More Generations Are Living Under One Roof This Year

This year challenged us to reprioritize everything - from the way we use our time to where we work, how we socialize and gather together, and our needs at home. For many, this also meant making decisions about how to best support and engage with our extended families, near and far.

In some cases, we weren’t able to see our relatives and loved ones who were living in senior facilities. In others, maybe older children moved back home. Jessica Lautz, Vice President of Demographics and Behavioral Insights for the National Association of Realtors (NAR), says:

“A lot of families have an aging senior relative who was living independently or in senior care and wanted to move them into their home.”

These changes led more homebuyers to invest in multi-generational homes to accommodate more long-term plans. A multi-generational home, according to the 2020 Profile of Home Buyers and Sellers from NAR, is a home that has adult siblings, adult children over the age of 18, parents, and/or grandparents in the household.

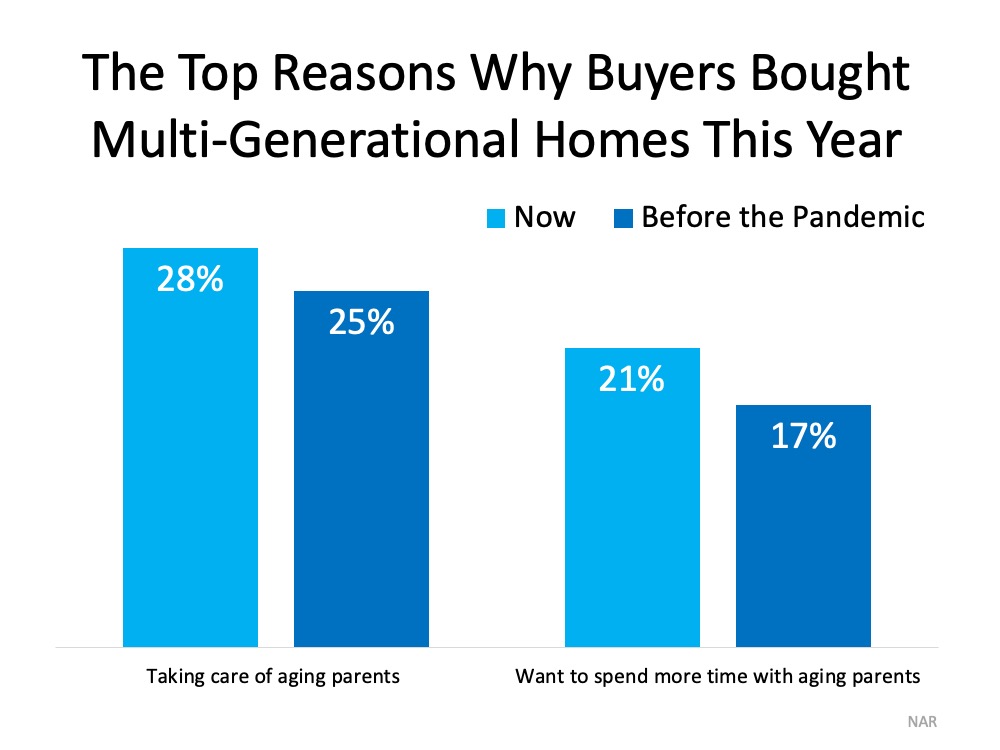

A recent study from NAR shows that since the health crisis began, there’s been an increase in purchasing trends for homes that cater to this dynamic:

“Buyers who purchased after March were more likely to purchase a multi-generational home at 15% compared to 11% who purchased before April.”

There are many reasons for this uptick in preference toward multi-generational homes. The graph below shows the top two reasons and how they’ve increased this year:

Bottom Line

More homeowners are making arrangements to accommodate their loved ones so they can safely take care of them at home. If you’re in a similar situation, let’s connect to discuss your options in our local area and maybe even have your whole family under one roof by early next year.

![2021 Housing Forecast [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/12/17164522/20201218-MEM-1046x2213.png)