Momentum Is Building for New Home Construction

If you’re in the process of looking for a home today, you know the supply of homes for sale is low because you’re feeling the impact of having a limited pool of options. And, if your biggest hurdle right now is that you’re having trouble finding something you like, don’t forget that a newly built home is a great option.

As a recent article from the National Association of Realtors (NAR) says:

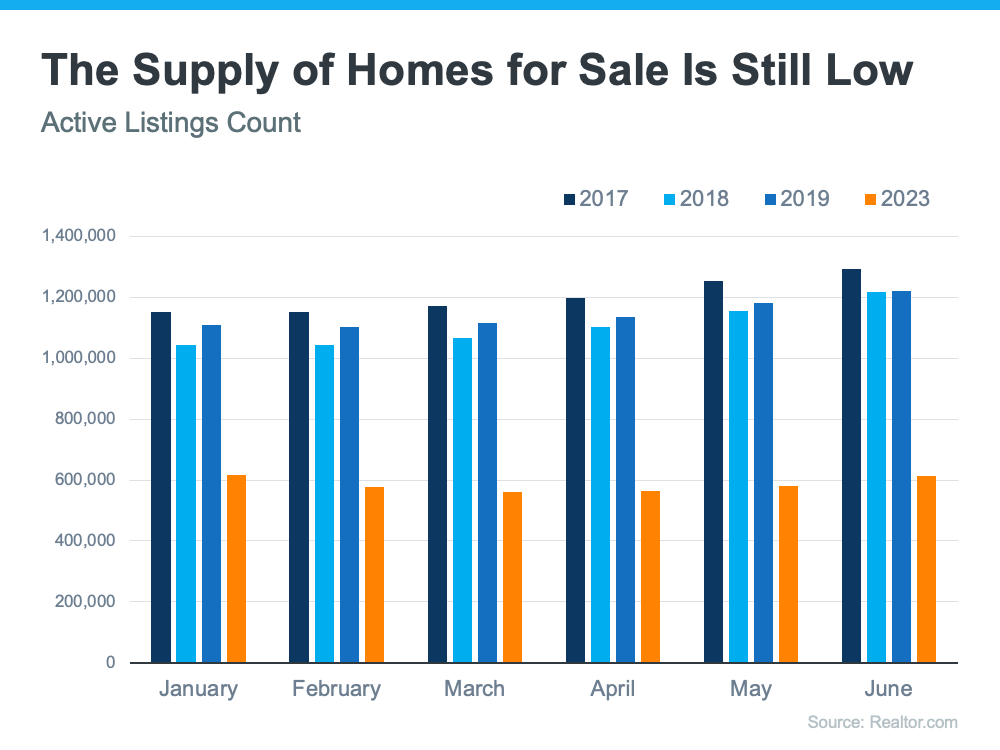

“Home buyers continue to be met with limited housing options during what’s typically the real estate market’s busiest season. . . . The current supply of existing homes is about half the level it was in 2019 . . . Meanwhile, the market for new construction is a bright spot.”

Here’s a look at a key metric that shows just how much new home construction is ramping up nationwide. It’s called new residential completions. Basically, completions are newly built homes that are finished and ready to move into.

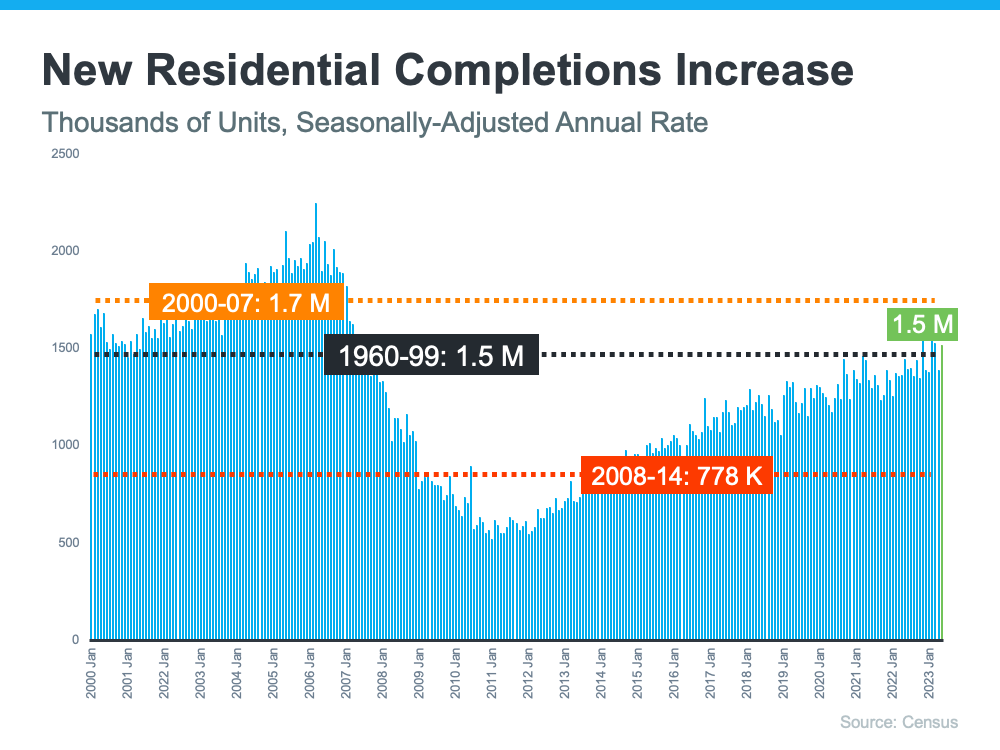

The graph below uses data from the Census to show the trend of new-home completions over time, including the long-term average for the number of finished housing units (shown in black on the graph):

As you can see on the left (shown in orange), leading up to the housing crash, builders exceeded that average. The result was an oversupply of homes on the market, so home values declined. That was one of the factors that led to the housing crash back in 2008.

Since then, the level of new home construction has fallen off, and builders haven’t built enough homes to meet the historical average (shown in red). That underbuilding left the housing market with a multi-year inventory deficit. And, that deficit is part of what makes inventory so low right now.

But, here’s the good news. The green on the right shows that according to the latest report from the Census, builders are matching the long-term average right now. And that means they’re bringing more newly built homes to the market than they have in recent memory.

And residential starts and permits are also gaining momentum. Starts are homes where the construction has officially kicked off. Permits are homes where builders are planning to break ground soon. Since both are up, it’s a sign there are even more newly built homes coming soon.

What This Means for You

More newly built homes in various stages of the construction process means your pool of options just got bigger. If you’re looking to move right now and timing is important to you, reach out to a local real estate professional to explore the homes that were recently completed in your area. If construction is done on those homes, you should be able to move in quickly.

But, if you can wait a bit and the idea of customizing a home from the ground up appeals to you, ask that same agent about the homes in your area that are in the process of being built. If you buy a home that’s still in the works, you can help pick the features and finishings along the way. And when none of the homes you’ve looked at so far are to your liking, being able to tailor one to your taste may be your best option.

Either way, a trusted real estate agent is a crucial part of the process. They’ll know exactly what’s available in your area and can base their recommendations on your unique needs, desired neighborhoods, and more.

Bottom Line

So, if you're having trouble finding a home you like while inventory is so low, it may be time to consider looking into new-home construction. If you'd like to start that conversation, let’s connect so you’re working with an expert on what’s available in our area.