeding through all of the available information

on mortgage rates can be exhausting. From trends to current percentage

fluctuations, there is always a surplus of information at your fingertips.

Below are three things you should know about today's mortgage arena, provided

by Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne

Realty.

They're on the way up – but still look good. Today's rates are higher than they were a year ago, but they're still relatively low. Recently, mortgage rates were weighing in around 4 percent, which isn't as low as 2012's 3 percent, but is still a great rate.

They shouldn't stop you from buying. If you're waiting to purchase a home because you think mortgage rates may drop – don't. While mortgage rates do increase and decrease slightly from month-to-month, larger changes happen extremely slowly. “If a fraction of a percent increase or decrease dramatically changes how much house you can buy, then you may be shopping a bit out of your price range,” explains Eisenberg.

There could be upcoming changes. The Federal Reserve has been keeping interest rates low by purchasing billions of dollars' worth of mortgage-backed securities every month, called Quantitative Easing. The Fed admits that this program may not be around much longer, and that when it is eliminated, mortgage rates will spike. “This is only a speculation, but it is still something to keep in mind if you're deciding on the right time to buy,” Eisenberg notes.

For more real estate information, please contact Louis Eisenberg, Associate Broker, Realtor, Prudential Towne Realty, 109 E. Main Street Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

They're on the way up – but still look good. Today's rates are higher than they were a year ago, but they're still relatively low. Recently, mortgage rates were weighing in around 4 percent, which isn't as low as 2012's 3 percent, but is still a great rate.

They shouldn't stop you from buying. If you're waiting to purchase a home because you think mortgage rates may drop – don't. While mortgage rates do increase and decrease slightly from month-to-month, larger changes happen extremely slowly. “If a fraction of a percent increase or decrease dramatically changes how much house you can buy, then you may be shopping a bit out of your price range,” explains Eisenberg.

There could be upcoming changes. The Federal Reserve has been keeping interest rates low by purchasing billions of dollars' worth of mortgage-backed securities every month, called Quantitative Easing. The Fed admits that this program may not be around much longer, and that when it is eliminated, mortgage rates will spike. “This is only a speculation, but it is still something to keep in mind if you're deciding on the right time to buy,” Eisenberg notes.

For more real estate information, please contact Louis Eisenberg, Associate Broker, Realtor, Prudential Towne Realty, 109 E. Main Street Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Friday, December 6, 2013

Wednesday, December 4, 2013

Monday, December 2, 2013

Home Improvement: Financing Your Project and Mechanic's Liens

NORFOLK, VA, Dec 02, 2013—If you're currently looking to remodel your home but aren't sure how to finance it, you're in luck. There are many ways to finance a remodeling project, explains Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. If you have equity in your home, a good credit rating, and steady income, you can refinance your mortgage and borrow a percentage of the equity to cover remodeling costs.

“Refinancing is a good option if you can get a mortgage interest rate at least two percentage points below your current home loan rate,” says Eisenberg.

Other options include a second mortgage, a home equity loan, or an unsecured loan. Less popular options: margin loans, which are taken against securities you own; and loans from retirement plans, life insurance policies and credit cards.

Remember that if you're hiring contractors for work, you need to be able to pay them. “If for any reason you can't, they can take out a mechanic's lien – a “hold” against your property that provides contractors and suppliers legal recourse to assure payment for services,” notes Eisenberg.

The liens vary from state to state and allow for a cloud on the title of your property and foreclosure action. Also, if you paid the contractor, but he failed to pay the subcontractors and laborers – who do not have a contract with you – then the workers may file a mechanic's lien on your home.

“This could result in a double payment by you for the same job,” explains Eisenberg. “You can protect yourself from unwarranted liens by selecting your contractor carefully and managing your construction project responsibly.

“Also, most construction lenders will specify a payment distribution process that involves the securing of lien waivers,” Eisenberg continues. The remodeling contract should address this as well, assuring that the general contractor is responsible for all payments as well as any costs required to remedy lien disputes that may arise.

For more information on refinancing, please contact Louis Eisenberg, REALTOR, ABR, SFR, Associate Broker, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Tuesday, November 26, 2013

Monday, November 25, 2013

Home Maintenance for the New Home Owner

NORFOLK, VA, Nov 25, 2013—Becoming a homeowner for the first time is one of the most fulfilling moments you may ever experience. Owning a home offers a myriad of benefits. However, it can also be costly, especially when you factor in maintenance and repairs over the lifetime of your home. To help reduce stress and costs, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty offers several tips for keeping up with home maintenance.

“From the day you move in to the day you sell your home, there will always be something that will need to be repaired or remodeled,” says Eisenberg. Some changes will be simple; you may want to undertake certain updates simply to elevate your comfort level – like installing central air conditioning – or spruce up the home’s aesthetics, such as adding a few stained-glass windows.

“Others will be more critical, like replacing a hazardous roof, fixing broken windows, and repairing leaky pipes,” says Eisenberg. These are all necessities. Left undone, they can lead to major problems and damages within the home.

One of the top ways, according to Eisenberg, to keep up with your home is to take inventory.

“From the very beginning, get in the habit of taking an inventory at least once a year of every nook and cranny in your home to check for potential problems,” says Eisenberg. “Examine the roof, foundation, plumbing, electrical wiring – basically everything. Try to fix trouble spots as soon as you uncover them. This proactive approach will help you avoid larger expenses later on, so leave no stone unturned when taking your inventory.”

In terms of preparing for expenses, you can expect to spend an average of one percent of the purchase price of your home every year to handle a myriad of tasks, including painting, tree trimming, repairing gutters, caulking windows, and routine system repairs and maintenance.

“An older home will usually require more maintenance, although a lot will depend on how well it has been maintained over the years,” notes Eisenberg.

Tell yourself that the upkeep of your home is mandatory, and budget accordingly. Otherwise, your home’s value will suffer if you allow it to fall into a state of disrepair.

It can be helpful to adopt the attitude that the cost of good home maintenance is usually minor compared to what it will cost to remedy a situation that you allowed to get out of hand. For example, unclogging and sealing gutters may cost a few hundred dollars, but repairing damage to a corner of your home where gutters have leaked can potentially cost several thousand dollars.

“Remember, there is usually a direct link between a property’s condition and its market value: The better its condition, the more a buyer will likely pay for it down the road,” says Eisenberg.

