Home prices in Virginia are 12.8% lower than at their peak in May of 2006

Market Trends and Insights for Home Buyers and Homeowners. #equalhousingopportunity

Monday, September 15, 2014

Monday, September 8, 2014

Home Buyer's Purchasing Power

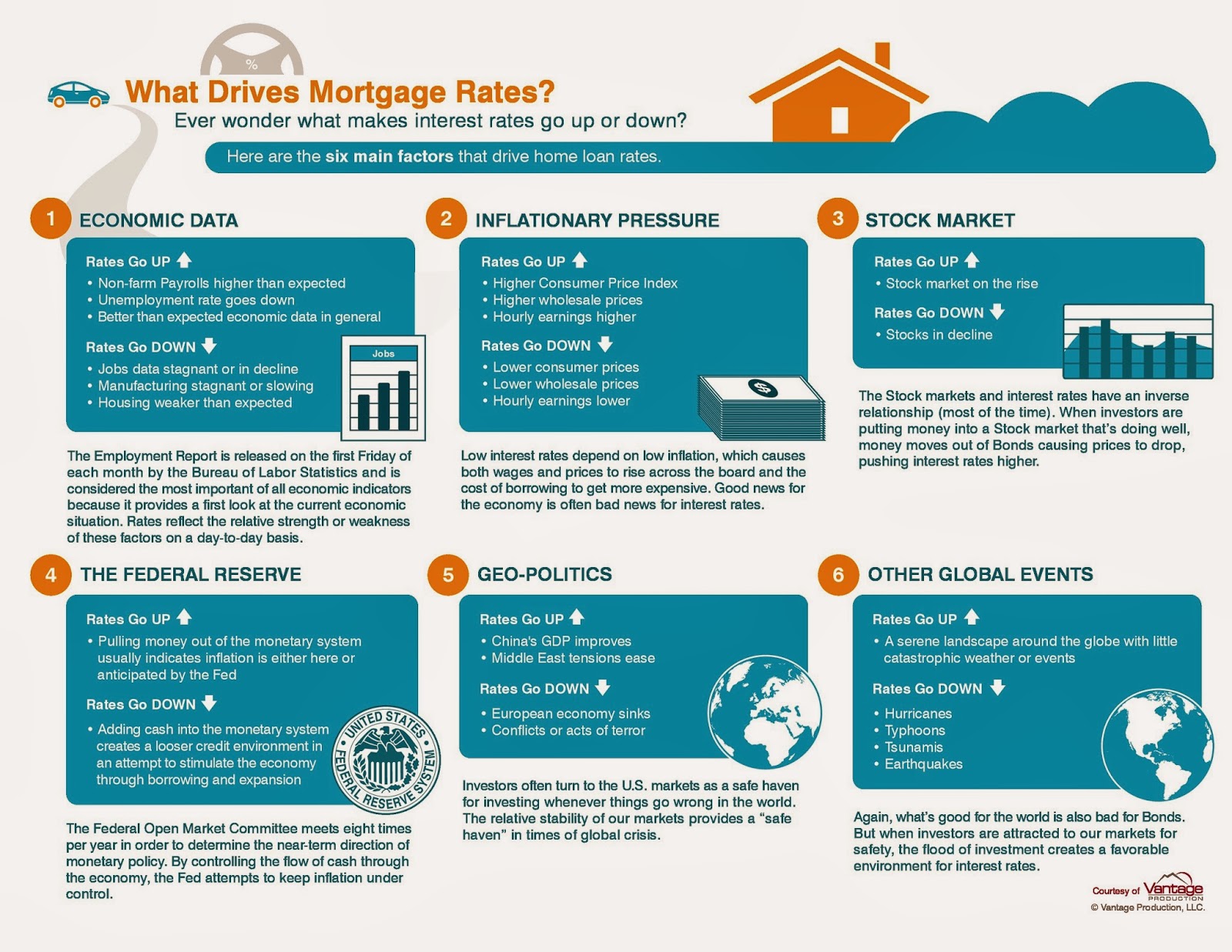

Home mortgage interest rates are still low, but are expected to rise this year and next.

You can buy more house now than if you wait.

Monday, August 4, 2014

Monday, June 9, 2014

Friday, May 30, 2014

Inexpensive Backyard Additions To Improve Atmosphere

Inexpensive

Backyard Additions to Improve Atmosphere

Fire pit – These are great backyard additions as they are multi-functional: Use them for a heat source on a chilly summer night, a social gathering point or as a place to toast marshmallows with the kids. “You can dig a pit yourself and line it with attractive stones, or purchase a stand-alone raised pit from your local home improvement store,” Eisenberg suggests.

DIY stone patio or walkway – “While you may not have the budget for a raised deck or poured concrete slab, you can easily create a simple stone garden walkway or patio,” says Eisenberg. Enlist the help of the family to level out the ground, and contact local garden shops or landscaping centers to enquire about sourcing stone.

A living area – No need to install a full-on outdoor kitchen to make a living space in your yard, notes Eisenberg. Group together some outdoor chairs to create an inviting atmosphere for evenings al fresco. Add a table for dining or playing cards, and scatter ample outdoor lighting.

An outdoor shower – Add a spa-like feel to your yard by adding an outdoor shower. While you will most likely need to enlist the help of a plumber, you can locate your outdoor shower near your current hose hookup for an easy and inexpensive procedure. For privacy, Eisenberg suggests placing several trellises around the shower and planting flowering vines along the base. Soon, you will have a secluded outdoor oasis for rinsing off after a day at the beach or a hard afternoon in the garden.

For more real estate information, please contact

Louis Eisenberg, Prudential Towne Realty, 109 E Main Street, Norfolk, VA 23510,

leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, May 19, 2014

Monday, May 12, 2014

Reasons To Buy A New Construction Home

Looking for a new construction home? Contact Louis Eisenberg, Prudential Towne Realty757-572-7244 to help you find one in Coastal Virginia.

Below are the top reasons people prefer a new construction home.

Below are the top reasons people prefer a new construction home.

Friday, May 9, 2014

Thursday, May 8, 2014

Things To Consider When Buying A Condo

NORFOLK,

VA, May 08, 2014—If you're currently considering buying a home, you may be

playing with the idea of purchasing a condo. Condominiums are buildings in which

individuals separately own the air space inside the interior walls, floors and

ceilings of their unit, but they jointly own an interest in the common areas

that they share – such as the land, lobby, hallways, swimming pool, and parking

lot.

