Market Trends and Insights for Home Buyers and Homeowners. #equalhousingopportunity

Friday, August 30, 2013

Thursday, August 29, 2013

Wednesday, August 28, 2013

5 big home mortgage mistakes to avoid

NORFOLK, VA, Aug 28, 2013—Applying for a mortgage can be a daunting task. It

takes many hours, lots of paperwork, and possibly a headache or two. Below are

several mistakes to avoid when on the hunt for a mortgage.

Not checking your credit. “This should be your first step in applying for a mortgage,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Check your score months before applying for a mortgage so you know where you stand, and have time to make any changes if necessary.

Not getting pre-approved. A mortgage pre-approval is one of the best things you can do to ease the home-buying process. During pre-approval, your bank checks your credit and examines your income, assets, and employment. “Before shopping for a home, get pre-approved,” advises Eisenberg. “Many sellers won't take you seriously otherwise.”

Applying for new credit AND a new mortgage. “Do not apply for a new line of credit before or during the mortgage application process – it hints at financial instability, and you're seen as a greater risk,” says Eisenberg.

Changing jobs. If you're thinking about switching jobs, then hold off on the mortgage application, or stick out your current position for longer. “While a change in the same field doesn't necessarily mean you will be rejected, a big change - like a brand new career - can be a red flag,” notes Eisenberg.

Not seasoning your assets. Uncle John is giving you $10,000 to put toward your mortgage? Terrific. Make sure it's in your account months before you apply for a mortgage. New funds do not equate to financial stability, and your underwriter will catch on.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Not checking your credit. “This should be your first step in applying for a mortgage,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. Check your score months before applying for a mortgage so you know where you stand, and have time to make any changes if necessary.

Not getting pre-approved. A mortgage pre-approval is one of the best things you can do to ease the home-buying process. During pre-approval, your bank checks your credit and examines your income, assets, and employment. “Before shopping for a home, get pre-approved,” advises Eisenberg. “Many sellers won't take you seriously otherwise.”

Applying for new credit AND a new mortgage. “Do not apply for a new line of credit before or during the mortgage application process – it hints at financial instability, and you're seen as a greater risk,” says Eisenberg.

Changing jobs. If you're thinking about switching jobs, then hold off on the mortgage application, or stick out your current position for longer. “While a change in the same field doesn't necessarily mean you will be rejected, a big change - like a brand new career - can be a red flag,” notes Eisenberg.

Not seasoning your assets. Uncle John is giving you $10,000 to put toward your mortgage? Terrific. Make sure it's in your account months before you apply for a mortgage. New funds do not equate to financial stability, and your underwriter will catch on.

For more information on obtaining a mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Sunday, August 25, 2013

Thursday, August 22, 2013

Wednesday, August 21, 2013

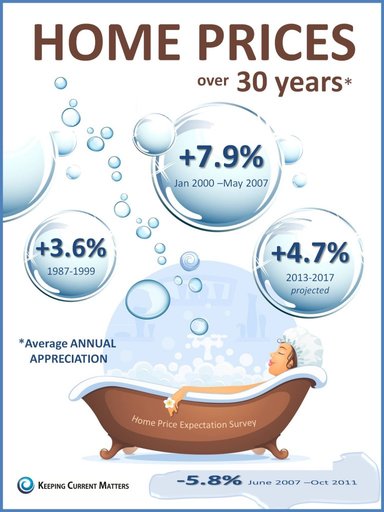

Projected home price appreciation

It is a good time to buy. Home mortgage interest rates are still low and home prices are rising. Residential real estate is a good investment. Note: Home price percentage appreciation in Hampton Roads is higher than the graphics National Average. (Graphic Courtesy of KCM BLOG)

Tuesday, August 20, 2013

Buying a home? First check for these costly problems

NORFOLK, VA, Aug 20, 2013—Buying a home is a hefty task, and with so many

things to consider (do I need that extra bedroom? How important is a big

yard?), it is easy to get a little lost in the process. There is nothing worse

than purchasing a home only to find out you need to sink thousands of

unexpected dollars into your new place, all because you weren't sure what to

look for.

Below are a few tips to make sure you're focusing on the right home features, so you can enjoy your new home AND still be able to afford that new dining room set.

