Buyers Are Finding More Space in the Luxury Home Market

A year ago, additional space and extra amenities had a very different feel for homebuyers. Today, the health crisis has brought to light how valuable more square footage and carefully designed floorplans can be. Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular, and some families are finding the space they need for these upgrades in the luxury market.

The Institute for Luxury Home Marketing (ILHM) explains:

“With quarantine concerns still top of mind for many luxury buyers, we see large, sprawling estates making their comeback.

For instance, the last six months have seen a resurgence in the buying of mega mansions and estate-size homes – specifically properties that offer space (both inside and outside), separate home offices, gyms, and private amenities such as swimming pools, yoga studios, and recreation rooms.”

This was not the case at this time last year, as the most recent Luxury Market Report from ILHM emphasizes:

“Exactly one year ago, we reported that demand for large properties, mega mansions, private estates, and luxury ranches had reduced significantly over the previous few years; especially from the younger generation of luxury property buyers.”

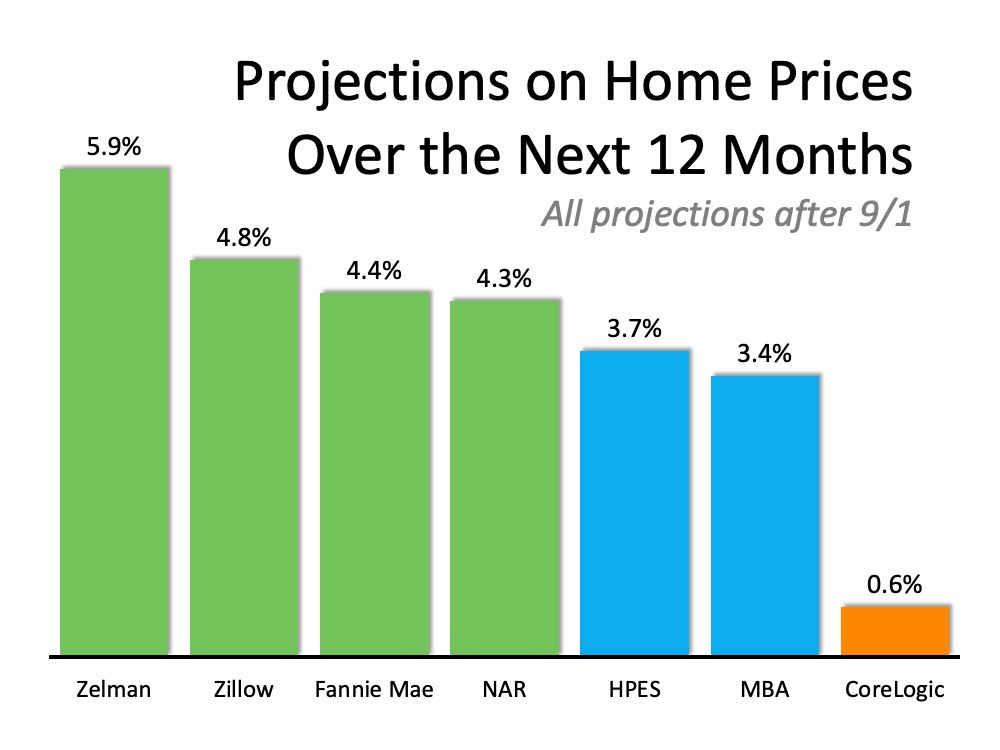

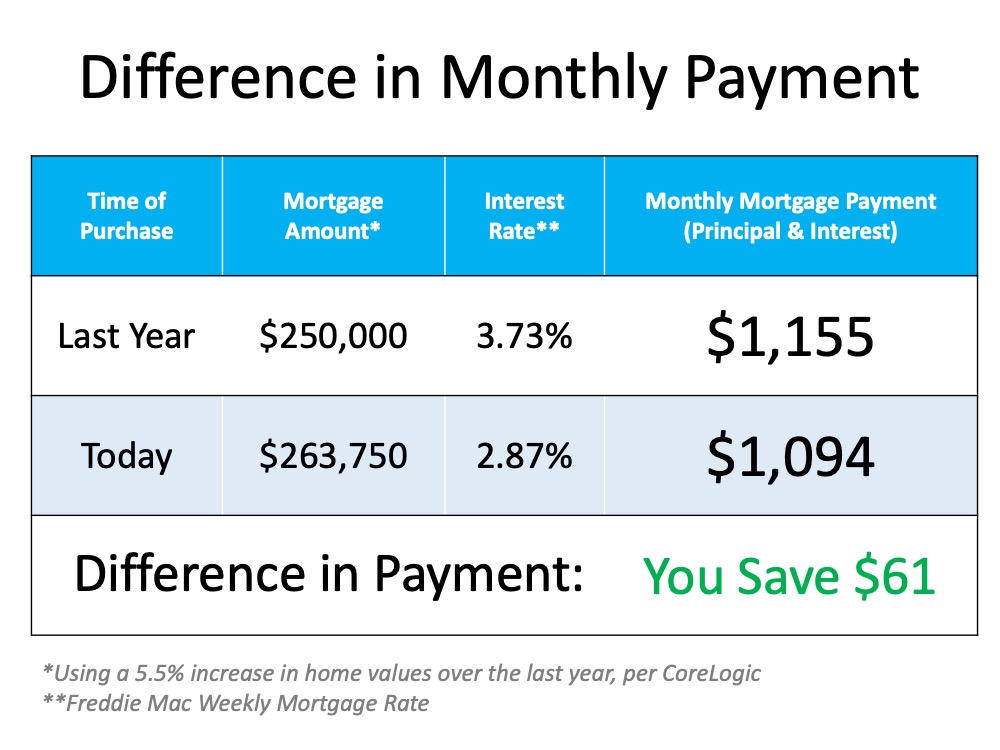

For today’s buyers looking for larger homes, steady increases in equity might be what makes a move possible. Leveraging home equity makes it easier to afford the down payment on a luxury home, and current low interest rates are making mortgage payments more affordable than they have been in years. The report from ILHM also notes:

“Luxury real estate prices may continue to strengthen further into the third quarter, as the affluent continue to see large investment returns from the currently strong stock market.

Coupled with the low interest rates, the policies granting (and insisting) on working from home implemented by many employers, and the concerns of the pandemic, all translate to the affluent increasingly trading in their city lifestyle for a home that has it all.”

Clearly, today’s strong gains in home equity paired with record-low interest rates make fall a great time to move up into the luxury market to meet those changing needs.

Bottom Line

If you’re ready to gain some breathing room in a larger home, let’s connect so you have the guidance you need to find more space in the luxury home market.

![Homes Across the Country Are Selling Fast [INFOGRAPHIC] | My KCM](https://files.mykcm.com/2020/09/17125830/20200918-MEM-1046x1575.jpg)