Most housing condominiums are apartments, although there are mobile home condominiums as well. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty outlines some pros and cons of going with a condo, and highlights things you should know before buying.

Why Buy a Condo?

“Condos are an appealing way to enter the housing market if the cost of a single-family home is out of your reach,” explains Eisenberg. “Condos are especially popular among single homebuyers, empty nesters, and first-time buyers in high-priced housing markets.”

The high price of single-family homes and the influx into the housing market of more single homebuyers have made condos relatively hot national investments. They have held their value as an investment despite economic downturns and problems with some associations.

Eisenberg notes that condominium associations have also worked hard in recent years to clean up their image. Disputes and lawsuits were once rampant. But now associations have become savvier about property management and have taken steps to prevent legal problems and disputes.

Condo vs. Single-Family Home

“Unlike a house, condos offer a lifestyle that is free of yard work and exterior maintenance and repairs,” says Eisenberg. Many condominium communities also offer amenities such as exercise rooms, tennis courts, and swimming pools that you might otherwise be unable to afford if you purchased a single-family home.

However, there are financial differences between condos and traditional homes. “In addition to paying a mortgage, each owner is responsible for paying a monthly fee to the condo association, which is made up of the unit owners,” explains Eisenberg. The fee covers maintenance, repairs, and building insurance.

How Do you Choose a Good Condo?

“If you're considering buying a condo, seek ownership in a well-maintained building, and pay special attention to the financial health of the condo association,” suggests Eisenberg. Lax maintenance may be a sign of financial trouble, which could result in higher maintenance fees and problems trying to resell the property later.

Things to consider:

Most housing condominiums are apartments, although there are mobile home condominiums as well. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty outlines some pros and cons of going with a condo, and highlights things you should know before buying.

Why Buy a Condo?

“Condos are an appealing way to enter the housing market if the cost of a single-family home is out of your reach,” explains Eisenberg. “Condos are especially popular among single homebuyers, empty nesters, and first-time buyers in high-priced housing markets.”

The high price of single-family homes and the influx into the housing market of more single homebuyers have made condos relatively hot national investments. They have held their value as an investment despite economic downturns and problems with some associations.

Eisenberg notes that condominium associations have also worked hard in recent years to clean up their image. Disputes and lawsuits were once rampant. But now associations have become savvier about property management and have taken steps to prevent legal problems and disputes.

Condo vs. Single-Family Home

“Unlike a house, condos offer a lifestyle that is free of yard work and exterior maintenance and repairs,” says Eisenberg. Many condominium communities also offer amenities such as exercise rooms, tennis courts, and swimming pools that you might otherwise be unable to afford if you purchased a single-family home.

However, there are financial differences between condos and traditional homes. “In addition to paying a mortgage, each owner is responsible for paying a monthly fee to the condo association, which is made up of the unit owners,” explains Eisenberg. The fee covers maintenance, repairs, and building insurance.

How Do you Choose a Good Condo?

“If you're considering buying a condo, seek ownership in a well-maintained building, and pay special attention to the financial health of the condo association,” suggests Eisenberg. Lax maintenance may be a sign of financial trouble, which could result in higher maintenance fees and problems trying to resell the property later.

Things to consider:

•

Get a copy of the latest financial statement from the condo association.

• Ask the board of directors – which is elected by the unit owners from among themselves – if major repairs or improvements are imminent. If so, find out how much they will cost and whether there is enough money in the reserve to cover them.

• Check the by-laws, rules and the covenants, codes and restrictions (CC&Rs). You may find, among other things, that they prohibit or restrict pets and the renting of units. Some may require that the board have the right of first refusal on the sale of any unit.

• Learn everything you can about the homeowners association, including legal disputes and conflicts. Start by reading the minutes of the association meetings.

• Find out the owner-to-tenant ratio. Because many condominiums are often purchased as investments, there could be a high percentage of tenants in the building.

• Ask the board of directors – which is elected by the unit owners from among themselves – if major repairs or improvements are imminent. If so, find out how much they will cost and whether there is enough money in the reserve to cover them.

• Check the by-laws, rules and the covenants, codes and restrictions (CC&Rs). You may find, among other things, that they prohibit or restrict pets and the renting of units. Some may require that the board have the right of first refusal on the sale of any unit.

• Learn everything you can about the homeowners association, including legal disputes and conflicts. Start by reading the minutes of the association meetings.

• Find out the owner-to-tenant ratio. Because many condominiums are often purchased as investments, there could be a high percentage of tenants in the building.

For

more information on purchasing a condo, please contact Louis Eisenberg, Prudential

Towne Realty, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, May 5, 2014

3 Reasons To Sell Your Home This Spring

Many sellers are still hesitant about putting their house up for sale. Where are prices headed? Where are interest rates headed? These are all valid questions. However, there are several reasons to sell your home sooner rather than later. Here are three of those reasons.

1. Demand is about to skyrocket

Most people realize that the housing market is hottest from April through June. The most serious buyers are well aware of this and, for that reason, come out in early spring in order to beat the heavy competition. We also have a pent-up demand as many buyers pushed off their home search this winter because of extreme weather. Sellers in markets where seasonal weather is never an issue must realize that buyers relocating to their region will increase dramatically this spring as these purchasers finally decide to escape the freezing temperatures of the winters in the north.

These buyers are ready, willing and able to buy…and are in the market right now!

2. There Is Less Competition - For Now

Housing supply always grows from the spring through the early summer. Also, there has been a growing desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners have seen a return to positive equity as prices increased over the last eighteen months. Many of these homes will be coming to the market in the near future.

The choices buyers have will continue to increase over the next few months. Don’t wait until all the other potential sellers in your market put their homes up for sale.

3. There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by approximately 4% this year and 8% by the end of 2015. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30 year housing expense with an interest rate at about 4.5% right now. Freddie Mac projects rates to be 5.1% by this time next year and 5.7% by the fourth quarter of 2015.

Moving up to a new home will be less expensive this spring than later this year or next year.

