How Does the Supply of Homes for Sale Impact Buyer Demand?

The price of any item is determined by supply, as well as the market’s demand for the item. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand).

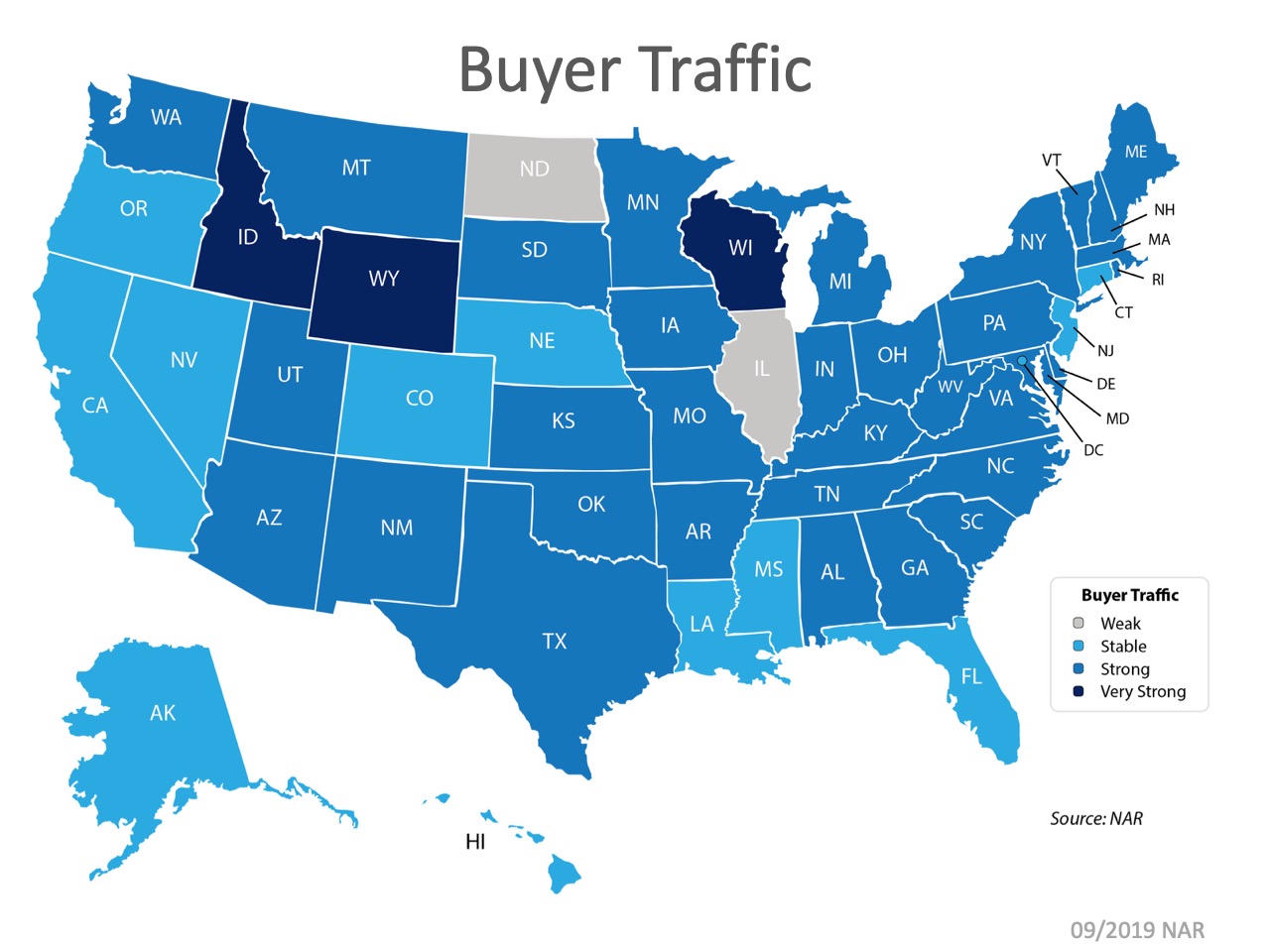

Buyer Demand

The map below was created after asking the question: “How would you rate buyer traffic in your area?” The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.Seller Supply

