The Difference in Net Worth Between Homeowners and Renters Is Widening

Becoming financially secure is an important goal for many people today, but some don’t realize just how much homeownership can help them achieve that dream. A recent report, The Journey Toward Financial Freedom, surveys Americans about their perspective on financial wellness and their goals. It shows there may be a significant misconception about the role owning a home plays in building wealth:

“Home ownership is one of the indicators Americans say is least connected to financial health."

Two major personal wealth goals – homeownership and net worth – work hand-in-hand. Below are just a few reasons why, if you’re looking for financial security, homeownership should be a top priority.

Homeownership Is an Important Cornerstone of Building Wealth

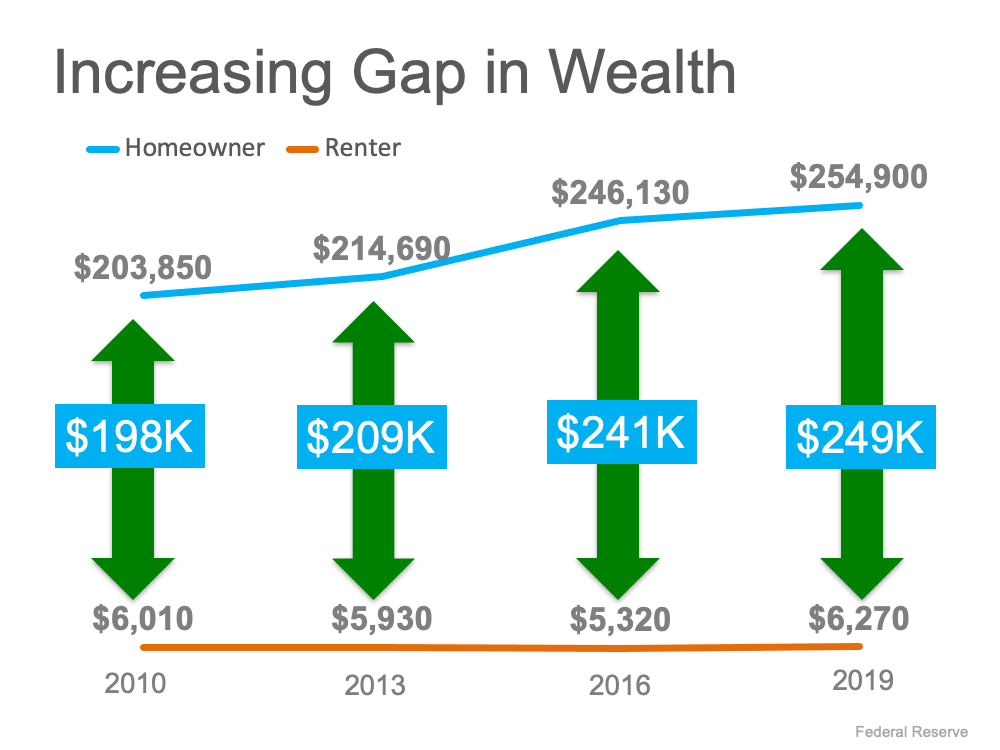

Every three years, the Federal Reserve releases the Survey of Consumer Finances which highlights the difference in wealth between homeowners and renters. The graph below shows the findings across the previous surveys including the latest data (2019), and the results are staggering: As the graph illustrates, the gap between homeowners and renters continues to widen. That’s because homeownership contributes massively to an individual’s overall net worth. Odeta Kushi, Deputy Chief Economist at First American, highlights this idea:

As the graph illustrates, the gap between homeowners and renters continues to widen. That’s because homeownership contributes massively to an individual’s overall net worth. Odeta Kushi, Deputy Chief Economist at First American, highlights this idea:

“. . . between 2016 and 2019, housing wealth was the single biggest contributor to the increase in net worth across all income groups . . . .”