Courtesy of KCM Blog

Friday, May 2, 2014

Thursday, May 1, 2014

Wednesday, April 30, 2014

Streamlining Your Home Construction Project

NORFOLK, VA, Apr 30, 2014—With the blooming of spring flora and reemergence

of fauna comes an increase of a different kind of outdoor activity –

construction. As more homeowners begin to prep for their spring renovation

projects, Louis Eisenberg,

Associate Broker REALTOR ABR SFR of Prudential Towne Realty takes us through

several big things to keep in mind as your construction kick-off day nears.

“After you've done your due diligence of shopping around for contractors, checking up on references, and picking out your project start date, there are still several things you can do to streamline your home improvement project,” notes Eisenberg.

Do your research and plan accordingly. Many construction issues are things you just can’t plan for, like inclement weather on the day your new roof is supposed to go up. However, fully understanding the ins and outs of your construction process, how long it should take, and what the steps are to achieve completion, can help you stay on time--and on budget. Talk to people who have had similar projects done, make full use of Google and call several contractors for price and time quotes.

Enlist a designer. “While you may think hiring a designer is overkill, professionals can premeditate issues you may not be privy to, and issues that contractors simply aren't trained to look for,” explains Eisenberg. If your budget simply won't allow for the help of an architect, ask around your social circle to see if anyone knows a design-minded friend or acquaintance. Most people are happy to lend their expertise in exchange for a cup of coffee or a glass of wine.

Check up on your communication. You may think your construction team knows your expected outcome, but you would be surprised to learn how many homeowners fail to clearly communicate with their architect, contractor and construction team. Be sure you see several full plans and mock-ups of the finished project before construction begins.

Add a buffer to your budget. “Even the most well-planned construction projects can go awry. Whether your workers need to spend another day building or you find out source material prices rose suddenly, adding a monetary buffer to your budget will be helpful and ease stress should you need to shell out a few more dollars. “Setting your budget with a 10 percent flexibility ratio is ideal,” recommends Eisenberg.

For more home improvement advice, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

“After you've done your due diligence of shopping around for contractors, checking up on references, and picking out your project start date, there are still several things you can do to streamline your home improvement project,” notes Eisenberg.

Do your research and plan accordingly. Many construction issues are things you just can’t plan for, like inclement weather on the day your new roof is supposed to go up. However, fully understanding the ins and outs of your construction process, how long it should take, and what the steps are to achieve completion, can help you stay on time--and on budget. Talk to people who have had similar projects done, make full use of Google and call several contractors for price and time quotes.

Enlist a designer. “While you may think hiring a designer is overkill, professionals can premeditate issues you may not be privy to, and issues that contractors simply aren't trained to look for,” explains Eisenberg. If your budget simply won't allow for the help of an architect, ask around your social circle to see if anyone knows a design-minded friend or acquaintance. Most people are happy to lend their expertise in exchange for a cup of coffee or a glass of wine.

Check up on your communication. You may think your construction team knows your expected outcome, but you would be surprised to learn how many homeowners fail to clearly communicate with their architect, contractor and construction team. Be sure you see several full plans and mock-ups of the finished project before construction begins.

Add a buffer to your budget. “Even the most well-planned construction projects can go awry. Whether your workers need to spend another day building or you find out source material prices rose suddenly, adding a monetary buffer to your budget will be helpful and ease stress should you need to shell out a few more dollars. “Setting your budget with a 10 percent flexibility ratio is ideal,” recommends Eisenberg.

For more home improvement advice, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Friday, April 18, 2014

Luz Bathroom Updates To Change Your Space

NORFOLK, VA, Apr 18, 2014—Whether you're fixing up your new home, prepping to sell your existing space, or just looking to renovate, the following suggestions from Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty can take your bathroom to a whole new level.

Upgrade your vanity – Instead of a standard sink, Eisenberg suggests recycling an existing piece of furniture into a bathroom vanity by cutting a hole in the top of a beloved dresser or chest to drop in a sink and a faucet. Make sure the piece of furniture has ample storage space—drawers and cabinets are a must.

Curved shower rod – These rounded shower rods make your shower seem more open and airy, providing more space at a low cost, Eisenberg notes.

Spa feel – “An updated master bathroom is one of the most coveted features for buyers,” says Eisenberg. Make your bathroom feel extra luxurious with added perks like a rain-style shower head, extra fluffy white towels (so worth the splurge) and a vessel sink.

A skylight – Natural light does wonders for any room, and the bathroom is no different. “If your home layout allows for it, try carving a skylight in your bathroom to flood the space with daylight while still allowing for privacy,” Eisenberg suggests.

Innovative light fixtures – If you can't afford a skylight but still crave a well-lit bathroom, mix multiple light sources to create a balanced lighting plan. Consider recessed ceiling lights, a four-bulb vanity light fixture over the mirror and lights in the shower to really give the room a bright makeover.

For more information on home improvements, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Tuesday, April 15, 2014

Percentage of Home Buyers By Generation

Silent Generation is a label for the generation of people born during the Great Depression and World War II.

Baby boomers are people born during the demographic Post–World War II baby boom between the years 1946 and 1964.

Gen X is the generation born after the Western Post–World War II baby boom.

Millennials (also known as the Millennial Generation[1] or Generation Y) are the demographic cohort following Generation X. There are no precise dates when the generation starts and ends. Researchers and commentators use birth years ranging from the early 1980s to the early 2000s.

Baby boomers are people born during the demographic Post–World War II baby boom between the years 1946 and 1964.

Gen X is the generation born after the Western Post–World War II baby boom.

Millennials (also known as the Millennial Generation[1] or Generation Y) are the demographic cohort following Generation X. There are no precise dates when the generation starts and ends. Researchers and commentators use birth years ranging from the early 1980s to the early 2000s.

Monday, April 14, 2014

Buying a home now will save you money

The average price of a home in Coastal Virginia is about $250,000. Take note. Making the decision to buy a home now will save you a lot of money.

Friday, April 11, 2014

Create a Unique Outdoor Space In Coastal Virginia

Farmhouse Porch by Atlanta Architects & Designers Historical Concepts

NORFOLK, VA, Apr 11, 2014—With spring here and summer on the distant horizon, more and more Coastal Virginia homeowners are stepping outside to tackle outdoor projects that have been laying low all winter. One popular project is revamping outdoor living spaces in preparation for the warmer months. Whether you're looking for a great space to entertain or just hang with the family on the weekends, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty gives some great advice on creating unique outdoor living spaces.