For more information on keeping up with your home, please contact Louis Eisenberg ABR, SFR, Realtor, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Friday, November 22, 2013

Tuesday, November 19, 2013

De-Stress Your Home Buying Process

NORFOLK, VA, Nov 19, 2013—For many, buying a home is one of the most

stressful endeavors you will ever take on. While you may never erase all of the

stress associated with home-buying, with the right mindset, and the right

toolset, you can certainly minimize the stress of finding and buying your dream

home.

1. Get pre-approved. Making sure you are able to get a mortgage will reduce the stress of the home buying process, because you know you're eligible before you even begin hunting, automatically taking that stress factor off your plate. That's not the only way pre-approval will reduce stress – it also makes the home search easier. “Many sellers won't even work with a buyer who is not pre-approved, so you automatically open up your housing pool when you get pre-approved,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

2. Find the right budget and stick to it. Money is a huge source of stress when buying a house. “Figure out exactly how much house you can afford, and refuse to even consider a home outside of that budget,” says Eisenberg.

3. Make a Needs vs. Wants list. Similar to sticking to a budget, understanding your needs (three bedrooms) in relation to your wants (a gourmet kitchen) can save you time and energy during the home hunt.

4. Hire an agent you trust. A real estate agent is the number one way to reduce the stress of buying—or selling—a home. “Find an agent who specializes in your market and similar clients—first-time buyers, move-up clients, vacation homes, etc,” Eisenberg suggests. While many think hiring an agent will make the home-buying process costlier, agents can help save money in the negotiating process. Regardless of money saved, working with an agent—who knows the process inside and out—will save you a great deal of stress.

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

1. Get pre-approved. Making sure you are able to get a mortgage will reduce the stress of the home buying process, because you know you're eligible before you even begin hunting, automatically taking that stress factor off your plate. That's not the only way pre-approval will reduce stress – it also makes the home search easier. “Many sellers won't even work with a buyer who is not pre-approved, so you automatically open up your housing pool when you get pre-approved,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

2. Find the right budget and stick to it. Money is a huge source of stress when buying a house. “Figure out exactly how much house you can afford, and refuse to even consider a home outside of that budget,” says Eisenberg.

3. Make a Needs vs. Wants list. Similar to sticking to a budget, understanding your needs (three bedrooms) in relation to your wants (a gourmet kitchen) can save you time and energy during the home hunt.

4. Hire an agent you trust. A real estate agent is the number one way to reduce the stress of buying—or selling—a home. “Find an agent who specializes in your market and similar clients—first-time buyers, move-up clients, vacation homes, etc,” Eisenberg suggests. While many think hiring an agent will make the home-buying process costlier, agents can help save money in the negotiating process. Regardless of money saved, working with an agent—who knows the process inside and out—will save you a great deal of stress.

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Saturday, November 16, 2013

Friday, November 15, 2013

Thursday, November 14, 2013

Wednesday, November 13, 2013

Stealing Space: How to Reconfigure Room for Your Home Addition

NORFOLK, VA, Nov 13, 2013—Looking to expand your home? You may have more room than you think, according to Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Just look around you. If you see any space you don't currently use—say, that downstairs powder room that rarely ever sees traffic—then you can repurpose it to fit your needs. This concept of “stealing” space from a neighboring room is called space reconfiguration and it is much cheaper than a major remodeling job.

“Recycling isn't just for cans and bottles. Repurposing room for your home can save money and energy as well,” says Eisenberg. “What's key is finding space that can work in a new way.” That space may be as close as the next room, particularly if there are unused or under utilized areas in your home.

There are two main ways you can do this:

Converting. Dying for a home office or a small in-house fitness space? “A garage, attic, side porch, large closet, or basement can all be converted to fit the use you have in mind,” suggests Eisenberg. The pre-existing structure and frame will make the process cheaper and easier to complete. This goes for major additions, like a bonus room, as well. Building up, or placing it above the garage, will be easier than creating a whole new foundation.

Carving. If you have an oversized kitchen or a big formal dining room, consider putting up walls to carve out a new space from the existing one. Maybe a small area can be carved from a larger area to create a powder or laundry room. Or, do it the other way around. “If your bedroom is bigger than you really need, expand your bathroom into a deluxe master suite,” says Eisenberg.

When looking to convert or carve new space, it's important to utilize what's already around you, and this includes things like plumbing. “Putting a new laundry room next to a kitchen or bathroom will be easier than sticking it on the second floor, because the piping is already nearby,” notes Eisenberg.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Monday, November 11, 2013

Friday, November 8, 2013

Thursday, November 7, 2013

Life after foreclosure: When can you buy?

NORFOLK, VA, Nov 07, 2013—For those consumers who have a foreclosure on their record, it may feel like they will never repair their credit enough to become a homeowner again. It can happen, notes Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty, but it will depend on a variety of variables.

“Bouncing back after a foreclosure will depend greatly on your individual circumstances, as well as the mortgage interest rate you are willing to pay,” says Eisenberg. Foreclosures can remain on your credit record for seven to 10 years. Most lenders will consider your request for a home loan two to four years after your foreclosure, although your interest rates will be higher.

“Keep an eye out for predatory lenders that will issue a home mortgage in less time than average, but will charge you obscenely high mortgage interest rates, fees, and penalties,” warns Eisenberg.

A quality lender will expect you to show that you have cleaned up your credit. In this light, a borrower who has worked hard to reestablish good credit may also be shown some leniency by the lender.

Repairing your credit is possible, although it can be a slow-moving process. Act as quickly as you can to take care of any outstanding delinquencies, tackling a little at a time until you get back on the right track. “Make an effort, if at all possible, to repay your debt in full and on time for six months to a year to prove you are working hard to repair any damage,” says Eisenberg.

“It will also be helpful to provide a reasonable explanation about the circumstances that led to the foreclosure, such as exuberant medical expenses or lifestyle changes beyond your control,” notes Eisenberg. If you declared bankruptcy because you were laid off from your job, the lender may be more sympathetic. If, however, you went through bankruptcy because you overextended personal credit lines and lived beyond your means, it is unlikely the lender will readily give you a break.

