Reasons To Consider Condos in Your Home Search

Are you having trouble finding a home that fits your needs and your budget? If so, you should know there’s an option worth considering – condominiums, also known as condos. According to Bankrate:

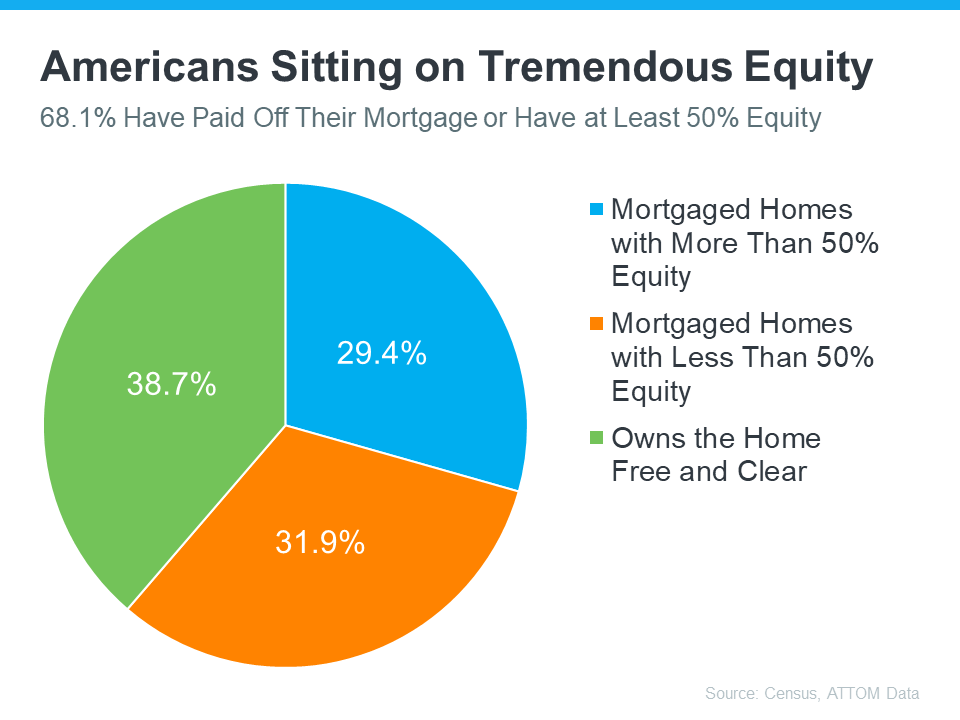

“A condo can be a more affordable entry point to homeownership than a single-family home. And as a homeowner, you’ll build equity over time and have access to tax benefits that a renter wouldn’t.”

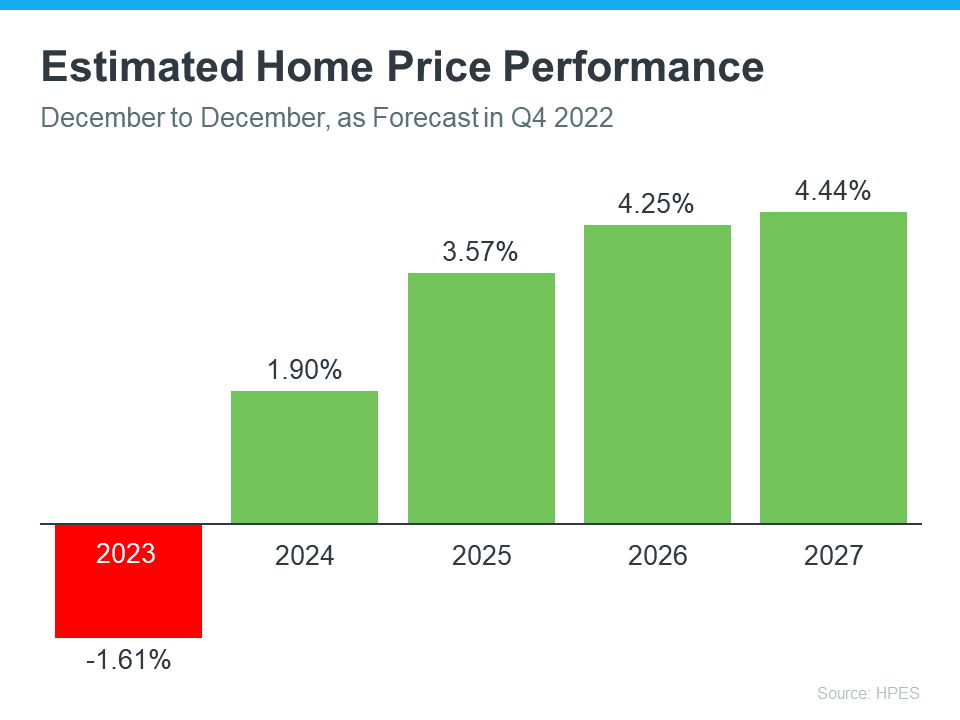

That’s why expanding your search to include additional housing types, like condominiums, could help you accomplish your homeownership goals this spring, especially if you can be flexible about the space you need. Condos are typically smaller than a single-family home, but that’s part of what can make them more budget-friendly (see graph below):

In addition to providing more options in your home search and possibly your price point, there are several other benefits to condo living. They tend to require less upkeep and lower maintenance – and that can give you more time to spend doing the things you enjoy. Plus, since many condos are in or near city centers, they offer the added benefit of being in close proximity to work and leisure.

Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the door as a homeowner so you can start building wealth in the form of home equity. In time, the equity you develop can fuel a future purchase if your needs change.

Ultimately, owning and living in a condo can be a lifestyle choice. And if that appeals to you, they could provide the added options you need in today’s market.