Tailor to your needs. “Think specifically about what you will be using the space for,” suggests Eisenberg. Just because a grill and a picnic table are standbys for a barbecue area doesn't mean that's what you need to go with. Maybe your family has a longstanding Saturday night pizza tradition, and so a wood-fire oven would be a better fit. Have young kids? Consider placing a swing set or a hanging hammock chair near your lounge chairs to keep the little ones entertained while you relax nearby with a watchful eye.

Go bold. Statement pieces don't only belong indoors. A unique set of tables and chairs or weatherproof sofa and chaise can look great in your garden. Are you an art fan or birding enthusiast? Consider a statue or a series of colorful bird baths and feeders.

Upgrade your furniture. Outdoor furniture has developed far past the traditional plastic deck chairs. “From wicker to wood and canvas, there are so many fun options that can really add character to your living space,” says Eisenberg.

Porch party. Porches aren't just meant as a reprieve from inclement weather. “Think of your front porch as a mini deck,” suggests Eisenberg. Homeowners with front porches can take advantage of their space by adding a luxurious feel with a daybed, a quaint reading nook, a space for sipping coffee on Sundays, or even a narrow bar with stools for entertaining.

Outdoor oasis. Love gardening? Create a living space within your garden beds by hanging a hammock between two trees, adding a delicate tea table, or several oversized outdoor chairs for lounging. “Adding a stone walkway or small patio can really up the garden atmosphere,” says Eisenberg. Garden party, anyone?

Keep it simple. Just because your outdoor space is limited, it doesn't mean your options need be, notes Eisenberg. A pair of elegant outdoor chairs and a small card table can go a long way in improving the livability of your yard. Add a trellis so plants can grow upward and provide a bit of privacy, ideal for urban dwellers.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com.

NORFOLK, VA, Apr 11, 2014—With spring here and summer on the distant horizon, more and more Coastal Virginia homeowners are stepping outside to tackle outdoor projects that have been laying low all winter. One popular project is revamping outdoor living spaces in preparation for the warmer months. Whether you're looking for a great space to entertain or just hang with the family on the weekends, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty gives some great advice on creating unique outdoor living spaces.

Tailor to your needs. “Think specifically about what you will be using the space for,” suggests Eisenberg. Just because a grill and a picnic table are standbys for a barbecue area doesn't mean that's what you need to go with. Maybe your family has a longstanding Saturday night pizza tradition, and so a wood-fire oven would be a better fit. Have young kids? Consider placing a swing set or a hanging hammock chair near your lounge chairs to keep the little ones entertained while you relax nearby with a watchful eye.

Go bold. Statement pieces don't only belong indoors. A unique set of tables and chairs or weatherproof sofa and chaise can look great in your garden. Are you an art fan or birding enthusiast? Consider a statue or a series of colorful bird baths and feeders.

Upgrade your furniture. Outdoor furniture has developed far past the traditional plastic deck chairs. “From wicker to wood and canvas, there are so many fun options that can really add character to your living space,” says Eisenberg.

Porch party. Porches aren't just meant as a reprieve from inclement weather. “Think of your front porch as a mini deck,” suggests Eisenberg. Homeowners with front porches can take advantage of their space by adding a luxurious feel with a daybed, a quaint reading nook, a space for sipping coffee on Sundays, or even a narrow bar with stools for entertaining.

Outdoor oasis. Love gardening? Create a living space within your garden beds by hanging a hammock between two trees, adding a delicate tea table, or several oversized outdoor chairs for lounging. “Adding a stone walkway or small patio can really up the garden atmosphere,” says Eisenberg. Garden party, anyone?

Keep it simple. Just because your outdoor space is limited, it doesn't mean your options need be, notes Eisenberg. A pair of elegant outdoor chairs and a small card table can go a long way in improving the livability of your yard. Add a trellis so plants can grow upward and provide a bit of privacy, ideal for urban dwellers.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com.

Thursday, March 27, 2014

How To Simplify Your Home Buying Experience

For more information and Assistance on Home Buying contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510. 757-572-7244, leisenberg@prudentialtownerealty.com www.LouisEisenberg.com

Monday, March 24, 2014

Tuesday, March 18, 2014

Determining Your Home's worth

NORFOLK, VA, Mar 18, 2014—One of the most difficult parts of selling your home occurs before you even place it on the market: determining its listing price. Coming up with a realistic number can be a confusing process, as a home is ultimately worth what it is paid for it. Everything else is really an estimate of value.

Take, for example, a hot seller’s market when demand for housing is high but the inventory of available homes for sale is low. During this time, homes can sell above and beyond the asking price as buyers bid up the price. The fair market value, or worth, is established when “a meeting of the minds” between the buyer and the seller takes place.

So how do you decide what your home is worth? “A comparative market analysis and an appraisal are the two most common and reliable ways to determine a home's value,” explains Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

Your real estate agent can provide a comparative market analysis, an informal estimate of value based on the recent selling price of similar neighborhood properties. “Reviewing comparable homes that have sold within the past year along with the listing, or asking, price on current homes for sale should prevent you from over or under pricing,” suggests Eisenberg.

In order to find the appraisal price, a certified appraiser is needed. After visiting the home to check such things as the number of rooms, improvements, size and square footage, construction quality, and the condition of the neighborhood, the appraiser then reviews recent comparable sales to determine the estimated value of the home.

However, it is often the buyer—not the listing party—who brings in the appraiser. Lenders normally require an appraisal – which run between $300 to $400 – before they will approve a mortgage loan. This protects the lender by ensuring the home is worth the money you want to borrow.

“You also can check recent sales in public records, through private firms, and on the Internet to help you determine a home’s potential worth,” notes Eisenberg.

Below are some other points you will have to understand when finding a listing price:

List price vs. sales price

You probably hear both terms being tossed around, and it may be causing some confusion. The list price is a seller's advertised price, or asking price, for a home. It is a rough estimate of what the seller wants to complete a home sale. A seller can price high, low – which does not happen very often – or very close to what they hope to get. “A good way to determine if the list price is a fair one is to look at the sales prices of similar homes that have recently sold in the area,” notes Eisenberg.

The sales price is the actual amount a home sells for.

What about appraised value and market value?

“A certified appraiser who is trained to provide the estimated value of a home determines its appraised value,” Eisenberg explains. The appraised value is based on comparable sales, the condition of the property, and several other factors.