If you've waited several years after your foreclosure and you're still having trouble obtaining a traditional mortgage, consider other options, such as subprime mortgages, which are made to borrowers who do not meet traditional credit criteria at a higher interest rate.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Monday, November 4, 2013

Buying a garage door? Think insulation

There are seemingly endless options through which homeowners must navigate when buying a new garage door: the style, materials and accessories, just to name a few. But perhaps the most important feature that should top the garage door consumer's list is energy efficiency.

Why? Because the garage door is generally the largest moving object in your home and offers the greatest exposure to the elements. An insulated garage door will maintain the temperature in your garage in the winter and in the summer and likely decrease your heating and cooling costs. Insulated garage doors not only make the garage itself more comfortable to be in, but also the rooms adjacent to or above the garage. A well-insulated garage also helps keep moisture out, and its sturdy construction offers a greater noise-reducing sound barrier.

What should consumers look for in an energy efficient garage door? For starters, check out the R-value. R-value is a measure of thermal resistance to heat flow and is how most manufacturers show the energy efficiency of their product. The higher the R-value of a door, the more insulation you'll get. Second, look at the door's construction. Well-insulated doors will have a "triple-layer" construction, consisting of environmentally safe polystyrene or polyurethane thermal insulation between two layers of heavy-duty steel. Some insulated garage doors also include a thermal break which is a nonconductive material within the door that keeps thermal energy from passing through, resulting in improved energy efficiency for the home.

Well-insulated garage doors should be able to stand up to the most extreme of conditions while simultaneously protecting your garage and the rest of your home.

Whether your garage door withstands heat, wind, snow, rain, or all of the above, it's the largest line of defense for your home. Make sure that it's working hard for you by reducing your home's energy consumption and providing strong, durable protection from the outside. Your utility bills - and the rest of your (climate-controlled) house will thank you.

For more information contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com (757) 572-7244 www.LouisEisenberg.com

Why? Because the garage door is generally the largest moving object in your home and offers the greatest exposure to the elements. An insulated garage door will maintain the temperature in your garage in the winter and in the summer and likely decrease your heating and cooling costs. Insulated garage doors not only make the garage itself more comfortable to be in, but also the rooms adjacent to or above the garage. A well-insulated garage also helps keep moisture out, and its sturdy construction offers a greater noise-reducing sound barrier.

What should consumers look for in an energy efficient garage door? For starters, check out the R-value. R-value is a measure of thermal resistance to heat flow and is how most manufacturers show the energy efficiency of their product. The higher the R-value of a door, the more insulation you'll get. Second, look at the door's construction. Well-insulated doors will have a "triple-layer" construction, consisting of environmentally safe polystyrene or polyurethane thermal insulation between two layers of heavy-duty steel. Some insulated garage doors also include a thermal break which is a nonconductive material within the door that keeps thermal energy from passing through, resulting in improved energy efficiency for the home.

Well-insulated garage doors should be able to stand up to the most extreme of conditions while simultaneously protecting your garage and the rest of your home.

Whether your garage door withstands heat, wind, snow, rain, or all of the above, it's the largest line of defense for your home. Make sure that it's working hard for you by reducing your home's energy consumption and providing strong, durable protection from the outside. Your utility bills - and the rest of your (climate-controlled) house will thank you.

For more information contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com (757) 572-7244 www.LouisEisenberg.com

Friday, November 1, 2013

Thursday, October 31, 2013

Keeping Up With Home Improvements

NORFOLK, VA, Oct 31, 2013—Being a homeowner is one of the most rewarding parts of life, but it is also a large undertaking. From the day you move in to the day you sell your home, there will always be something that will need to be repaired or remodeled. You may want to undertake some changes simply to elevate your comfort level – like installing central air conditioning – or spruce up the home’s aesthetics, such as adding a few stained-glass windows.

But other work will need to be done to maintain the property and minimize problems later on. These may include replacing a hazardous roof, fixing broken windows, and repairing leaky pipes. These are all necessities. Left undone, they can lead to major problems and damages within the home.

If you decide one day to sell, other improvements will likely be made to increase the home’s value and appeal to potential buyers, says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

“From the very beginning, get in the habit of taking an inventory at least once every year of every nook and cranny of your home to check for potential problems,” suggests Eisenberg. Examine the roof, foundation, plumbing, electrical wiring – basically everything. Try to fix trouble spots as soon as you uncover them.

“This proactive approach will help you avoid larger expenses later on, so leave no stone unturned when taking your inventory,” explains Eisenberg.

Eisenberg notes that you may expect to spend one percent of the purchase price of your home every year to handle a myriad of tasks, including painting, tree trimming, repairing gutters, caulking windows, and routine system repairs and maintenance.

An older home will usually require more maintenance, although a lot will depend on how well it has been maintained over the years.

“Tell yourself that the upkeep of your home is mandatory, and budget accordingly,” says Eisenberg. Otherwise, your home’s value will suffer if you allow it to fall into a state of disrepair. Remember, there is usually a direct link between a property’s condition and its market value: The better its condition, the more a buyer will likely pay for it down the road.

“Adopt the attitude that the cost of good home maintenance is usually minor compared to what it will cost to remedy a situation that you allowed to get out of hand,” says Eisenberg. For example, unclogging and sealing gutters may cost a few hundred dollars. But repairing damage to a corner of your home where gutters have leaked can potentially cost several thousand dollars.

For more information on home improvement, please contact, Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA. 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Saturday, October 26, 2013

Wednesday, October 23, 2013

Fall Fun: 5 enjoyable Fall renovations

NORFOLK, VA, Oct 23, 2013—Dreading your home renovation? It can be hard not

to – from the planning to the cost, home improvement can cause a lot of stress.

In order to make your renovation more enjoyable, Louis Eisenberg, Associate

Broker REALTOR ABR SFR of Prudential Towne Realty lists a handful of updates

that aren't all that bad.

Pull up the old carpet. Getting rid of dingy carpet in your home can be a satisfying task. “What's even more satisfying is revealing lustrous hard wood underneath,” comments Eisenberg. If your home has hidden wood floors, polish them up and see your space transform. No wood? No worries. Replace it with fresh, updated carpet.

Landscaping. Fall is a beautiful time to landscape your yard. Get the whole family involved and turn it into a weekend project. Plan, mulch, plant, and then sit back and enjoy your hard work.