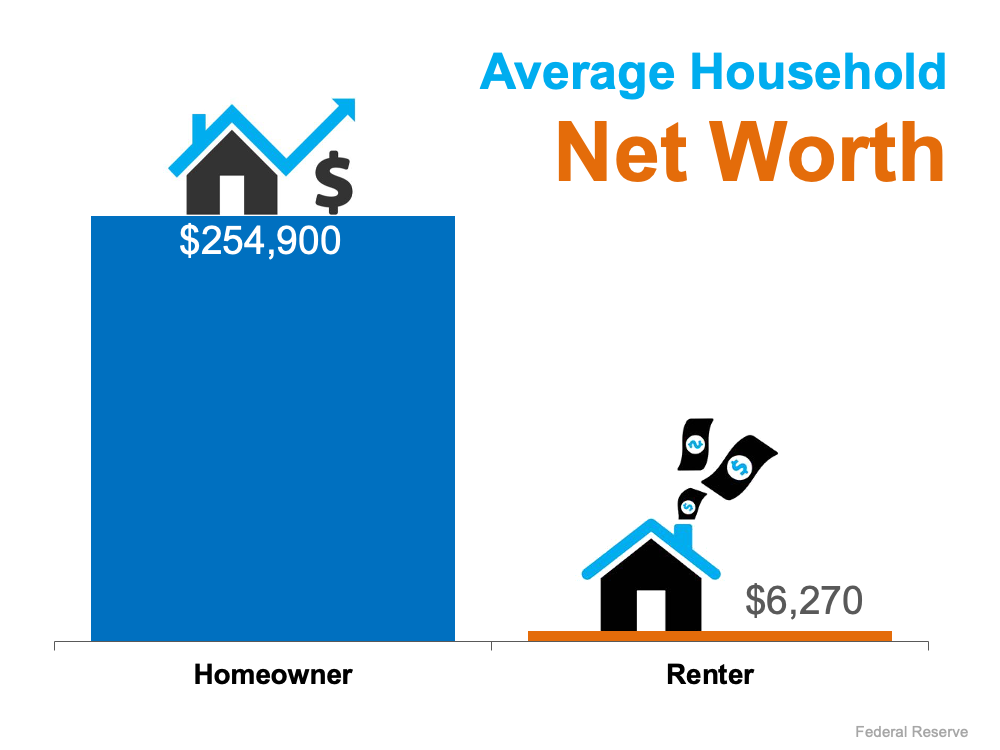

When we look even closer at the most recent data from 2019, the average homeowner’s net worth is more than 40 times greater than that of the average renter (see graph below): The gap exists in large part because homeowners build equity as their home appreciates in value and they pay off a portion of their mortgage each month. When you own your home, your monthly mortgage payment is, in essence, forced savings that come back to you when you sell your home or refinance. As a renter, you’ll never see a return on the money you pay out in rent every month.

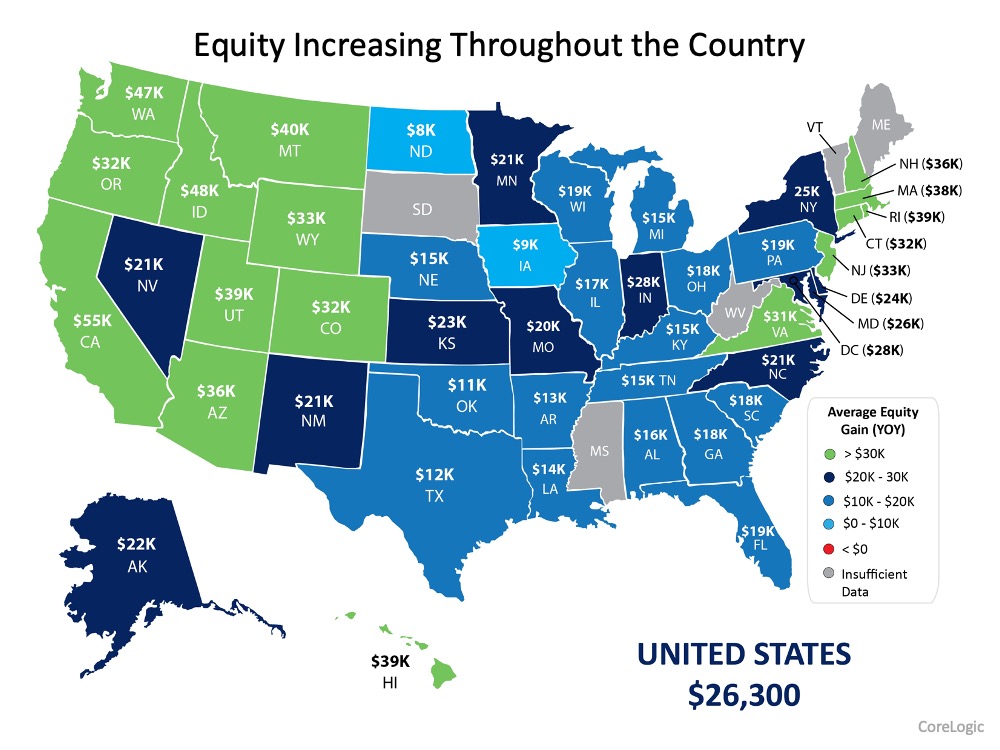

The gap exists in large part because homeowners build equity as their home appreciates in value and they pay off a portion of their mortgage each month. When you own your home, your monthly mortgage payment is, in essence, forced savings that come back to you when you sell your home or refinance. As a renter, you’ll never see a return on the money you pay out in rent every month.

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with today’s low mortgage rates, your purchasing power may be higher now than it has been in some time. That means there may be no better time than now to start working towards your homeownership goals – especially since rates are anticipated to rise in the coming months.

Bottom Line

Owning a home provides one of the strongest foundations for building individual wealth and lasting financial security. If you’re ready to start your path towards homeownership, let’s connect today.