Market value is the price the house will bring at a given point in time, once the buyer and seller establish a “meeting of the minds” on price.

For more information on buying in our Coastal Virginia low inventory market, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Wednesday, March 12, 2014

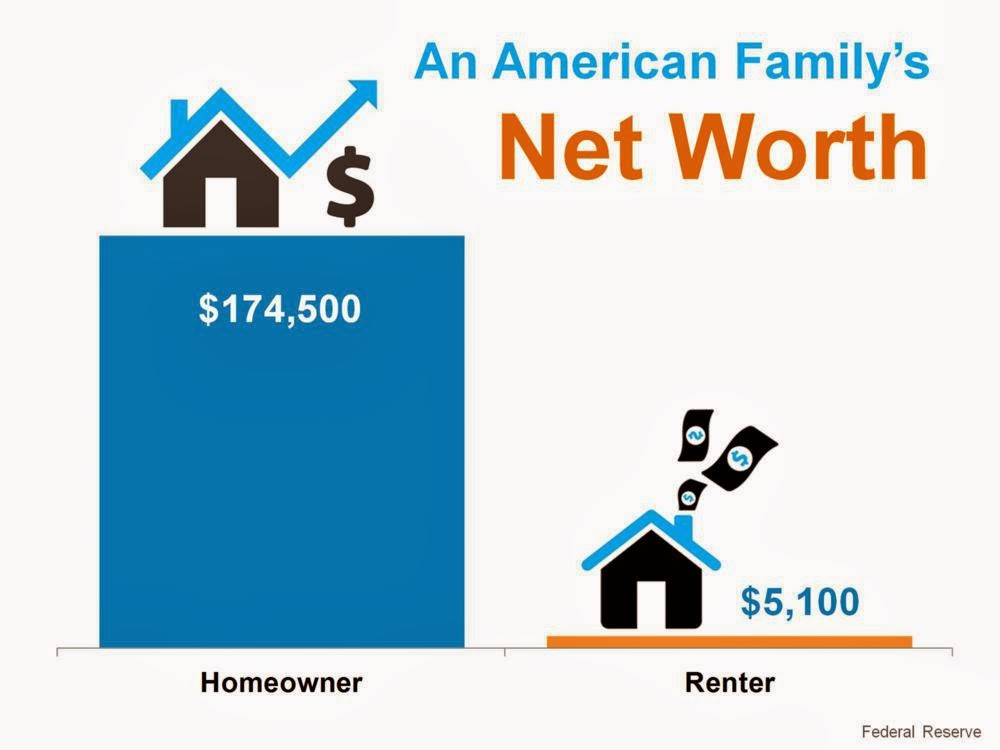

Buying a Home vs. Renting

For more information contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, 757-572-7244, leisenberg@prudentialtownerealty.com, www.LouisEisenberg.com

Monday, March 10, 2014

Year Over Year Home Price Change By Region

Year over year home price change by region. For more information contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510. 757-572-7244, leisenberg@prudentialtownerealty.com, www.LouisEisenberg.com

Friday, March 7, 2014

Home Mortgage Changes to Know In 2014

For more information contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, 757-572-7244, leisenberg@prudentialtownerealty.com, www.LouisEisenberg.com

Wednesday, March 5, 2014

Tuesday, March 4, 2014

5 Household Delimmas You Can Solve On Your Own

NORFOLK, VA, Mar 04, 2014—While a house doesn't come with an owner's manual, there are several things you can do to stay on top of, and ahead of, your home. Knowing how to handle small maintenance fixes will save you stress and money,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Save your dollars for when it's really time to call in a professional. In order to feel confident handling simple maintenance tasks, read through the following tips and tricks.:

1. Open the garage door when the power is out. Need to leave the house in a power outage? Pull on that red cord dangling from the ceiling-mounted operator. “This disengages the chain drive, allowing you to manually slide the door up its track,” explains Eisenberg.

2. Remove the base of a broken light bulb. Accidentally break a lightbulb while it's still screwed into your lamp? No need to panic, as long as you have a potato in the pantry. Take a raw potato, cut it in half, and press the sliced end onto the jagged glass. Then, simply unscrew. This is also a great party trick.

3. Learn how to locate a stud. Trying to hang a heavy mirror? Nothing is worse than ripping a hole in your drywall. Many people know how to rap on walls to locate a stud. But there is a systematical approach, as well. “The majority of studs are placed at 16-inch intervals, so once you knuckle one out, you can usually find the others,” explains Eisenberg.

4. Remedy a seized lock. Can't jiggle your keys in the door any longer? Don't worry - your spouse didn't change the locks. Chances are, your lock is seized. Instead of calling a locksmith who will hand you a hefty bill, head to the drug store and arm yourself with WD-40. “Spray some into the lock to get the gears moving again,” suggests Eisenberg.

5. Unclog a sink. No, not with a chemical pour, which really only burns a hole in the blockage. To really clear out a block, you need to clear out the mechanism. To do so, remove the stopper and block off overflow holes. Then, notes Eisenberg, run water into the sink and as the water runs, plunge the hole with a plunger. Not enough? Get yourself a hand snake and push the coil down the drain to clear out the block.

Know when to hire a handyman. You can only DIY so often. “Know when it's time to bring in the professionals – anything involving electricity or wiring is usually a good time for the real deal,” says Eisenberg.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Friday, February 28, 2014

What To Do About A Neighbors Tree

For more Real Estate Information Contact: Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, 757-572-7244, leisenberg@prudentialtownerealty.com, www.LouisEisenberg.com

Thursday, February 27, 2014

5 Tips for Creating An Outdoor Space

NORFOLK, VA, Feb 27, 2014—With Spring somewhere on the horizon, many

homeowners are beginning to dream of warmer weather, and accompanying home

improvement projects. Whether you want to up your home value for sale, or are

just looking to luxuriate outdoors this year, you may be thinking about

creating an outdoor living space.

“From outdoor sitting areas to full-on kitchens, outdoor living spaces are becoming increasingly popular home additions,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Below are five tips for planning your ideal outdoor living space.

1. Tour similar spaces. If you think you want a livable outdoor space, visit other homes with similar spaces for ideas about what you would and wouldn't like. “Luckily, with Internet access being what it is these days, you can get thousands of ideas from the web,” explains Eisenberg. But you shouldn't stop there, Eisenberg notes. “Try and do in-person research as well.” Have a friend or neighbor with a covetable deck or bath house? Invite yourself over to check it out in detail.