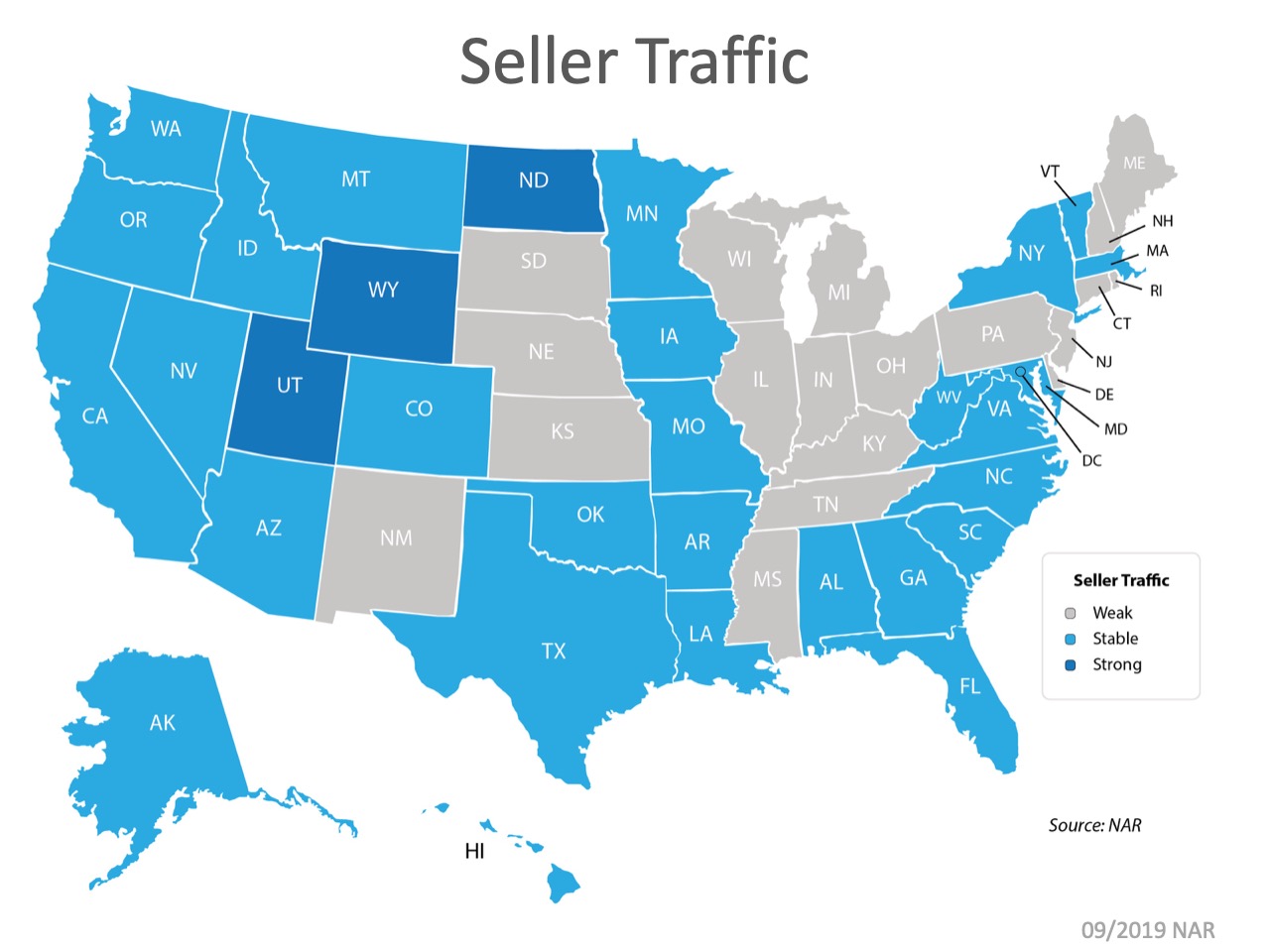

The index also asked: “How would you rate seller traffic in your area?” As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.

As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.

As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.

As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.Bottom Line

Looking at the maps above, it is not hard to see why prices are appreciating in many areas of the country. Until the supply of homes for sale starts to meet buyer demand, prices will continue to increase. If you are debating listing your home for sale, let’s get together to help you capitalize on the demand in our market now.

![What Is the Cost of Waiting Until Next Year to Buy? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/26072655/20190927-MEM-1046x1354.jpg)

![4 Reasons to Sell This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/19104136/20190920-MEM-1046x808.jpg)

![A+ Reasons to Hire a Real Estate Pro [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/03132635/20190906-MEM-1046x1308.jpg)