Paint the interior. “Painting can be fun, even meditative,” says Eisenberg. Make sure to choose a color you love, and don't forget to have a little fun with it. Eisenberg suggests adding a festive accent wall or color border.

Make use of empty space. “Planning out how to change your already existing layout can be extremely rewarding, like a puzzle,” says Eisenberg. Transform that unused office into a home theatre or fitness room. Make a pantry out of that extra space in the laundry room. If you have the financial ability, you can even get luxurious – use extra bedroom space to create a walk-in closet or bathroom suite, or turn that unused first floor bathroom into extended kitchen space.

Play designer. “Sometimes the renovation that packs the most punch isn't a renovation at all,” says Eisenberg. Redesigning your space can completely transform it, and it's usually pretty fun. Pick out new accents, from throw-pillows to curtains. Shop for affordable art, buy new furniture and lay it out differently. You will be amazed with how much can be accomplished with the space you already have.

For more information on buying in a low inventory market, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk ,VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Pull up the old carpet. Getting rid of dingy carpet in your home can be a satisfying task. “What's even more satisfying is revealing lustrous hard wood underneath,” comments Eisenberg. If your home has hidden wood floors, polish them up and see your space transform. No wood? No worries. Replace it with fresh, updated carpet.

Landscaping. Fall is a beautiful time to landscape your yard. Get the whole family involved and turn it into a weekend project. Plan, mulch, plant, and then sit back and enjoy your hard work.

Paint the interior. “Painting can be fun, even meditative,” says Eisenberg. Make sure to choose a color you love, and don't forget to have a little fun with it. Eisenberg suggests adding a festive accent wall or color border.

Make use of empty space. “Planning out how to change your already existing layout can be extremely rewarding, like a puzzle,” says Eisenberg. Transform that unused office into a home theatre or fitness room. Make a pantry out of that extra space in the laundry room. If you have the financial ability, you can even get luxurious – use extra bedroom space to create a walk-in closet or bathroom suite, or turn that unused first floor bathroom into extended kitchen space.

Play designer. “Sometimes the renovation that packs the most punch isn't a renovation at all,” says Eisenberg. Redesigning your space can completely transform it, and it's usually pretty fun. Pick out new accents, from throw-pillows to curtains. Shop for affordable art, buy new furniture and lay it out differently. You will be amazed with how much can be accomplished with the space you already have.

For more information on buying in a low inventory market, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk ,VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Tuesday, October 22, 2013

Selling: Tips for top negotiation

NORFOLK, VA, Oct 22, 2013—If you're selling your home, you're probably

enjoying the fact that the market currently appears to be back on track. As more

and more buyers come into the fold, you may have multiple offers on your

property. Whether you're choosing a buyer, or currently in the throes of

negotiating price, Louis Eisenberg, Associate Broker REALTOR ABR SFR of

Prudential Towne Realty offers the following tips for negotiating price and

landing the best deal on your home.

“If someone offers you a lowball price, one way to up the ante without quarreling over money is to offer an incentive for a higher offer,” says Eisenberg. Incentives are especially effective with first time buyers. Some good incentives are providing the buyers with a home warranty or title insurance; paying for closing costs or homeowner's association fees; offering to repaint or re-carpet to specifications, or purchasing a year-long membership to a local pool or club.

If you don't want to get into this type of situation to begin with, it's important to price appropriately, says Eisenberg. Many sellers focus too much on what they bought the home for, or the work they put into it. Unfortunately, a home value is based on the current market, so it's important to forget about the cost of that new deck and instead familiarize yourself with current conditions.

“To get a good sense of what comparable homes are selling for, attend open houses and check out local listings,” says Eisenberg. “Ask your agent for help with this—they have access to the MLS.”

For more information on selling your home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

“If someone offers you a lowball price, one way to up the ante without quarreling over money is to offer an incentive for a higher offer,” says Eisenberg. Incentives are especially effective with first time buyers. Some good incentives are providing the buyers with a home warranty or title insurance; paying for closing costs or homeowner's association fees; offering to repaint or re-carpet to specifications, or purchasing a year-long membership to a local pool or club.

If you don't want to get into this type of situation to begin with, it's important to price appropriately, says Eisenberg. Many sellers focus too much on what they bought the home for, or the work they put into it. Unfortunately, a home value is based on the current market, so it's important to forget about the cost of that new deck and instead familiarize yourself with current conditions.

“To get a good sense of what comparable homes are selling for, attend open houses and check out local listings,” says Eisenberg. “Ask your agent for help with this—they have access to the MLS.”

For more information on selling your home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Friday, October 18, 2013

Tax Tips For Home Sellers

NORFOLK, VA, Oct 18, 2013—Tax season may feel far away, but with the rush of the holiday season nearly upon us, it's important to start thinking ahead, especially if you sold a home this year. Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty takes us through several of the need-to-know facts about tax season for home sellers.

Under $250,000? You may be able to exclude gains

“Just because you profited on your home sale does not mean you have to pay taxes on it,” says Eisenberg. “In fact, if you're eligible to exclude your gains, you don't even need to note that you sold your home at all when you file.

To be eligible, you need to have made a profit of less than $500,000 on a joint return or $250,000 on an individual return, and the home must have been your primary residence for at least two years prior to sale.

You may not have to report your home sale at all

“If you can exclude all of the gain--meaning it was under 500,00 on a joint return or $250,000 on a single--you probably don’t need to report the sale of your home on your tax return at all,” says Eisenberg. Double check this with your accountant, but this is the case in most situations.

But you can't deduct your losses

While it's great you can exclude financial gains, you can't deduct financial losses, which is unfortunate.

The more homes, the more complicated tax-time can be

“Several complications can arise from owning more than one property, be it an investment or vacation home,” says Eisenberg. The home you live in the majority of the time is considered your primary residence. This is important because it's necessary for you to report any gains you may have made on your second home.

If you can't exclude gains...

If you can’t exclude all of the gain because it was over the allotted amount, or you choose not to exclude it, then you will need to report the sale on your tax return. “Keep an eye out for Form 1099-S, Proceeds From Real Estate Transactions,” suggests Eisenberg.

If you’re selling your first home...

One more reminder about selling your home and tax season, says Eisenberg. “Special rules may apply when you sell a home for which you received the first-time homebuyer credit.”