2. Plan ahead. Take your time while planning your outdoor space, and think about how you can best compliment your interior design. Find the right contractor, if you're using one, and take time to consider the cost effectiveness of your materials. “You should never rush a building project,” says Eisenberg. “You will hardly ever be happy with the results.”

“How will your new deck affect your inside spaces?” Eisenberg asks. “From darkening a room with a covered deck, to changing the view of the yard from the bedroom, don't forget to figure out all of the logistics before you begin building,” says Eisenberg.

3. Think about water access. Outdoor living spaces need to be weatherized, winterized and water-proofed, Eisenberg reminds us. “This may seem like a no brainer, but if done wrong, it can lead to costly repairs down the road,” explains Eisenberg.

4. Bring in a professional. If you're new to landscaping and home design, bring in a professional to give you advice, even if it's just a one-time consultation. “A professional designer can give you advice about things you may be overlooking, so it's important to get that expert opinion before you finalize your plans or break ground,” Eisenberg notes.

5. Do your research. Are those deck railings you're interested in up to code in your county? What are the laws about open pool plans in your area? “As building codes vary by location, before you open your wallet, make sure your plans are up to code,” warns Eisenberg.

For more information creating an outdoor space, please contact Louis Eisenberg, Prudential Towne Realty, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Wednesday, February 26, 2014

Contracting Your Home Contractor

NORFOLK, VA, Feb 26, 2014—Choosing a contractor for your home building or

remodeling can be a big decision. In order to choose the right bid, it's

important to be educated, says Louis Eisenberg, Associate Broker REALTOR ABR

SFR of Prudential Towne Realty. It's a good idea to shop aggressively for the

most reasonable bid, not necessarily the cheapest. “Inexpensive, but shoddy,

work will only cost you more money in the long run,” Eisenberg reminds us.

However, once you've chosen who to go with, the decision making doesn't stop there – you still have to draft a contract. Many things should be covered in a contractor's contract, and not all contracts are outlined the same, says Eisenberg.

According to the National Association of the Remodeling Industry, a well-written contract should contain the following information:

- The contractor’s name, address, telephone and license

number, if applicable

- Details about what will and will not be done

- A detailed list of materials for the project, including

model, brand name and color

- The approximate start date and substantial completion

dates

- A written notice of your right to cancel a contract

within three business days of signing, without penalty – provided the

contract was solicited at some place other than the contractor’s place of

business or appropriate trade premise

- Financial terms that are spelled out clearly, including

payment schedules and any cancellation penalties

- A one-year minimum warranty identified as either “full”

or “limited” to cover materials and workmanship, as well as the name and

address of the party who will honor the warranty

- A binding arbitration clause, in the event a

disagreement occurs

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, February 24, 2014

Number of DIstressed Properties Declining

Distressed Properties ( Short Sales and Foreclosures) have declined from 35% of existing home sales in January of 2012 to just 14% of existing home sales in January 2014.For more information on distressed properties contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA, 757-572-7244, leisenberg@prudentialtownerealty.com, www.LouisEisenberg.com

Friday, February 21, 2014

Home Sales And Prices Are On The Upswing In Virginia

Existing home sales and prices are on the upswing in Virginia. For more information contact Louis Eisenberg, Prudential Towne Realty-Chesapeake & Norfolk Offices 109 E. Main Street, Norfolk , VA 757-572-7244 www.LouisEisenberg.com

Thursday, February 20, 2014

Tuesday, February 18, 2014

Monday, February 17, 2014

What You Should Know About Home Improvements

NORFOLK, VA, Feb 17, 2014—Many potential first-time homebuyers list “home improvement costs” as a reason they're wary about making the switch from renting to owning. While it's true that being your own landlord means you will be doing a lot more work on your property, home improvement doesn't need to be a time and money suck. In the following article, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty takes us through some home improvement basics.

How often will you need to repair?

“From the day you move in to the day you sell your home, there will always be something that will need to be repaired or remodeled,” says Eisenberg. “You may want to undertake some changes simply to elevate your comfort level – like installing central air conditioning – or spruce up the home’s aesthetics, such as adding a few stained-glass windows.”

But other work will need to be done to maintain the property and minimize problems later on. For example, replacing a hazardous roof, fixing broken windows, and repairing leaky pipes. These are all necessities. Left undone, they can lead to major problems and damages within the home.

“But this doesn't mean home improvement needs to be exhausting or daunting,” says Eisenberg. “If you keep on top of your home's condition, it's possible to stay ahead of your improvements.”

How can you stay ahead of your home?

From the very beginning, get in the habit of taking an inventory at least once every year of every nook and cranny of your home to check for potential problems, suggests Eisenberg. Examine the roof, foundation, plumbing, electrical wiring – basically everything. Try to fix trouble spots as soon as you uncover them. This proactive approach will help you avoid larger expenses later on, so leave no stone unturned when taking your inventory.

How expensive will home improvements be?

It's hard to project a price tag, but Eisenberg suggests you can expect to spend one percent of the purchase price of your home every year to handle a myriad of tasks, including painting, tree trimming, repairing gutters, caulking windows, and routine system repairs and maintenance.

“An older home will usually require more maintenance, although a lot will depend on how well it has been maintained over the years,” explains Eisenberg.

Tell yourself that the upkeep of your home is mandatory, and budget accordingly. Otherwise, your home’s value will suffer if you allow it to fall into a state of disrepair. “Remember,” cautions Eisenberg. “There is usually a direct link between a property’s condition and its market value: The better its condition, the more a buyer will likely pay for it down the road.

Also, adopt the attitude that the cost of good home maintenance is usually minor compared to what it will cost to remedy a situation that you allowed to get out of hand. For example, unclogging and sealing gutters may cost a few hundred dollars. But repairing damage to a corner of your home where gutters have leaked can potentially cost several thousands dollars.

