Why Moving to a More Affordable Area Makes Sense

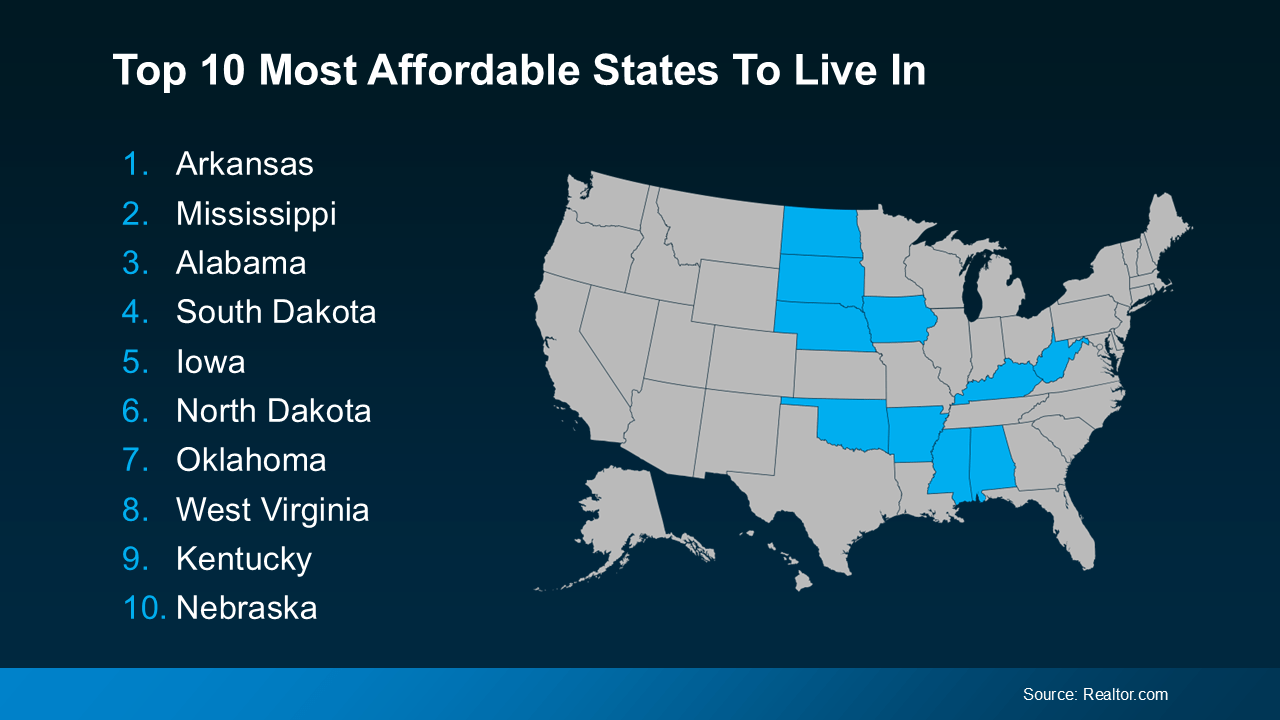

Moving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your desired location – no matter where you want to be – is always the best plan. And with the rising cost of living, many people are rethinking where they live and looking for ways to cut expenses. If that sounds like you, here’s a great place to start (see visual below):

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you're open to relocating, you might discover the savings you’re looking for.

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you're open to relocating, you might discover the savings you’re looking for.

Why Move to a Lower-Cost Area?

Life is getting more expensive by the day. From rising home prices to higher grocery bills, it feels like everything costs more than it used to. Housing, the largest expense for most people, has become especially costly.

In fact, according to data from Case-Shiller, home prices increased 3.9% from September 2023 to September 2024. And data from GOBankingRates shows insurance costs are up too, with home insurance premiums averaging $2,151 annually – a significant jump compared to recent years.

These rising costs can feel like a lot to handle. That’s why more people are considering lower-cost areas. An article from the National Association of Realtors (NAR) says:

"With the past decade of rising home prices, buyers are looking for more affordable areas . . . As housing affordability continues to shape migration patterns, these areas may provide an opportunity . . . for those looking for more cost-effective alternatives to the nation’s larger, pricier metropolitan areas."

Lower-cost areas typically offer more affordable housing, less expensive home insurance, and reduced costs for daily living like groceries and gas. Transportation expenses and car insurance premiums also tend to be lower. For anyone feeling stretched thin, moving to a less expensive area can provide meaningful financial relief.

Planning Your Big Move

Whether it’s finding a home that fits your budget or cutting down on other expenses, making the right move in any market can bring significant financial relief. Of course, moving isn’t a decision to take lightly.

Whether you’re moving just a few towns over or to a completely different state, there’s a lot to consider. From job opportunities, to schools, to local amenities – it all has an impact on finding the right home for you.

This is where a knowledgeable local real estate agent can be your best resource. Not only can they help you navigate the housing market in your new or desired area, but they’ll also guide you to neighborhoods that balance affordability with your needs.

And don’t worry if none of the states on the affordability list seem like the right fit for you. An agent can still help you identify budget-friendly options wherever you need to be.

Bottom Line

If the rising cost of living has you feeling stuck, know that you have options. Moving to a more affordable area could be the fresh start you need to get ahead financially and improve your quality of life.

But don’t try to tackle the process alone. With the help of a real estate agent who knows the area, you’ll be well-prepared to make a move. When you’re ready to take the first step, let’s connect.