Keep in mind that tax time can be stressful and busy, so it's always a good idea to have a professional look over your paperwork if you had an unusual financial year.

For more information on selling your home, please contact Louis Eisenberg, Prudential Towne Realty, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Thursday, October 17, 2013

Home Buyers Purchasing Power

Housing Market Forecasts mortgage interest rates are on the rise as well as the price of homes. Now is a good time to buy or sell a home

Wednesday, October 16, 2013

What to know about buying a home in the Fall

NORFOLK, VA, Oct 16, 2013—The fall often calls for a slowdown from the bustling Summer homebuying season. However, due to affordable interest rates and home prices, this fall is proving to be a busier buying time than the falls that have come before. Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty let's us in on a few tips for buying a home in the fall:

Check up on homes you liked this summer. Remember that gorgeous home with the wrap-around porch you fell in love with in June, but passed on because it was a bit out of your price range? Check back. “If it's still on the market, it may have dropped in price, and even if it hasn't, offering a little less than asking price may be a good idea if the seller is trying to close before winter,” comments Eisenberg.

Buy a home that needs a little TLC. In the fall, not only are homes cheaper, but building materials are, too. Home improvement stores typically have huge fall sales now that the prime building season (looking at you, summer) is over. “So if you are unsure about a home because it needs a renovated kitchen or bathroom, you may be able to swing it if you make good use of the season's discounts,” says Eisenberg.

Take advantage of more selection. While many areas around the country are experiencing a shortage in listing, the fall will offer more selection than the summer or spring. Use this to your advantage by shopping around and comparing prices.

Don't rush. Just as sellers are looking to unload their properties before winter, you may be feeling rushed to purchase one before the holidays start rolling in. “Take your time and make intelligent buying decisions – you want a home you can enjoy for years to come, so don't allow the changing seasons to pressure you,” notes Eisenberg.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, October 14, 2013

Friday, October 4, 2013

Wednesday, October 2, 2013

Tuesday, October 1, 2013

Monday, September 30, 2013

Friday, September 27, 2013

Tuesday, September 24, 2013

Renovating your home? Here is a reality check

NORFOLK, VA, Sep 24, 2013—With all of the DIY and big dream renovation

reality shows currently airing on TV, it's easy to set your hopes high when it

comes to your own renovation project. They make it look so easy on TV, it's all

you can do to keep from imagining that update that's both wallet friendly and

quick. “In reality—the actual reality—home renovations take a lot of work, from

project planning to building,” says Louis Eisenberg, Associate Broker REALTOR

ABR SFR of Prudential Towne Realty. “And although it's good to be

budget-friendly, sometimes it's more important to splurge on lasting material

than go with a cheaper version.”

Here are a few tips that can help you get your head in the right place before you plan out that brand new master bedroom.

How important is this? “If the home may not be where you spend all of your time—say, it's an investment property or you plan to sell in the next five years—then don't go overboard on expensive renovations,” says Eisenberg. This is especially true if your renovation is tailored to your specific taste. While a home theater is important to you, your buyer in five years may not place the same value on this type of space.

Don't overspend on appliances. While top-of-the-line appliances might feel nice, they're a quick way to blow your budget, and those brand names don't always work better than their less expensive counterparts. “Be sure to avoid trendy pieces,” says Eisenberg. The same goes for fancy counters and cabinetry. “Choose something that is simple and timeless so you still enjoy it 10 years down the line,” notes Eisenberg.

Research, research, research. Did a neighbor or coworker recently renovate their home? “Ask for their advice, take note of anything they're remorseful of, and learn from their mistakes before you make your own,” suggests Eisenberg. Also, do your due diligence when it comes to finding your contractor. Make sure to research, get multiple price quotes, and ask for—and check up on—referrals.

Give yourself enough time. Just because projects on TV get done in one episode doesn't mean your project will be fast and smooth. Set aside a realistic time frame, with extra time sandwiched on either end for delays, and try not to push up against tight deadlines—say, relatives arriving in three weeks or a big holiday party you're hosting.

For more information on renovating, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244 or www.LouisEisenberg.com .

Here are a few tips that can help you get your head in the right place before you plan out that brand new master bedroom.

How important is this? “If the home may not be where you spend all of your time—say, it's an investment property or you plan to sell in the next five years—then don't go overboard on expensive renovations,” says Eisenberg. This is especially true if your renovation is tailored to your specific taste. While a home theater is important to you, your buyer in five years may not place the same value on this type of space.

Don't overspend on appliances. While top-of-the-line appliances might feel nice, they're a quick way to blow your budget, and those brand names don't always work better than their less expensive counterparts. “Be sure to avoid trendy pieces,” says Eisenberg. The same goes for fancy counters and cabinetry. “Choose something that is simple and timeless so you still enjoy it 10 years down the line,” notes Eisenberg.

Research, research, research. Did a neighbor or coworker recently renovate their home? “Ask for their advice, take note of anything they're remorseful of, and learn from their mistakes before you make your own,” suggests Eisenberg. Also, do your due diligence when it comes to finding your contractor. Make sure to research, get multiple price quotes, and ask for—and check up on—referrals.

Give yourself enough time. Just because projects on TV get done in one episode doesn't mean your project will be fast and smooth. Set aside a realistic time frame, with extra time sandwiched on either end for delays, and try not to push up against tight deadlines—say, relatives arriving in three weeks or a big holiday party you're hosting.

For more information on renovating, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244 or www.LouisEisenberg.com .

Monday, September 23, 2013

Friday, September 20, 2013

Monday, September 16, 2013

Want to buy a home in the near future? Here is what you do now

NORFOLK, VA, Sep 16, 2013—Perhaps you're several years away from buying a

home. However, whether you plan to make a move in one year, or five, there are

steps you should be taking now to get ready for homeownership on the horizon.

Gather good credit – “From gaining credit to keeping a close eye on it, credit is a huge deal when it comes to applying for a mortgage,” notes Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Things like credit cards, car payments, student loans and even phone bills can establish credit, so you may already be well on your way. If you haven’t built up credit yet, don't worry. Open a line of credit and use only what you can pay off each month.

“Another way to establish credit and prove you're a responsible potential homeowner is to have your current home rental—if you have one—in your name,” suggests Eisenberg. This works for utilities like electric and even cable, as well.