For more information on home improvements, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244 or www.LouisEisenberg.com

Thursday, February 13, 2014

Wednesday, February 5, 2014

3 Home Buying Tips For 2014

NORFOLK, VA, Feb 05, 2014—As the market makes steady moves toward a solid recovery, more and more hopeful homeowners are entering the playing field. If you're looking to buy a new home this year, be it a downsize, vacation home, or your very first house purchase, follow these three tips, offered by Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

Check into reality

Instead of daydreaming your ideal home, make a list of what things are absolutely essential: a specific number of bedrooms, close proximity to work or your child's school, a decent-sized yard. “Once you know what you need, but before you begin your actual house hunt, start looking at what sold in the last six months that fits your bill,” says Eisenberg. See what the selling prices are looking like, and figure out if you can afford a similar price tag. If you can't, it might mean waiting a bit, or reassessing your needs.

Get pre-approved, not pre-qualified

Many people get confused between “pre-approved” and “pre-qualified” when it comes to obtaining a loan. “Getting pre-approved means a bank has qualified you for a mortgage based on information you provided, but they have not actually checked up on your credentials,” says Eisenberg. A letter of pre-approval means the bank has thoroughly checked out your financial status, and is ready to give you a loan. “This holds more weight in terms of buying quickly, and can act as leverage should it come to beating out other buyers,” explains Eisenberg.

Don't lowball

“When it was a buyer's market, lowballing was often a good way to start negotiating price,” notes Eisenberg. However, now that we're seeing inventory shortages across the country and more and more buyers entering the fold, lowballing most likely means you won't land a deal. Instead, present a fair offer that's in your price range but still leaves some negotiation room on both ends.

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, February 3, 2014

Home Buying In A Competive Market

For more information on Home Buying, please contact Louis Eisenberg, REALTOR, Associate Broker, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510 leisenberg@prudentialtownerealty.com, 757-572-7244, www.LouisEisenberg.com

Friday, January 31, 2014

The Impact of Immigration Reform on Housing

Immigration reform will have a tremendous impact on the economy, especially in the housing sector. The housing sector creates millions of jobs.

Wednesday, January 29, 2014

Homeowner's To Do List: Revamp Your Garage

NORFOLK, VA, Jan 29, 2014—If your garage is musty, cluttered or downright chaotic, don't stress. In the following article, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty gives us a few tips to take your garage space from disorganized and dirty to livable, or at least lovable.

Sort. “The first step to organizing your garage is clearing out anything you no longer need,” says Eisenberg. Donate old items (like kiddie toys your troop has long outgrown) and toss anything no longer working.

Clean. Now that you're only keeping the essentials, clean your garage from top-to-bottom. Powerwash the floor, scrub down the walls, and get into every nook.

Paint your floor. Once your floor is clean, Eisenberg suggests, give it a glossy coat of paint. Use an epoxy paint, which provides a tough finish that will hold up longer and resist cracking and peeling.

Add storage. Wall-to-wall shelves or a storage unit can help keep your newly ordered space organized for longer. “To find the perfect place for an item, keep in mind how often you use it,” suggests Eisenberg. If it's an every week thing, don't place it on a top shelf. That sprinkler that won’t come out for six more months? Feel free to stow that away until summer.

Utilize wall space. Hang gardening tools and appliances along the wall, suggests Eisenberg. Add a coat or shoe rack if you often enter the house through the garage.

Upgrade lighting. Tired of digging around a dark garage? Make sure you have ample lighting – not just the automatic light that comes on when the door opens, notes Eisenberg.

Create usable space. Don't park your car in the garage? Or maybe your garage is larger than you need. Create usable space – like a workshop, or a home gym corner. Now that your garage is clean, organized, and well-lit, you won't mind crafting or sweating in it.23510

For more information on remodeling your home, please contact Louis Eisenberg, Realtor, Prudential Towne Realt, 109 E Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Friday, January 24, 2014

Tuesday, January 21, 2014

5 Things That Add Instant Value To Your Home

NORFOLK, VA, Jan 21, 2014—If you're considering selling your home, most likely you've heard some of the crucial elements to a successful sale: proper staging, proper pricing, and curb appeal. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty lets us in on several things that can add instant value to your home.

Landscaping. Bring in a professional or DIY. However, avoid going over-board. “While a nice looking yard will add value, a high maintenance garden may put off any potential buyers who lack a green thumb,” warns Eisenberg.

A usable garage. You might assume it's okay to leave junk in your garage when showing your home. It is, after all, a garage. However, cleaning out your garage and highlighting it as a fully usable space (for cars, storage, or a workshop) is an asset to buyers. “Allow them to imagine how they will use the space themselves – don't show them where last season's lawn furniture is hibernating,” says Eisenberg.

Add more closets. If you have a small renovation budget, add extra closets and storage spaces wherever possible. Can you find room for a walk-in closet in the master bedroom? That's a huge draw for many buyers.

Create outdoor living spaces. “Whether it's just a nook you've carved in the garden, a deck, or a full-on patio with a pool, outdoor living spaces are always popular,” notes Eisenberg. If you're on a budget, you don't have to go overboard. Simply cluster together some lawn furniture, set up a table by the grill, and you have a great space for summer entertaining.

Refinish the basement. Believe it or not, many homes in Coastal Virginia have basements. The more usable living space, the better. If your basement is unfinished, and you have the budget, making it a livable space can be a huge bonus when it comes to listing your home. “You can do it minimally, by finishing the flooring and painting the walls, or go all out and create a game room or even an in-law suite,” recommends Eisenberg. A home office or an extra bedroom are always a boon for your listing.

For more information on selling your home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Thursday, January 16, 2014

Tuesday, January 14, 2014

Mortgage Matters: What is an Assumable Mortgage?

NORFOLK, VA, Jan 14, 2014—If you're shopping for a mortgage for the first

time, you're probably hearing tons of terms you're unfamiliar with. One of these

terms, although not as popular as traditional mortgages, is an assumable

mortgage. In the following article, Louis Eisenberg, Associate Broker REALTOR

ABR SFR of Prudential Towne Realty lets us in on what makes this mortgage

different, and if it may be a good fit for you.

“An assumable mortgage is held by the seller and can be taken over by the buyer when a home is sold,” explains Eisenberg. “Such loans are hard to find because most lenders stopped voluntarily writing them many years ago.”

Most new assumable loans today are adjustable rate mortgages. They may be attractive if the interest rate on the existing loan is lower than the rate the buyer could otherwise get on a new mortgage, either because of current market conditions or the buyer’s poor credit history.