Hire a home inspector. “Getting a home inspected is the No. 1 way you can avoid surprises after closing,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. However, it's still important to know what to look for on your own, as it can save you precious time and energy expenditure. For instance, if you know you can't afford a new foundation, then you can skip over making offers on homes that are clearly in need.

Check the basement. After you ooh and ah over the walk-in closets, head on down to the basement. Check out the plumbing, examine building materials, and check out insulation. “Can you see daylight peeking through cracks in the walls? That spells high heating bills, as the home may have some insulation issues,” suggests Eisenberg. Basements are not a big issue in Hampton Roads, but some older homes, especially in Ghent, have them.

Scope out the foundation. “Big cracks or corrosion can spell big trouble down the line,” notes Eisenberg. “Foundation is an expensive repair, so make sure the home is sound.”

Look for water damage. Check for discoloration and rings around pipes, windows and doors, as well as kitchen and bathroom fixtures.

Eye the roof. “You definitely aren't going to climb up to the roof while visiting a potential home, but you can scope it from the outside,” says Eisenberg. Can you see any visible missing tiles or discoloration? “And feel free to ask the agent when the roof was last replaced.”

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Below are a few tips to make sure you're focusing on the right home features, so you can enjoy your new home AND still be able to afford that new dining room set.

Hire a home inspector. “Getting a home inspected is the No. 1 way you can avoid surprises after closing,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. However, it's still important to know what to look for on your own, as it can save you precious time and energy expenditure. For instance, if you know you can't afford a new foundation, then you can skip over making offers on homes that are clearly in need.

Check the basement. After you ooh and ah over the walk-in closets, head on down to the basement. Check out the plumbing, examine building materials, and check out insulation. “Can you see daylight peeking through cracks in the walls? That spells high heating bills, as the home may have some insulation issues,” suggests Eisenberg. Basements are not a big issue in Hampton Roads, but some older homes, especially in Ghent, have them.

Scope out the foundation. “Big cracks or corrosion can spell big trouble down the line,” notes Eisenberg. “Foundation is an expensive repair, so make sure the home is sound.”

Look for water damage. Check for discoloration and rings around pipes, windows and doors, as well as kitchen and bathroom fixtures.

Eye the roof. “You definitely aren't going to climb up to the roof while visiting a potential home, but you can scope it from the outside,” says Eisenberg. Can you see any visible missing tiles or discoloration? “And feel free to ask the agent when the roof was last replaced.”

For more information on buying a home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Monday, August 19, 2013

Friday, August 16, 2013

Thursday, August 15, 2013

Selling on a budget? The best low cost home renovations

NORFOLK, VA, Aug 15, 2013—Selling your home usually requires some staging maintenance. However, for those on a budget, there are still some changes you can make to help your home sell faster while keeping money in the bank. Below, Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty provides us with a few ideas.

1. Painting – Whether you need to give the interior or exterior—or both—of your home a facelift, painting is the cheapest and easiest ways to keep your home looking fresh and well-maintained. With a bit of patience, you can even do the interior paint job yourself. “I would hire a professional for the exterior,” recommends Eisenberg.

2. Landscaping - “A messy exterior automatically sends the wrong message to buyers,” says Eisenberg. Keep the grass cut, the garden happy, and tools or toys out of sight. “If your budget allows, plant a few new trees or add some outdoor furniture so buyers can envision themselves spending time in your yard.

3. Accents – Linens, rugs, curtains, furniture covers – all of these can be quickly refreshed for a relatively low cost, and they really can amp your home's appeal. “Even a few throw pillows tailored to the color scheme of the season you're selling can make an interior more inviting,” notes Eisenberg.

4. Energy efficient updates - “If you can afford it, get a few energy efficient features added to your home. They are a major selling point right now,” says Eisenberg. Budget depending, you can have new windows installed, or just an energy efficient washer and dryer that you can offer as an inclusion with your sale.

For more information on selling you home, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23505, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com .

Wednesday, August 14, 2013

Friday, August 9, 2013

Why air contioning costs are heating up

You might wish that summer could go on and on—until it comes time to recharge your air conditioning system. The cost of the common refrigerant R-22 (also known as Freon), widely used in residential air conditioning systems, has already increased by more than 400 percent in the past 18 months and is expected to go even higher, making air conditioning repairs more costly for many.

R-22 has been the refrigerant of choice for residential heat pump and air conditioning systems for more than four decades, but it has been identified as having a negative environmental impact, including contributing to ozone depletion. Under EPA regulations, R-22 is being phased out, with production totally prohibited after 2020.