Save – From down payments to closing costs, purchasing a home is a pricey process, and that's before you factor in any needed repairs and that new dining room set. “Don't count on that check your parents promised you for your first home,” says Eisenberg. “Lenders look at how long funds have been in your account when considering you for a mortgage, so be sure to start saving now.” Set up an automatic transfer that saves a little of your monthly paycheck to bolster your savings account.

Educate – No matter how financially prepared you may be for your first home, hunting for and buying a home is still a lengthy and often arduous process. Start researching the mortgage process now so that by the time you're ready to make a move, you have a wealth of knowledge, and resources.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Gather good credit – “From gaining credit to keeping a close eye on it, credit is a huge deal when it comes to applying for a mortgage,” notes Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Things like credit cards, car payments, student loans and even phone bills can establish credit, so you may already be well on your way. If you haven’t built up credit yet, don't worry. Open a line of credit and use only what you can pay off each month.

“Another way to establish credit and prove you're a responsible potential homeowner is to have your current home rental—if you have one—in your name,” suggests Eisenberg. This works for utilities like electric and even cable, as well.

Save – From down payments to closing costs, purchasing a home is a pricey process, and that's before you factor in any needed repairs and that new dining room set. “Don't count on that check your parents promised you for your first home,” says Eisenberg. “Lenders look at how long funds have been in your account when considering you for a mortgage, so be sure to start saving now.” Set up an automatic transfer that saves a little of your monthly paycheck to bolster your savings account.

Educate – No matter how financially prepared you may be for your first home, hunting for and buying a home is still a lengthy and often arduous process. Start researching the mortgage process now so that by the time you're ready to make a move, you have a wealth of knowledge, and resources.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Friday, September 13, 2013

Thursday, September 12, 2013

How to refinance your home without perfect credit

NORFOLK, VA, Sep 12, 2013—Are you hoping to refinance, but nervous because your credit is not where it should be? Unlike what you may have heard, it's still possible to refinance your mortgage without great credit. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty provides us with several tips how.

Start with clear expectations. You may be hearing about great refinance rates. However, without great credit, these will probably not be available to you. “Although you won't be applicable for the best rates, you can still refinance.” says Eisenberg. “Just be ready for higher interest rates.”

How is your equity? “Your equity may be more important when refinancing than your credit,” Eisenberg cautions. If you have a scant amount of equity, this could be your greatest challenge. “Try applying for an FHA-backed loan, as they're easier to secure.”

Show your best assets. If your credit history is shady, show your lender that you are, in fact, improving. Show how you're working hard to pay off your debt. Highlight that you have a long-standing, steady and secure job. Provide any bank statements that show a full savings account, and highlight that you haven't made any risky purchases—new car? That's a red flag right there.

“While securing a refinance is more difficult with bad credit, it isn't impossible. Be sure to put your best financial foot forward and you can most likely still find a lender,” says Eisenberg.

For more refinance information, please contact Louis Eisenberg Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com .

Wednesday, September 11, 2013

If you are considering selling your home, the time is now

As

more inventory comes on the market, buyer urgency will wane and price increases

will slow and even decline seasonally in many areas this winter.

Tuesday, September 10, 2013

Monday, September 9, 2013

Why Do American Families Buy a Home?

The following post is Courtesy of KCM Blog

The KCM Crew

There is a plethora of opinions voiced by real estate gurus as to why the dream of home ownership is so important to most Americans. However, study after study reveals the same five reasons families decide to buy a home. They…

There is a plethora of opinions voiced by real estate gurus as to why the dream of home ownership is so important to most Americans. However, study after study reveals the same five reasons families decide to buy a home. They…

Why Do American Families Buy a Home?

- Want a good place to raise children

- Want a place where their family feels safe

- Want more living space

- Want control of that living space

- Realize that owning makes better financial sense than does renting

If you are considering purchasing a home, look at the five reasons mentioned above. If any of them apply to you and your family, perhaps it is time for you to take the plunge. With both prices and interest rates rising, waiting will only increase your monthly cost as we move forward.

Friday, September 6, 2013

Thursday, September 5, 2013

Homeownership still the American Dream

The following article Courtesy of KCM BLOG:

The KCM Crew

A big question facing the real estate industry over the last few years is how the housing crisis would impact the public’s belief in homeownership as a major component of the American Dream. Many felt the tragedy experienced by so many families would force them to reconsider their desire to ever be a homeowner again.

A big question facing the real estate industry over the last few years is how the housing crisis would impact the public’s belief in homeownership as a major component of the American Dream. Many felt the tragedy experienced by so many families would force them to reconsider their desire to ever be a homeowner again.

A recent study by the Joint Center for Housing Studies at Harvard University addressed this question. Their paper, Reexamining the Social Benefits of Homeownership after the Housing Crisis, revealed some interesting findings:

Harvard: Homeownership Still the American Dream

A recent study by the Joint Center for Housing Studies at Harvard University addressed this question. Their paper, Reexamining the Social Benefits of Homeownership after the Housing Crisis, revealed some interesting findings:

Homeownership Still Preferred Over Renting

“Even after the dramatic loss of equity and the high foreclosure rates, the early evidence suggests that people seem to believe that, over the long run, owning is still preferable to renting…The long term cultural preference for owning seems to have weathered the recent housing crisis.”

Americans Still Expect to be Homeowners

“The research on home-buying expectations supports the conclusion that very large percentages of Americans still expect to buy a home at some time in the future.”

Younger Americans More Desirous of Homeownership

“Moreover, the finding that younger renters and owners are more likely than their older counterparts to expect to own bodes well for the future of the housing market.”Even after one of the most difficult decades in this country’s real estate history, the belief that homeownership is a part of the American Dream still lives on.

Friday, August 30, 2013

Thursday, August 29, 2013

Wednesday, August 28, 2013

5 big home mortgage mistakes to avoid

NORFOLK, VA, Aug 28, 2013—Applying for a mortgage can be a daunting task. It

takes many hours, lots of paperwork, and possibly a headache or two. Below are

several mistakes to avoid when on the hunt for a mortgage.

Not checking your credit. “This should be your first step in applying for a mortgage,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Check your score months before applying for a mortgage so you know where you stand, and have time to make any changes if necessary.