“To determine whether to assume an old loan or apply for a new one, pay close attention to the possible assumption fee, usually one point, and other terms of assumption set forth in the existing loan,” says Eisenberg.

One plus: there are generally few closing costs with an assumable loan.

“While an assumable mortgage can speed up the property sale, sellers should be careful about letting a buyer assume their mortgage,” warns Eisenberg. Depending on the state and terms of the mortgage, a seller may remain liable for the loan until it is paid off in full, meaning the lender may go after both the seller and the buyer if the loan is not paid.

For more information on loans and mortgages, please contact Louis Eisenberg, Associate Broker, Realtor, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

“An assumable mortgage is held by the seller and can be taken over by the buyer when a home is sold,” explains Eisenberg. “Such loans are hard to find because most lenders stopped voluntarily writing them many years ago.”

Most new assumable loans today are adjustable rate mortgages. They may be attractive if the interest rate on the existing loan is lower than the rate the buyer could otherwise get on a new mortgage, either because of current market conditions or the buyer’s poor credit history.

“To determine whether to assume an old loan or apply for a new one, pay close attention to the possible assumption fee, usually one point, and other terms of assumption set forth in the existing loan,” says Eisenberg.

One plus: there are generally few closing costs with an assumable loan.

“While an assumable mortgage can speed up the property sale, sellers should be careful about letting a buyer assume their mortgage,” warns Eisenberg. Depending on the state and terms of the mortgage, a seller may remain liable for the loan until it is paid off in full, meaning the lender may go after both the seller and the buyer if the loan is not paid.

For more information on loans and mortgages, please contact Louis Eisenberg, Associate Broker, Realtor, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Monday, January 13, 2014

Sunday, January 12, 2014

Saturday, January 11, 2014

Friday, January 10, 2014

Tuesday, January 7, 2014

Take Necessary Precautions When Buying a Flipped House

NORFOLK, VA, Jan 07, 2014—As home prices are rising, home flippers are returning to the fold, snapping up properties or listing already flipped masterpieces they've been sitting on while prices were low. Home flipping is the process of buying a property, renovating it and selling it for a higher price. Many investors, known as “serial flippers,” buy multiple homes and flip them in quick succession. If you're looking at a home that has recently been flipped, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty offers you a few things to keep in mind.

The history

“Check the tax records to see how long the previous owner owned the property,”

suggests Eisenberg. “If it was a very short time, do your due diligence to determine whether the home was an investment opportunity, or whether the owner may be leaving because something is awry.”

The flipper

If the current owner of your home's information is available, and they seem to be a serial flipper, check out any homes they have flipped in the past. How does their previous work look? Were the buyers of those homes satisfied?

The permits

“If any structural changes were made, be sure they were properly permitted and that all the necessary inspections were done,” notes Eisenberg.

The quality of renovation

Make sure to get a proper inspection on the property, and have a builder pay special attention to the home's structure or any recent changes. “While many home flippers are extremely talented renovators, some cut corners and take shortcuts to flip the home faster,” cautions Eisenberg. Make sure everything is sound so you don't stumble upon a problem post-sale. “If you can't have an inspection until you've made an offer, make sure to include a contingency clause enabling you to walk away if the inspection shows a critical issue,” says Eisenberg.

Plumbing, heating and AC

Since many flippers do not live in the homes while working on them, their systems may not have been used, and issues may go unnoticed or unnamed. Does the AC work? How about the plumbing? Any leaks? Be sure to check thoroughly.

For more information on flipped homes, please contact Louis Eisenberg REALTOR, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

The history

“Check the tax records to see how long the previous owner owned the property,”

suggests Eisenberg. “If it was a very short time, do your due diligence to determine whether the home was an investment opportunity, or whether the owner may be leaving because something is awry.”

The flipper

If the current owner of your home's information is available, and they seem to be a serial flipper, check out any homes they have flipped in the past. How does their previous work look? Were the buyers of those homes satisfied?

The permits

“If any structural changes were made, be sure they were properly permitted and that all the necessary inspections were done,” notes Eisenberg.

The quality of renovation

Make sure to get a proper inspection on the property, and have a builder pay special attention to the home's structure or any recent changes. “While many home flippers are extremely talented renovators, some cut corners and take shortcuts to flip the home faster,” cautions Eisenberg. Make sure everything is sound so you don't stumble upon a problem post-sale. “If you can't have an inspection until you've made an offer, make sure to include a contingency clause enabling you to walk away if the inspection shows a critical issue,” says Eisenberg.

Plumbing, heating and AC

Since many flippers do not live in the homes while working on them, their systems may not have been used, and issues may go unnoticed or unnamed. Does the AC work? How about the plumbing? Any leaks? Be sure to check thoroughly.

For more information on flipped homes, please contact Louis Eisenberg REALTOR, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Thursday, January 2, 2014

Home Selling 101: Capital Gains on the Sale of Your Home

NORFOLK, VA, Jan 02, 2014—For those who sold their home this year, it's important to understand how selling your home may impact your tax returns, now that tax season is upon us. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty explains how capital gains work for those who have recently sold a home.

“If you sell your primary residence, you may be able to exclude up to $250,000 of gain – $500,000 for married couples – from your federal tax return,” says Eisenberg. To claim the exclusion, the IRS says your home must have been owned by you and used as your main home for a period of at least two out of the five years prior to its sale.

There are a few catches, Eisenberg explains. “You also must not have excluded gain on another home sold during the two years before the current sale.” However, special rules apply for members of the armed, uniformed and foreign services and their families in calculating the 5-year period.

If you do not meet the ownership and use tests, you may use a reduced maximum exclusion amount. But only if you sold your home due to health, a change in place of employment, or unforeseen circumstances.

An extra perk? According to Eisenberg, if you can exclude all the gain from the sale of your home, you do not report it on your federal tax return. If you cannot exclude all the gain, or you choose not to, you must use Schedule D of Form 1040, Capital Gains or Losses, to report the total gain and claim the exclusion you qualify for.

How about for those with more than one home?

“You can exclude the gain only from the sale of your main residence,” says Eisenberg. “You must pay tax on the gain from selling any other home.” If you have two homes and live in both of them, your main home is usually the one you live in most often.

For more real estate information, please contact Louis Eisenberg, REALTOR, Associate Broker, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, 757-572-7244, or www.LouisEisenberg.com

Subscribe to:

Comments (Atom)