This has added new considerations for homeowners who are considering whether to repair or replace an air conditioning unit. For instance, some refrigerant manufacturers have begun selling cheaper alternatives to R-22, often referred to as "drop-in" replacement refrigerants. But alternatives are cheaper only in the short run.

"Lennox, one of the leading air conditioning manufacturers, has conducted research that shows these cheaper alternate refrigerants are not compatible with the lubricating oil used in R-22 units," says Dave Moody, director of marketing for Service Experts Heating & Air Conditioning. "Recharging older air conditioners with these alternative refrigerants may actually damage the system and void your manufacturer's warranty. As a result, we've instructed our 2,500 technicians to follow the manufacturer's recommendations and use only R-22 when they recharge R-22 systems."

Moody also points out that reclaimed and recycled R-22 is expected to be available to repair existing systems after production ceases in 2020, but as the supply of new R-22 refrigerant continues to be reduced, costs of both new and recycled R-22 refrigerant will increase significantly.

All new air conditioning systems now use a more environmentally friendly refrigerant, R410A.-These newer systems offer many benefits, including greater energy efficiency, longer warranty periods and quieter operation, and may prove to be the wiser investment when homeowners are faced with repairing an older system that uses R-22 refrigerant.

"There is no one-size-fits-all answer about whether to repair or replace your R-22 AC," says Moody. "It really does depend on the individual family, their home, their lifestyle and their budget.”

R-22 has been the refrigerant of choice for residential heat pump and air conditioning systems for more than four decades, but it has been identified as having a negative environmental impact, including contributing to ozone depletion. Under EPA regulations, R-22 is being phased out, with production totally prohibited after 2020.

This has added new considerations for homeowners who are considering whether to repair or replace an air conditioning unit. For instance, some refrigerant manufacturers have begun selling cheaper alternatives to R-22, often referred to as "drop-in" replacement refrigerants. But alternatives are cheaper only in the short run.

"Lennox, one of the leading air conditioning manufacturers, has conducted research that shows these cheaper alternate refrigerants are not compatible with the lubricating oil used in R-22 units," says Dave Moody, director of marketing for Service Experts Heating & Air Conditioning. "Recharging older air conditioners with these alternative refrigerants may actually damage the system and void your manufacturer's warranty. As a result, we've instructed our 2,500 technicians to follow the manufacturer's recommendations and use only R-22 when they recharge R-22 systems."

Moody also points out that reclaimed and recycled R-22 is expected to be available to repair existing systems after production ceases in 2020, but as the supply of new R-22 refrigerant continues to be reduced, costs of both new and recycled R-22 refrigerant will increase significantly.

All new air conditioning systems now use a more environmentally friendly refrigerant, R410A.-These newer systems offer many benefits, including greater energy efficiency, longer warranty periods and quieter operation, and may prove to be the wiser investment when homeowners are faced with repairing an older system that uses R-22 refrigerant.

"There is no one-size-fits-all answer about whether to repair or replace your R-22 AC," says Moody. "It really does depend on the individual family, their home, their lifestyle and their budget.”

Thursday, August 8, 2013

Wednesday, August 7, 2013

5 demands to make on your real estate agent

The following article is courtesy of KCM Blog

If we were hiring an agent to sell my home today, we would require that they:

1. Tell us the truth about the price

Too many agents just take the listing at any price and then try to the ‘work the seller’ for a price correction later. Demand that the agent prove to you that they have a belief in the price they are suggesting. Make them show you their plan to sell the house at that price – TWICE! Every house in today’s market must be sold two times – first to a buyer and then to the bank.The second sale may be more difficult than he first. The residential appraisal process has gotten tougher. It has become more difficult to get the banks to agree on the contract price. A red flag should be raised if your agent is not discussing this with you at the time of the listing.

2. Understand the timetable with which my family is dealing

You will be moving your family to a new home. Whether the move revolves around the start of a new school year or the start of a new job, you will be trying to put the move to a plan. This can be very emotionally draining. Demand from your agent an appreciation for the timetables you are setting. I am not suggesting that your agent can pick the exact date for your move. You just want the agent to exert any influence they can.3. Remove as many of the challenges as possible

It is imperative that your agent know how to handle the challenges that will arise. An agent’s ability to negotiate is critical in this market.Remember: If you have an agent who was weak negotiating with you on the parts of the listing contract that were most important to them (commission, length, etc.), don’t expect them to turn into Superman when they are negotiating for you with your buyer.