Not getting pre-approved. A mortgage pre-approval is one of the best things you can do to ease the home-buying process. During pre-approval, your bank checks your credit and examines your income, assets, and employment. “Before shopping for a home, get pre-approved,” advises Eisenberg. “Many sellers won't take you seriously otherwise.”

Applying for new credit AND a new mortgage. “Do not apply for a new line of credit before or during the mortgage application process – it hints at financial instability, and you're seen as a greater risk,” says Eisenberg.

Changing jobs. If you're thinking about switching jobs, then hold off on the mortgage application, or stick out your current position for longer. “While a change in the same field doesn't necessarily mean you will be rejected, a big change - like a brand new career - can be a red flag,” notes Eisenberg.

Not seasoning your assets. Uncle John is giving you $10,000 to put toward your mortgage? Terrific. Make sure it's in your account months before you apply for a mortgage. New funds do not equate to financial stability, and your underwriter will catch on.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Not checking your credit. “This should be your first step in applying for a mortgage,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Check your score months before applying for a mortgage so you know where you stand, and have time to make any changes if necessary.

Not getting pre-approved. A mortgage pre-approval is one of the best things you can do to ease the home-buying process. During pre-approval, your bank checks your credit and examines your income, assets, and employment. “Before shopping for a home, get pre-approved,” advises Eisenberg. “Many sellers won't take you seriously otherwise.”

Applying for new credit AND a new mortgage. “Do not apply for a new line of credit before or during the mortgage application process – it hints at financial instability, and you're seen as a greater risk,” says Eisenberg.

Changing jobs. If you're thinking about switching jobs, then hold off on the mortgage application, or stick out your current position for longer. “While a change in the same field doesn't necessarily mean you will be rejected, a big change - like a brand new career - can be a red flag,” notes Eisenberg.

Not seasoning your assets. Uncle John is giving you $10,000 to put toward your mortgage? Terrific. Make sure it's in your account months before you apply for a mortgage. New funds do not equate to financial stability, and your underwriter will catch on.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Sunday, August 25, 2013

Thursday, August 22, 2013

Wednesday, August 21, 2013

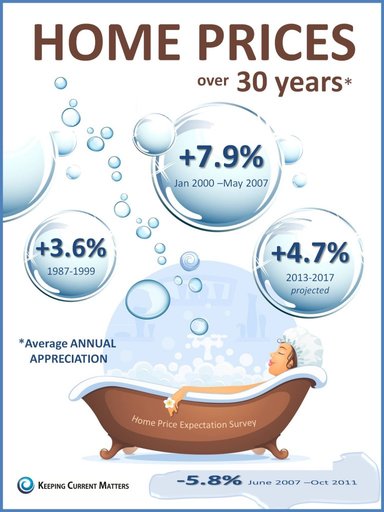

Projected home price appreciation

It is a good time to buy. Home mortgage interest rates are still low and home prices are rising. Residential real estate is a good investment. Note: Home price percentage appreciation in Hampton Roads is higher than the graphics National Average. (Graphic Courtesy of KCM BLOG)

Tuesday, August 20, 2013

Buying a home? First check for these costly problems

NORFOLK, VA, Aug 20, 2013—Buying a home is a hefty task, and with so many

things to consider (do I need that extra bedroom? How important is a big

yard?), it is easy to get a little lost in the process. There is nothing worse

than purchasing a home only to find out you need to sink thousands of

unexpected dollars into your new place, all because you weren't sure what to

look for.

Below are a few tips to make sure you're focusing on the right home features, so you can enjoy your new home AND still be able to afford that new dining room set.

Hire a home inspector. “Getting a home inspected is the No. 1 way you can avoid surprises after closing,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. However, it's still important to know what to look for on your own, as it can save you precious time and energy expenditure. For instance, if you know you can't afford a new foundation, then you can skip over making offers on homes that are clearly in need.

Check the basement. After you ooh and ah over the walk-in closets, head on down to the basement. Check out the plumbing, examine building materials, and check out insulation. “Can you see daylight peeking through cracks in the walls? That spells high heating bills, as the home may have some insulation issues,” suggests Eisenberg. Basements are not a big issue in Hampton Roads, but some older homes, especially in Ghent, have them.

Scope out the foundation. “Big cracks or corrosion can spell big trouble down the line,” notes Eisenberg. “Foundation is an expensive repair, so make sure the home is sound.”

Look for water damage. Check for discoloration and rings around pipes, windows and doors, as well as kitchen and bathroom fixtures.

Eye the roof. “You definitely aren't going to climb up to the roof while visiting a potential home, but you can scope it from the outside,” says Eisenberg. Can you see any visible missing tiles or discoloration? “And feel free to ask the agent when the roof was last replaced.”

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Below are a few tips to make sure you're focusing on the right home features, so you can enjoy your new home AND still be able to afford that new dining room set.

Hire a home inspector. “Getting a home inspected is the No. 1 way you can avoid surprises after closing,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. However, it's still important to know what to look for on your own, as it can save you precious time and energy expenditure. For instance, if you know you can't afford a new foundation, then you can skip over making offers on homes that are clearly in need.

Check the basement. After you ooh and ah over the walk-in closets, head on down to the basement. Check out the plumbing, examine building materials, and check out insulation. “Can you see daylight peeking through cracks in the walls? That spells high heating bills, as the home may have some insulation issues,” suggests Eisenberg. Basements are not a big issue in Hampton Roads, but some older homes, especially in Ghent, have them.

Scope out the foundation. “Big cracks or corrosion can spell big trouble down the line,” notes Eisenberg. “Foundation is an expensive repair, so make sure the home is sound.”

Look for water damage. Check for discoloration and rings around pipes, windows and doors, as well as kitchen and bathroom fixtures.

Eye the roof. “You definitely aren't going to climb up to the roof while visiting a potential home, but you can scope it from the outside,” says Eisenberg. Can you see any visible missing tiles or discoloration? “And feel free to ask the agent when the roof was last replaced.”

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Monday, August 19, 2013

Friday, August 16, 2013

Thursday, August 15, 2013

Selling on a budget? The best low cost home renovations

NORFOLK, VA, Aug 15, 2013—Selling your home usually requires some staging maintenance. However, for those on a budget, there are still some changes you can make to help your home sell faster while keeping money in the bank. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty provides us with a few ideas.

1. Painting – Whether you need to give the interior or exterior—or both—of your home a facelift, painting is the cheapest and easiest ways to keep your home looking fresh and well-maintained. With a bit of patience, you can even do the interior paint job yourself. “I would hire a professional for the exterior,” recommends Eisenberg.

2. Landscaping - “A messy exterior automatically sends the wrong message to buyers,” says Eisenberg. Keep the grass cut, the garden happy, and tools or toys out of sight. “If your budget allows, plant a few new trees or add some outdoor furniture so buyers can envision themselves spending time in your yard.

3. Accents – Linens, rugs, curtains, furniture covers – all of these can be quickly refreshed for a relatively low cost, and they really can amp your home's appeal. “Even a few throw pillows tailored to the color scheme of the season you're selling can make an interior more inviting,” notes Eisenberg.

4. Energy efficient updates - “If you can afford it, get a few energy efficient features added to your home. They are a major selling point right now,” says Eisenberg. Budget depending, you can have new windows installed, or just an energy efficient washer and dryer that you can offer as an inclusion with your sale.

For more information on selling you home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com .

Wednesday, August 14, 2013

Friday, August 9, 2013

Why air contioning costs are heating up

You might wish that summer could go on and on—until it comes time to recharge your air conditioning system. The cost of the common refrigerant R-22 (also known as Freon), widely used in residential air conditioning systems, has already increased by more than 400 percent in the past 18 months and is expected to go even higher, making air conditioning repairs more costly for many.

R-22 has been the refrigerant of choice for residential heat pump and air conditioning systems for more than four decades, but it has been identified as having a negative environmental impact, including contributing to ozone depletion. Under EPA regulations, R-22 is being phased out, with production totally prohibited after 2020.

This has added new considerations for homeowners who are considering whether to repair or replace an air conditioning unit. For instance, some refrigerant manufacturers have begun selling cheaper alternatives to R-22, often referred to as "drop-in" replacement refrigerants. But alternatives are cheaper only in the short run.

"Lennox, one of the leading air conditioning manufacturers, has conducted research that shows these cheaper alternate refrigerants are not compatible with the lubricating oil used in R-22 units," says Dave Moody, director of marketing for Service Experts Heating & Air Conditioning. "Recharging older air conditioners with these alternative refrigerants may actually damage the system and void your manufacturer's warranty. As a result, we've instructed our 2,500 technicians to follow the manufacturer's recommendations and use only R-22 when they recharge R-22 systems."

Moody also points out that reclaimed and recycled R-22 is expected to be available to repair existing systems after production ceases in 2020, but as the supply of new R-22 refrigerant continues to be reduced, costs of both new and recycled R-22 refrigerant will increase significantly.

All new air conditioning systems now use a more environmentally friendly refrigerant, R410A.-These newer systems offer many benefits, including greater energy efficiency, longer warranty periods and quieter operation, and may prove to be the wiser investment when homeowners are faced with repairing an older system that uses R-22 refrigerant.

"There is no one-size-fits-all answer about whether to repair or replace your R-22 AC," says Moody. "It really does depend on the individual family, their home, their lifestyle and their budget.”

R-22 has been the refrigerant of choice for residential heat pump and air conditioning systems for more than four decades, but it has been identified as having a negative environmental impact, including contributing to ozone depletion. Under EPA regulations, R-22 is being phased out, with production totally prohibited after 2020.

This has added new considerations for homeowners who are considering whether to repair or replace an air conditioning unit. For instance, some refrigerant manufacturers have begun selling cheaper alternatives to R-22, often referred to as "drop-in" replacement refrigerants. But alternatives are cheaper only in the short run.

"Lennox, one of the leading air conditioning manufacturers, has conducted research that shows these cheaper alternate refrigerants are not compatible with the lubricating oil used in R-22 units," says Dave Moody, director of marketing for Service Experts Heating & Air Conditioning. "Recharging older air conditioners with these alternative refrigerants may actually damage the system and void your manufacturer's warranty. As a result, we've instructed our 2,500 technicians to follow the manufacturer's recommendations and use only R-22 when they recharge R-22 systems."

Moody also points out that reclaimed and recycled R-22 is expected to be available to repair existing systems after production ceases in 2020, but as the supply of new R-22 refrigerant continues to be reduced, costs of both new and recycled R-22 refrigerant will increase significantly.

All new air conditioning systems now use a more environmentally friendly refrigerant, R410A.-These newer systems offer many benefits, including greater energy efficiency, longer warranty periods and quieter operation, and may prove to be the wiser investment when homeowners are faced with repairing an older system that uses R-22 refrigerant.

"There is no one-size-fits-all answer about whether to repair or replace your R-22 AC," says Moody. "It really does depend on the individual family, their home, their lifestyle and their budget.”

Thursday, August 8, 2013

Wednesday, August 7, 2013

5 demands to make on your real estate agent

The following article is courtesy of KCM Blog

If we were hiring an agent to sell my home today, we would require that they:

1. Tell us the truth about the price

Too many agents just take the listing at any price and then try to the ‘work the seller’ for a price correction later. Demand that the agent prove to you that they have a belief in the price they are suggesting. Make them show you their plan to sell the house at that price – TWICE! Every house in today’s market must be sold two times – first to a buyer and then to the bank.The second sale may be more difficult than he first. The residential appraisal process has gotten tougher. It has become more difficult to get the banks to agree on the contract price. A red flag should be raised if your agent is not discussing this with you at the time of the listing.

2. Understand the timetable with which my family is dealing

You will be moving your family to a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan. This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. I am not suggesting that your agent can pick the exact date for your move. You just want the agent to exert any influence they can.3. Remove as many of the challenges as possible

It is imperative that your agent know how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.Remember: If you have an agent who was weak negotiating with you on the parts of the listing contract that were most important to them (commission, length, etc.), don’t expect them to turn into Superman when they are negotiating for you with your buyer.

4. Help with the relocation

If you haven’t yet picked your new home, make sure the agent is capable and willing to help you. The coordination of the move is crucial. You don’t want to be without a roof over your head the night of the closing. Likewise, you don’t want to end up paying two housing expenses (whether it is rent or mortgage). You should, in most cases, be able to close on your current home and immediately move into your new residence.

5. Get the house SOLD!