4. Help with the relocation

If you haven’t yet picked your new home, make sure the agent is capable and willing to help you. The coordination of the move is crucial. You don’t want to be without a roof over your head the night of the closing. Likewise, you don’t want to end up paying two housing expenses (whether it is rent or mortgage). You should, in most cases, be able to close on your current home and immediately move into your new residence.

5. Get the house SOLD!

There is a reason you are putting yourself and your family through the process of moving. You are moving on with your life in some way. The reason is important or you wouldn’t be dealing with the headaches and challenges that come along with selling. Do not allow your agent to forget these motivations. Constantly remind them that selling the house is why you hired them. Make sure that they don’t worry about your feelings more than they worry about your family. If they discover something needs to be done to attain your goal (i.e. price correction, repair, removing clutter), insist they have the courage to inform you.Good agents know how to deliver good news. Great agents know how to deliver tough news. In today’s market, YOU NEED A GREAT AGENT!

Tuesday, August 6, 2013

Can you do anything about encroachment?

NORFOLK, VA, Aug 06, 2013—You may be sitting there wondering what “encroachment” is; if you've

ever been in a sticky situation with a neighbor regarding property boundaries, then you're

more familiar with the term than you think.

“Encroachment is when another individual builds a structure that sits on or interferes with your

land,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty. “Perhaps your neighbor builds a deck that creeps out onto your property line, or a shed for his new boat that sits a few feet over

the border.”

So what do you do? And more importantly, what can you do? “If the encroachment doesn't

bother you, than maybe there is no reason to do anything about it—you save the relationship

between you and your neighbor, and what's a few feet of yard loss anyway? However, when it

comes time to sell your home, you could run into some trouble,” Eisenberg explains.

Here are a few steps you can take:

1. Solidify the boundaries. Double and triple check your boundary lines so you don't start an

issue over a mistake or misunderstanding.

2. Talk with your neighbor. If it's a shed or movable structure, perhaps they can relocate.

3. Consider alternatives. “There are several things you can do to remedy this situation without

ending up in court,” says Eisenberg. One is writing the neighbor a written permission to use

your property. While this will not hold over if you sell your property, it will at least clear the air

and any confusion between who owns what. Another possibility is selling the square feet to

them, extending their property line so that their structure now sits on their land and they are no

longer encroaching. Not keen on selling the square footage? Suggest renting it. “Be sure to

contact a legal advisor and, if necessary, your mortgage lender before a property sale. And of

course, keep all documentation of the sale,” Eisenberg cautions.

4. If you aren't able to keep the situation hospitable, you may have to take the issue to court.

This can be a painstakingly long process, so Eisenberg suggests this as a last-ditch effort.

For more real estate information, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, VA 23510 at leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Thursday, August 1, 2013

Should you prepay your mortgage?

NORFOLK, VA, Aug 01, 2013—At first glance, prepaying your mortgage sounds like a financially intelligent move. By paying extra principal, your house will be paid off faster, and you will end up paying less interest over the life of your loan.

“You get to save thousands of dollars and shave years off the life of your loan because the additional payments made toward your monthly principal basically constitutes a partial prepayment of your mortgage,” says Louis Eisenberg, Associate Broker REALTOR ABR SFR of Prudential Towne Realty.

However, there can be some drawbacks; each mortgage has specific terms describing how and when prepayment may occur. Some lenders impose a penalty if you repay the loan too soon.

The total savings potential also will depend on how long you plan to live in your home. If you expect to move in the near future, do not expect to reap savings as large as those gained by people who pay ahead of schedule until they own their home free and clear.

“If you're putting additional payments into your mortgage, make sure you're also building up your retirement fund. While your home is your greatest investment, you don't want to end up house rich and cash poor in the end,” advises Eisenberg.

Another note from Eisenberg; If you plan to speed up your mortgage payments, do it on your own instead of enlisting the help from a bank, who may charge a fee.

For more information on paying off your mortgage, please contact Louis Eisenberg, Prudential Towne Realty, 109 E. Main Street, Norfolk, Virginia 23510, leisenberg@prudentialtownerealty.com, (757) 572-7244, or www.LouisEisenberg.com

Subscribe to:

Comments (Atom)